Resolute Mining (ASX: RSG) is a mid-tier mining company listed on the ASX with mining operations in Australia and Mali. They also have development projects in Ghana and Egypt. Over the past 18 months, RSG has experienced a 55% price decline after peaking at almost $2.40 in late September 2016, with the current price of $1.13 as at Thursday 24th May 2018. This article aims to provide a review of the company's operating performance, financial position and prevailing environmental conditions in order to estimate a fair value for the stock.

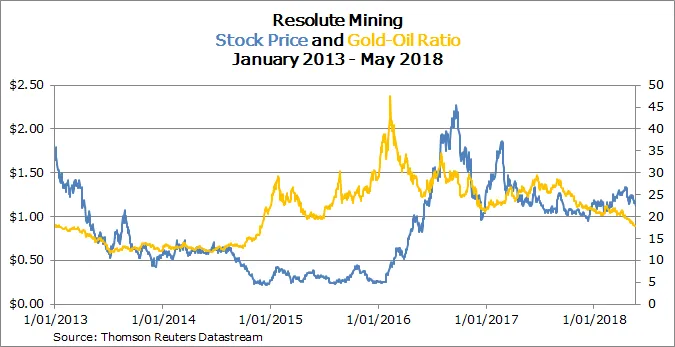

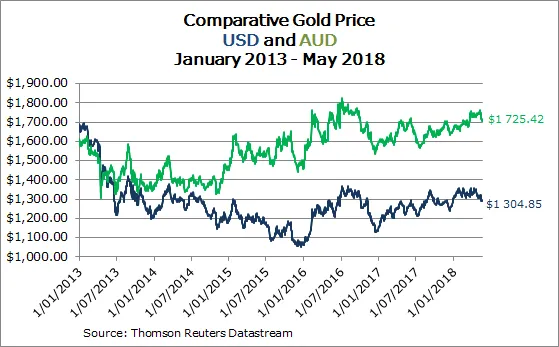

The price history of RSG stocks, the gold/oil ratio and the gold price over the period from 2013 to now are given in the figures below:

The gold price in USD terms has been somewhat rangebound between US$1 050 to US$1 400 since the smackdown of the gold price in April 2013. However, in AUD terms, gold price has been steadily rising since the end of 2016 after the US election led to a momentary spike in the gold price followed by a sharp decline. At the same time, RSG stock price has been lingering since the the start of 2017.

The extended weakness of the RSG stock price relative to other comparable gold miners seems to be due to a combination of the declining gold-oil ratio and operational issues specific to the Syama underground mine development and bottlenecks in the existing production.

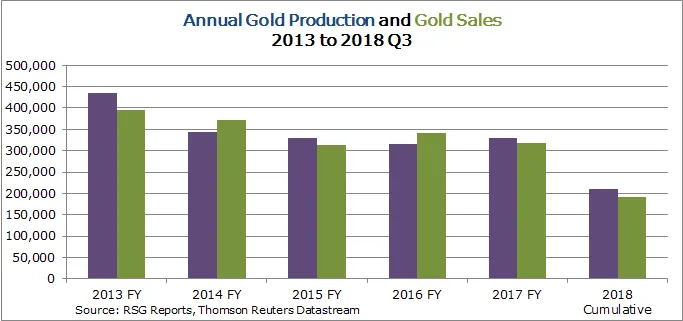

The gold production and sales over the period from 2013 to now is given in the figure below:

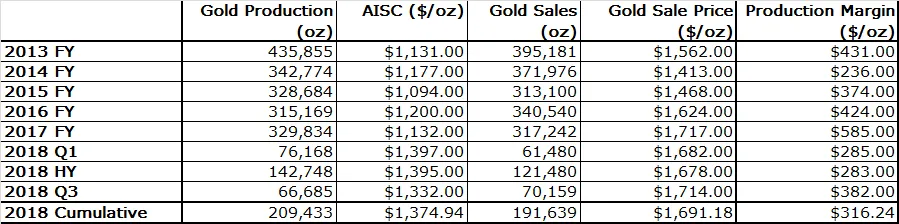

Since RSG finished with mining at Golden Pride mine in Tanzania in 2014, the annual gold production has dropped to the 300-340koz range. However, for the 2018 financial year, the annual production will fall to 280-300koz. This is less than the guidance range given last August of 300koz, resulting from lower grades at Syama and also complications in processing the ore at Syama. Up to the March quarter of 2018 (third quarter), RSG has produced 209koz of gold and has sold 192koz. This is approximately 15% less than in the past, resulting in lower revenue.

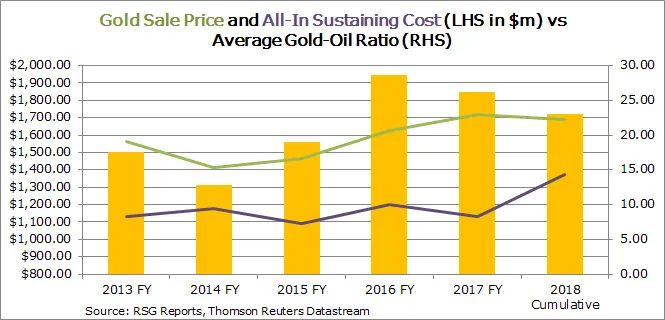

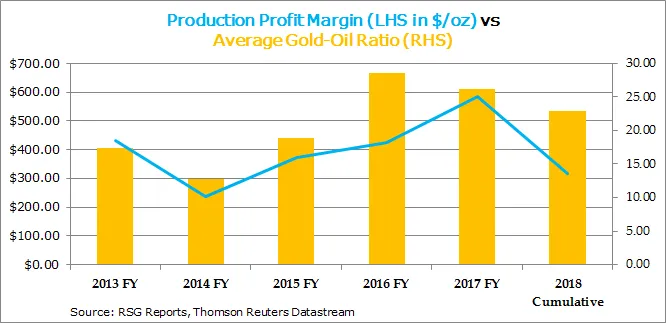

The transition towards underground mining at Syama appears to be unable to offset the slowdown in production. As a result, the all-in sustaining cost of production per oz (AISC/oz) will correspondingly increase. The figure below shows the relationship between the gold sale price, AISC and the gold-oil ratio:

The rising trend of the AISC over the past two years has corresponded with the falling gold-oil ratio, but it is more pronounced than other gold mining companies owing to reduced production volume and efficiency. The figure below showing the production margin (difference between gold sales price less the AISC) relative to the gold-oil ratio further highlights the company's declining efficiency:

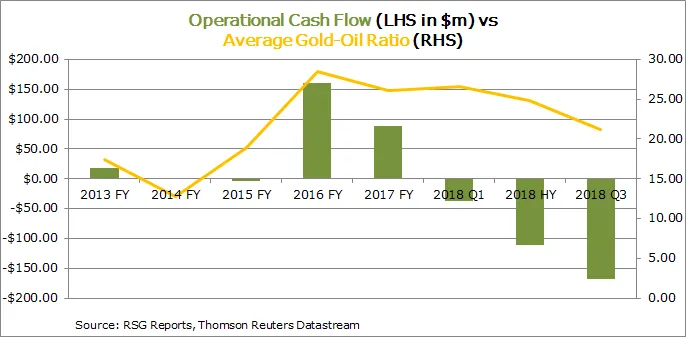

The company's ability to generate cash flows from operations less sustaining capital expenditure (not growth) reflects how likely they can grow their business, pay down debt and distribute dividends to shareholders. Shareholders are interested in this when determining whether to buy or sell their stocks. The graph below gives the operating cash flow net of sustaining capex and the gold-oil ratio:

The gold-oil ratio seems to be quite well correlated with the ability for RSG to generate positive net operating cash flows up to 2017. For the 2018 financial year, RSG has been steadily burning cash, despite only a mild decline in the gold-oil ratio. This has been flagged before by management as they plan to develop the Syama underground mine project. However, lower than expected production and efficiency have plagued the company's ability to generate net operating cash flows. The accelerating trend in its decline may further disappointed shareholders and kept new investors away. There is possibly anger also from the shareholders who participated in the $70m equity raising in late 2016 at $1.90 a stock, as those stocks would be deeply underwater.

The net cash position (cash net of debt, excluding bullion and gold in circuit) has declined from $247.5m at the end of the 2017 financial year to $71.3m as at the March quarter of 2018, a decline of $170m in nine months! While the amount spent will likely increase their future production and hence profit generation, the investment is significant and its return is yet to be proven.

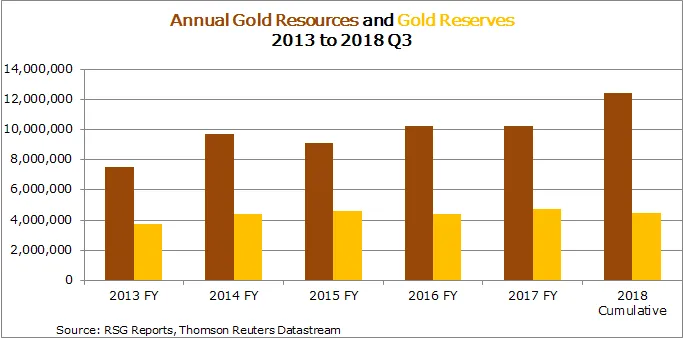

Looking at the future potential of RSG, consider the resources and reserves, there is evidence to suggest optimism going forward. The mines have observed growing trend in the amount of gold resources (underground ore estimated to be available for mining) is at 12.65Moz even after depletion, with the gold reserves (underground ore that is economic to mine out at prevailing gold price) holding steady at 4.7Moz after depletion. As gold price rises, which is expected to be imminent, the gold reserves will similarly rise as resources are converted to reserves. The Syama underground mine development plan will likely lead to more reserves being booked by the end of the 2018 financial year, and this may lead to a stock re-rating. The Bibiani mine development project will similarly book more reserves after having delivered a 40% increase in resources at the end of last year. The figure below gives the resources and reserves over the past 5 years:

To estimate a fair value for RSG stocks, the operating performance, cash flow generation net of capex, resources and reserves, and the prevailing economic environment are considered. Valuation will be using the enterprise value relative to gold reserves and gold resources, and then comparing it against the production margin to obtain a suitable ratio of the EV relative to the production margin. This approach takes into account the prevailing operating efficiency, the future potential of the resources and reserves, and also the weighting based on investor perception on the company's earning potential in the prevailing environment.

The stock price of RSG as at Thursday 24th May 2018 was $1.13, giving a market capitalisation of $838m. The net cash is $71.3m but RSG also holds $28.3m of bullion and $160m of gold in circuit (GIC) at Syama. Adjusting the GIC at 50% of market value, the enterprise value would be $658m. The production margin is $316.24/oz. The gold resources (net of depletion over the 2018 financial year, with 10% adjustment) is 12.4Moz and the gold reserves (net of depletion, with 5% adjustment) is 4.5Moz.

The recent history in the operating performance is given in the table below:

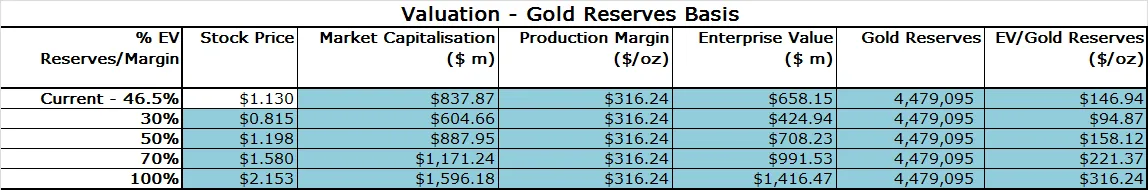

The table below gives the valuation ranges under the EV/Gold Reserves basis:

The current stock price implies a ratio of the EV/Gold Reserves to Production Margin of 46.5%. This compares to 60-80% for similar mid-tier gold mining companies, though these companies operate with higher efficiency.

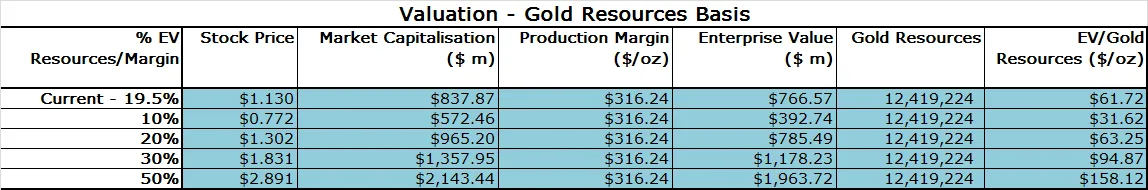

The table below gives the valuation ranges under the EV/Gold Resources basis

The current stock price implies a ratio of 19.5%. This compares to 10-30% for similar mid-tier gold mining companies.

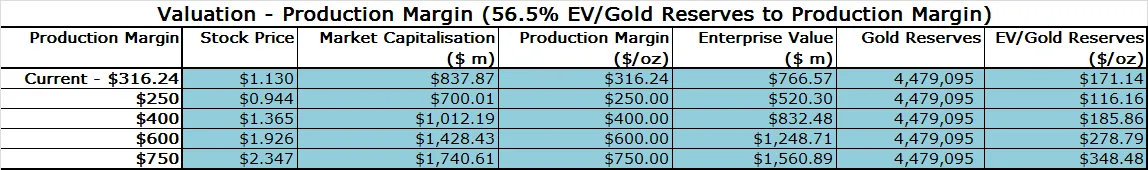

The table below gives the valuation ranges considering different production margin levels:

At the current price, the production margin of $316.24 is in the lower half of its historical range of $236-585.

As RSG completes the Syama underground mine development and also addresses the bottlenecking in processing, they will return to improved efficiency. In addition, the Ravenswood mine is also upgrading the processing plant and this will result in higher production over the next 12 months. They will also proceed with building the Bibiani mine over the next financial year, with further capital expenditure needed. However, RSG is expected to be able to fund it through their existing cash reserves, operating cash flow and drawing down debt. Thus, the chance of RSG needing to dilute their shareholdings may be slim.

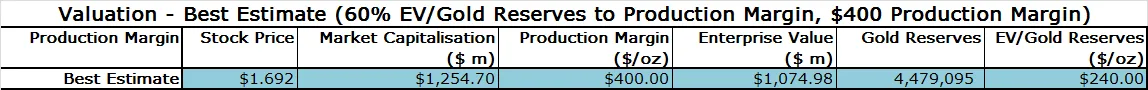

The author proposes that as the company will soon turn around, the production margin for 2019 financial year will be around $400/oz and the EV/Gold Reserves to Production Margin should rise to 60%. The best estimate value is given in the table below:

At the current price of $1.13, the best estimate price of $1.69 implies a potential return of almost 50% in the coming six months. Significant risks exist given the recent cash flow drain suggesting that RSG may need to raise capital, higher oil prices increasing AISC and also delays in processing and mine development.

Disclaimer - This report is not investment advice and should not be taken as recommendation to buy or sell the stock. The author has conducted his own independent research without receiving payments for his work except via Steemit and his subjective judgment has been applied. The author owns stocks in RSG and hence eats his own cooking.