this one is an interesting article though it does nothing for the current situation as youre still in a bear market. and this time it is different. you have much more debt than in any of those cycles in the past. and this time you cant pay it off nor can you bail it out. so for any retard that thinks for some reason theyre magically better off, theyre not. in fact, it's much worse.

and the person is right, experience this time will show you exactly what these degenerates are going to get. 2008 imploded for a reason. 2018 is imploding for the very same reason except at a much larger scale. so assholes never learn.

and if you buy and hold this one, youre likely to be wiped out pretty quickly.

and it's interesting he talks about a fed mistake. this time it isn't a fed mistake, they have no choice. but he's right to point out that every time the fed tightened, pain came along with it. and it's just to show how much those markets are dependent on cheap money. except this time, they flooded it with money so cheap it was actually a negative real interest rate paying people to take on debt. debt they could never pay back. at such a large scale it could never be bailed out. so yes, the fed mistake was there. but in this case it wasn't in tightening.

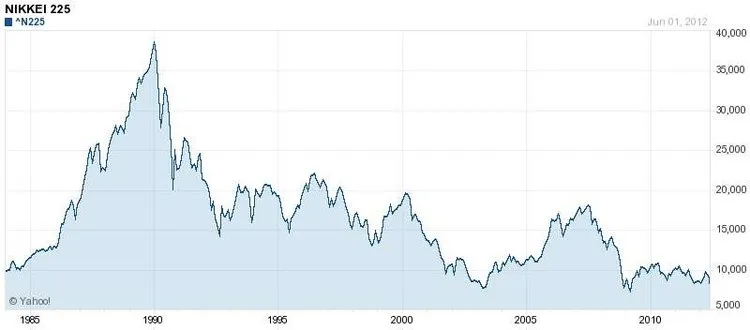

and if anyone questions that, look at where they got QE from. Japan. And how did they do after their money printing and now non existent markets because they had to buy everything up?

and just like Japan, this time around, it looks like a real recovery may take more than a few decades.

on the note of experience, what was that disclaimer that was always run after some mutual fund ad on TV? "Past performance is not indicative of future results"?

the cycle charts are nice to see what happened in the past under different conditions. this time, it's much worse.

he should've used Japanese charts instead of American ones.

Here's a nice one, it shows their boom in the 80's and 90's and how even 30 years later, they haven't recovered, and i dont think it's even adjusted for the massive inflation they've had since then like in the chart in the article, so it's actually much worse than this chart depicts:

and this is the article that it is from and is a pretty good description of what happened to Japan, at least their index, in terms of their real economy, which is not a stock market index. https://www.businessinsider.com/stocks-for-the-long-run-dow-japan-2012-6

Nietzsche: God is dead.

God: Nietzsche is dead.

The Rever rennddd

https://www.zerohedge.com/news/2018-09-06/roberts-experience-only-cure-ignorance