1.3.2 The importance of permissionless innovation

-92. The first mainstream media articles analysing Bitcoin appear mid-2011 when the US Government bans dollar donations to Wikileaks, and supporters of Julian Assange announce in response that Wikileaks is going to accept Bitcoin donations. It is truly the first instance when the “crypto anarchist” vision of Tim May takes shape. Among the magazines that run a feature on Bitcoin are Forbes and The Economist . The latter publication looks at Bitcoin not from a technological nor legal point of view, but from that of economists. It thus writes: “Critics point out that Bitcoins suffer the same flaws as other metal-based currencies with finite supply. Many economists put at least part of the blame for the severity of the Depression on the strictures of the gold standard, as countries clung to gold and put off stimulus. In the case of Bitcoins, some think that decreasing the rate of money creation over time will entail deflation.” Twelve years later, those economists have been proved right: a similar basket of goods and services which could have been bought with 1000 bitcoins in mid-2011 would only be worth 1 bitcoin today, as the dollar value of the currency has increased more than 1000-fold. The conclusion of The Economist’s paper is thus: “Bitcoin is technically sophisticated. As a monetary system, it looks primitive.”

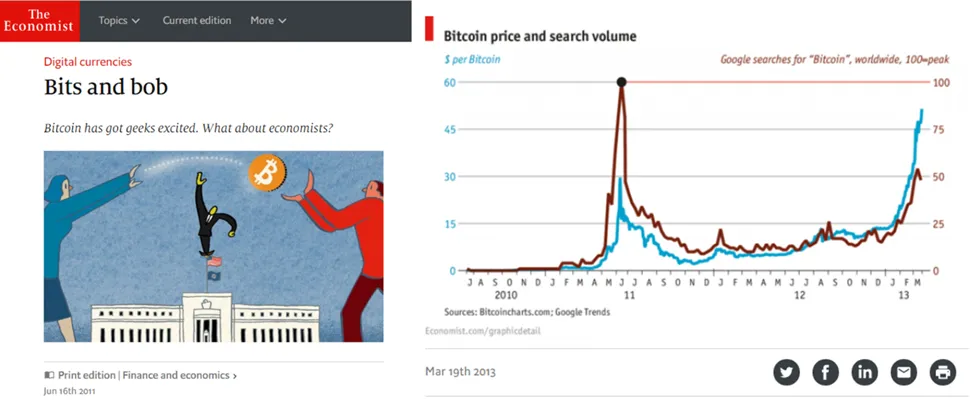

Figure 4. One of the first mentions of Bitcoin in mainstream media, on the left. In the right-hand chart (from 2013) it can be noticed that it was associated to a first price spike. (The Economist)

Figure 4. One of the first mentions of Bitcoin in mainstream media, on the left. In the right-hand chart (from 2013) it can be noticed that it was associated to a first price spike. (The Economist)

-93. Economic arguments are no doubt among the reasons which underpinned a flurry of “Coasian” innovation leading to a “Cambrian-like explosion” in the number of different crypto-currencies borrowing some, but not all of bitcoin’s characteristics and often proposing different economic mechanism designs. Most, including Ethereum, the second most popular blockchain and cryptocurrency, have relaxed the very aggressive deflation schedule of Bitcoin and saw an increased velocity in money circulation.

-94. In March 2014, in an article titled “Bitcoin’s Future”, The Economist underscores Bitcoin’s potential for innovation: “This means that third parties can make use of Bitcoin’s features without having to ask anyone for permission – as is the case with the internet. Such ‘permissionless innovation’, in the jargon, should in time result in a cornucopia of applications.”

-95. As a later article from The Economist correctly predicted in January 2015, Bitcoin’s success sparked a “constellation of linked crypto-currencies and blockchains, with all sorts of uses: stores of value, means of exchange, mechanisms for transferring assets and verifying transactions, whatever. […] Mr. Nakamoto can be proud of having unleashed a wave of financial innovation and founded what looks set to become a sizeable new branch of the global IT industry.” Speaking of “constellation”, I will refer to this as “the cryptoverse” from the contraction of “cryptocurrencies” and “Universe”.

-96. In probably the most important series of articles published by the mainstream media on the topic, the relevance of Bitcoin, blockchains and cryptocurrencies for our societies has been remarkably captured by the same magazine in its October 31st, 2015, issue. In an article titled “The trust machine”, The Economist writes: “The notion of shared public ledgers may not sound revolutionary or sexy. Neither did double-entry book-keeping or joint-stock companies. Yet, like them, the blockchain has the potential to transform how people and businesses co-operate.”

-97. Revisiting the topic in June 2018, the respected magazine surveys the cryptoverse and writes about “the many startups that have recently launched new crypto-currencies via an initial coin offering (ICO), a much-hyped form of crowdfunding. […] Their main aim is to use technology to make the online world a more decentralized place where people can do business ‘on their own terms’. […] Bitcoin pointed the way. Satoshi Nakamoto, its elusive inventor, also designed what is now called ‘a crypto-economic model’. Miners are promised a monetary reward for their number-crunching work. Many […] projects have developed their own crypto-economic models. The idea is to replace a centralized firm with a decentralized organization, held together by incentives created by a token – a kind of ‘crypto-co-operative’.”

-98. Two things need to be underlined. First, Bitcoin and blockchain technologies’ ability to “support the potential of digital finance in terms of innovation” is inherently linked to open blockchain platforms allowing third parties to make use of them without having to ask anyone for permission, as it’s the case for the internet. To illustrate, imagine for an instant what the world would look like today if back in the 1990-ies governments had imposed a “prior authorization” or even a “prior notification” system before anyone could launch a new web server, a new web application or web site.

-99. Second, blockchains have the potential to transform how people cooperate through a decentralized ‘crypto-cooperative’ which substitute a “shared public ledger” to the traditional “trusted third party” and does not necessarily rely on the state and its laws, but rather on economic incentives. This is the “Coasian” innovation avenue I am referring to above.

| Table of Contents | |

|---|---|

| <previous> | <next> |

[71] A. Greenberg, “Crypto Currency”, Forbes, April 2011

[72] The Economist, “Bits and bob”, June 2011

[73] The Economist, “Bitcoin’s Future”, March 2014

[74] The Economist, “The magic of mining”, January 2015

[75] The Economist, “The trust machine”, October 2015

[76] The Economist, “Blockchain technology may offer a way to re-decentralise the internet”, June 2018

[77] Proposal for a Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937 (MiCA)