On October 30th, 2017, I called a dead-cat bounce in bitcoin dominance and posted the following image:

Here is what has happened since:

This happened much quicker than I expected and I would expect to see a counter-trend bounce from here.

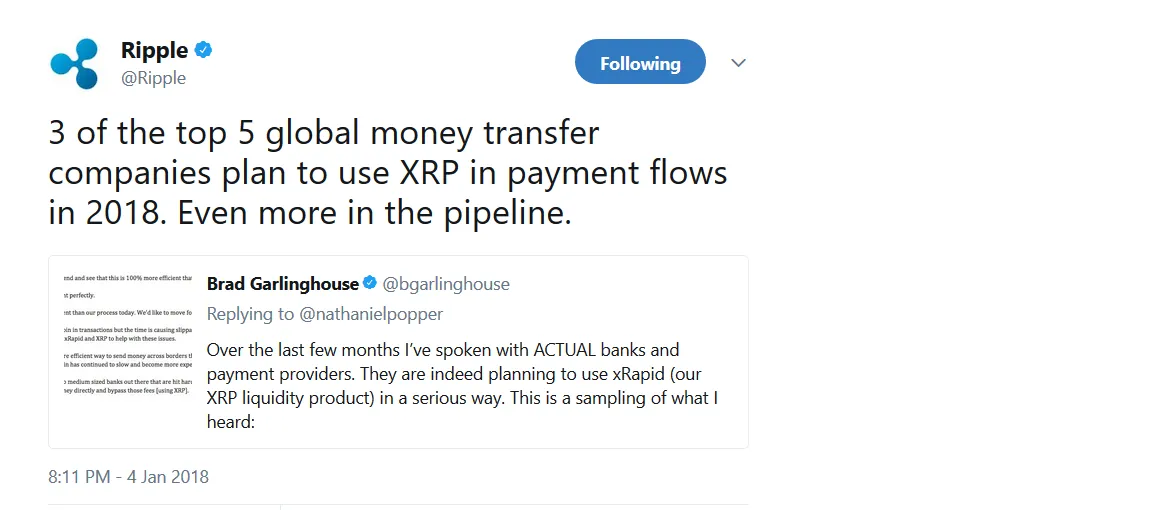

The big gainer in the alt-coin space has been ripple xrp with news out that potentially Western Union and other money exchange businesses plan to use the underlying currency to enhance their services.

Ripple is often criticized for being centralized and the network does currently consist of only 5 validating nodes listed on its default Unique Nodes List (UNL) and the company currently owns 55 billion xrp, which is over half of the total supply of currency on the network.

Of course, as an investor, I don’t look at the current state of the technology, which is why I have owned xrp for quite some time. I look at the future potential of the technology, something that unfortunately appears to be lost on most people, who seem to only look at the current state of the technology to make investment decisions. Ripple has plans to further decentralize its network, mostly by diversifying its validator list. However, one of the key differences between ripple and bitcoin is that validators in ripple are selected much more autocratically than in bitcoin, which uses POW mining where anyone with enough hash power can validate transactions. Ripple validators are selected by full nodes on the network who maintain a Unique Nodes List (UNL), which is defaulted to validators recommended by ripple, the company.

Technically, however, any ripple user who runs a full node can modify their Unique Nodes List (UNL) to specify validators that are not recommended by ripple co. In practice, this is not likey to happen unless a large faction of users decide to change their UNLs, which brings me to my next point – the power of the hard fork. With open source code, users can choose to fork away from the ripple network at will (albeit with a good bit of sound technical knowledge), just as factions of users have broken away from bitcoin and ethereum, resulting in the emergence of bitcoin cash and ethereum classic, respectively. I have stated it before and will state it again, the ability to hard fork at will is perhaps the most critical component to Nakamoto Consensus, not the consensus mechanism itself. If enough users of the ripple protocol are unhappy with the direction that ripple co. is taking it, they can fork the network, strip ripple co. of its 55 billion xrp, move forward with their own version, and perhaps ultimately win out over the original protocol. That folks, is the power that separates this technology from legacy fiat-currency based systems, and it has proven to work - again, working examples being bitcoin cash and ethereum classic.

With that said, ripple xrp, at a $280 billion valuation may have gotten way ahead of itself, mostly because of the abundance of competitors out there. Ripple xrp is competing with many other systems including bitcoin, ethereum, bitcoin cash, cardana, nem, ect. to become the underlying internet of value, even if ripple co.'s aim right now is to be compatible with legacy banking systems – other systems may eventually have this capability.

Contrary to popular belief, the ripple network does have the ability to become a decentralized, multi-trillion dollar underlying-internet-of-value protocol, long-term. It remains to be seen which system will ultimately win out, but the evolution will be interesting to watch.

Disclaimer: None of this is advice of any kind.