Chapter 1.2 Crypto-assets and blockchain technology

-40. To understand MiCA and its potential impact, we need first to define and understand crypto-assets and their underlying blockchain technology. The challenge is multiple: first, the “blockchain” label is not protected and has been taken to a very liberal use, leading to confusion. Everybody can call their system “blockchain” and stretch the meaning of the word beyond recognition. Second, Bitcoin innovates at different levels: technological, economic, and political.

-41. The meaning I give to “blockchain” in this dissertation is “that which best captures and abstracts the determinants of Bitcoin’s and other crypto-assets success”, and I include the economic and political dimensions. In this chapter I’ll explain why reducing “blockchain” to a mere technology and attributing the Bitcoin and crypto-assets phenomenon solely to the technological advances, is deeply misguided.

1.2.1 Without Bitcoin, we wouldn’t be here today

-42. Let’s start with a simple yet fundamental observation: whether directly or indirectly, MiCA would not have existed if not for Bitcoin. Bitcoin is the archetypal crypto-asset. Understanding the success of Bitcoin is essential if we want to understand crypto-assets and more generally “blockchain technologies”. And to understand Bitcoin, we are first going to briefly tell its story, in its economic and political context.

-43. On Monday, October 15, 2008, the collapse of the Lehman Brothers investment bank triggered world’s greatest post-WW2 financial crisis. The subsequent “Emergency Economic Stabilization Act” managed to stave off a catastrophic “domino effect” that could have brought the global financial system to a standstill.

-44. Only a few weeks after, October 31st, a cryptography mailing list received a message from ‘satoshin@gmx.com’ reading “I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.” The mail contained as an attachment a nine-page long paper describing the proposed system and signed “Satoshi Nakamoto” . The definition of the problem that the proposed system aimed to solve is contained in the introduction: “What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” The specified system relies on a network of distributed instances (copies of the same program) which communicate with one another using peer-to-peer protocols initially developed for transmitting music files (Napster) and then digital copies of movies (bitTorrent).

-45. Let’s shortly consider here the origin of “crypto” in crypto-assets. The “crypto” prefix historically comes from the ancient Greek “kruptos”, meaning “hidden” or “secret”. Yet the Bitcoin system is hardly so: the source code is open-source, meaning that anyone can copy, read and modify it as they please (and many have done so during the following years) and the operational system is designed around a public access database where everyone can consult the full history of all transactions since the system started operating. Instead, the “crypto” in “cryptocurrencies” and “crypto-assets” comes from “cryptography”, the science of communicating, of securely transferring information in the presence of malicious third-parties or under adversarial conditions.

-46. Second, we must reckon that the Bitcoin paper is a specification for a computer program and Bitcoin itself is primarily just that: a running computer program. The mysterious Satoshi Nakamoto started operating his system on January 3rd, 2009. As initially only a very small number of people interested in cryptography were aware of its existence, Satoshi could have been the only one to operate his program (for as long as he wanted, until he would have deemed that it’s pointless to continue running it).

-47. Because the code is free and open-source, some of the people aware of it at the beginning of 2009 could have downloaded a copy and started their own parallel instance. If that happened back then, it had no visible consequences – which reaffirms the fact that Bitcoin had something unique going for it, beyond its computer code, and that we are facing primarily a socio-political phenomenon embodied in an IT system.

-48. Indeed, what we do know for sure is that, among those who read the messages of that cryptography mailing-list, some have indeed downloaded a copy and started running an instance of an identical copy. These instances are called “nodes”. Moreover, they also downloaded the same database of transactions history and connected their instance to Satoshi’s one.

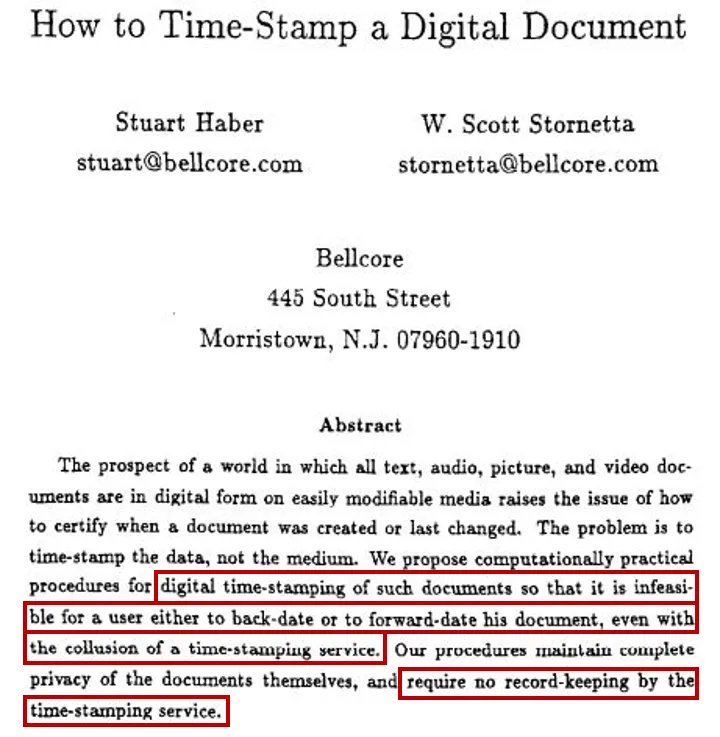

-49. This database recording the transactions in the system has a peculiar, although not unprecedented structure: it gathers transactions into blocks of data connected to previous blocks, hence its name: “blockchain”. The first description of such a structure dates from 1991, when Haber and Stornetta published a theoretical solution using cryptographic hash functions and digital signatures in order to produce secure timestamps for “digital documents”. Moreover, they went further by describing two possible theoretical solutions for “simulating the action of a trusted [Time-Stamp Server], in the absence of generally trusted parties.” Seventeen years later, the Bitcoin paper quotes this prior article and chooses the first of the two solutions, called “linking” to create a “chain” of digitally signed blocks of data secured using cryptographic hash functions.

Figure 3. The 1991 original description of the "blockchain" structure

Figure 3. The 1991 original description of the "blockchain" structure

-50. It is widely accepted that Haber and Stornetta (rather than S. Nakamoto) are the fathers of “the blockchain technology.” I’ll note here that a precursor to this technology, “append-only ledgers” were known since the mid ’80-ies (see Part 3, section 3.1.2).

-51. However, it should be emphasized that, even though the theoretical underpinnings of the technology had been known for so long, almost no blockchain system was known to the mainstream, for reasons which are going to be exposed later (see par. 74-76 and Part 3, section 3.1.2).

-52. It should come as a surprise then that the “Bitcoin” phenomenon only spread from there, even though for more than a year, until the spring of 2010 “bitcoins” had no monetary value. Today, it is estimated that more than 10 000 computers run an instance of the Bitcoin code: more than 10 000 “nodes” using the same database that Satoshi started on January 3rd, 2009. This type of redundant computing, where the same copy of the program code is run synchronously as several identical instances networked to one another is called a distributed system and it exacts a high cost. Yet the Bitcoin system has run without interruption during all these years, thus becoming the longest-running IT system ever documented, despite ever-increasing aggregate operational costs.

-53. Referring to the research I quoted in the previous chapter (par. 26-27), we have an actual successful illustration confirming the research of Robert Axelrod and Michael Taylor : strangers spontaneously cooperating. The open-source bitcoin code provided predictability and, through its clever reward system, encouraged cooperative behavior. However, there’s something intriguing in the case of Bitcoin as, in contrast to the findings of Axelrod and Taylor, 10 000 is way too big a number for sustained cooperation. Indeed theirs, and others’ research tended to indicate that “stateless cooperation” would begin to break down above 150 – 200 participants. Bitcoin was able to break that human limitation.

-54. It has been argued that the main determinant of Bitcoin’s success was its novel system of governance, of achieving consensus among anonymous parties, the so-called “Nakamoto consensus” based on the “proof of work” protocol, although an exhaustive analysis is outside the scope of this document.

-55. To sum it up, I posit that MiCA would not exist if Bitcoin had not been so successful and that its success in turn is not to be found primarily in its technology, but rather in its emerging “political properties”. Indeed, Bitcoin uses and combines artfully several technologies which had long been known, including the “blockchain” and peer-to-peer distributed computing. Aside from a few rather confidential uses in very specific settings, which I’m going to mention later (see par. 71), the blockchain had not found mainstream application and adoption until Bitcoin came around.

| Table of Contents | |

|---|---|

| <previous> | <next> |

[44] S. Nakamoto op. cit.

[45] Ibid.

[46] S. Haber, W. Scott Stornetta, “How to Time-Stamp a Digital Document”, Journal of Cryptology, vol 3, no. 2, pages 99-111, 1991

[47] P. Mueller, S. Bergsträsser, A. Rizk, R. Steinmetz, “The Bitcoin Universe: An Architectural Overview of the Bitcoin Blockchain”, Lecture Notes in Informatics, Gesellschaft für Informatik, Bonn, 2018

[48] R. Axelrod, op. cit.

[49] M. Taylor, op.cit., p.129

[50] A. Narayanan, J. Bonneau, E. Felton, A. Miller, S. Goldfeder “Bitcoin and Cryptocurrency Technologies” Princeton University Press, 2016