A talk into the best civilization money generator, Time!!

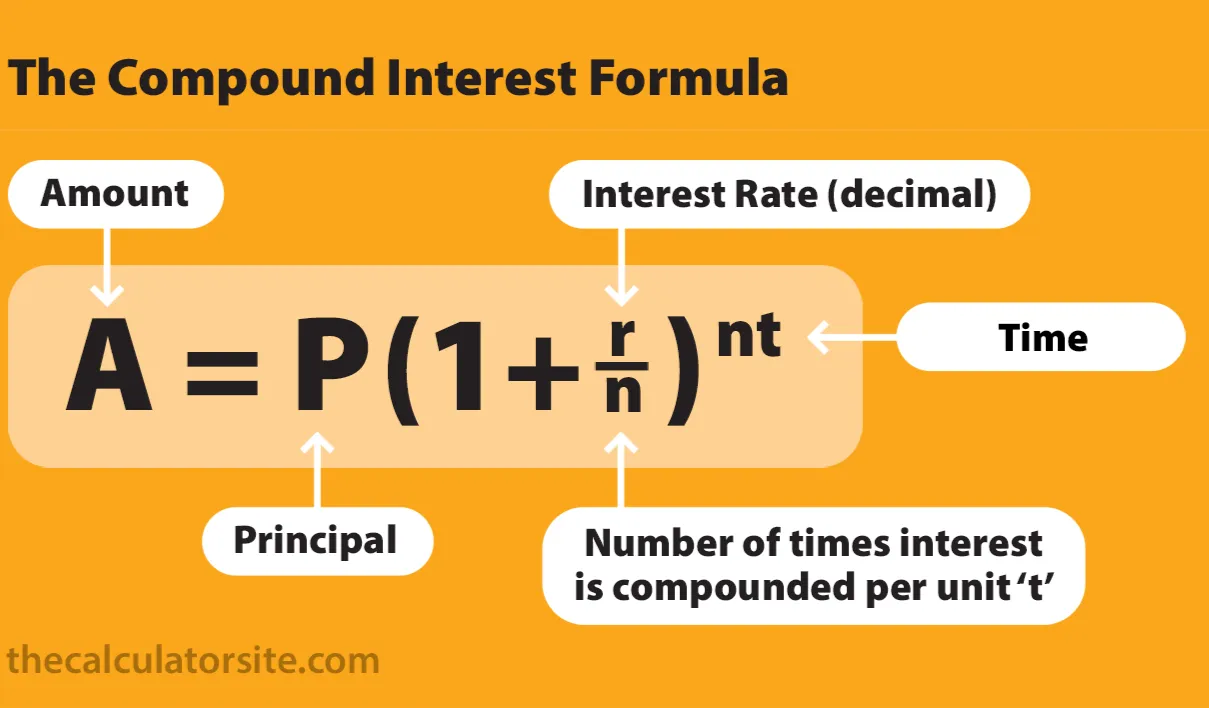

By analyzing the compound interests rates formula (same for compounding yield or apy) we can see that time (T) is the potence there, the exponencial factor (multiplied by the number of periods its compounded).

(I wanted to detail it and give examples, but post would get too long and boring, search for it if you want)

But by a simple observation that tells a lot about the explosive effect time gives on long term. And If you are also able to have high yield or performance simultaneously with consistency... You gonna get there faster.

However time itself won't make people rich by investing few ammounts... Thats why one of the best beginner's strategies is to farm tokens on pools, where you are generating this compound in nominal value (numerical quantity). Well, if you checked whitepaper fundamentals, tokenomics, technical analysis, market cap, and wants to support and invest in it... You gonna be farming stuff that you expect to have a great capitalization potential also. Thats where our imagination leads us.

So yeah, I love hive liquidity pools!! There are really low fees for stakings, really low slipperage (spread) for swapping on tribaldex or beeswap... This gives many usabilities to the ecossystem functions... Thoses revenues are also redistributed to LP. You can re-stake the farmed tokens on hive engine and add liquidity while gaining some few others yields, so you compound twice... Its insane!! I never saw anything so easy like this, makes me think it will turn financial system upside down.

You can also search on beeswap that some pools have great Apr (simple yield), but you can just re-stake periodacally (daily, weekly, monthly) to have an Apy.

[Obs: you stake two tokens in parity, 50% of each in a pool to have an equivalent share of the pool, and they are inflicted by IL (Impermanent Loss), that happens when one variates in relation to the other, thats why some of them uses stablecoins in parity, will depend on the pool adm how it works, but if both upvalue, is expected that LP (liquidity providers) rewards also increases, which is the farmed token for ex or also others together, so do your own research how it works, because the balancing on staked position is invertional to thoses tokens variation direction.]

Many tokens sets community engagement usability by stakings, so you can get others ways to earn by interacting, make things flowing together to help ecossystem... You even are rewarded a few ammount by giving likes on posts, I mean, wtf?!

Hive whitepaper and peakd behavior workings through curation pools distribution is an insane invention... Hats off.

I recommend to read @aggroed posts about how low changes on pool swaps fees improved it for everyone, higher rewards for liquidity providers and how that incentivates people to stake more, increasing the liquidity volume, so it also helps with low slipperage for who wants to swap bigger ammounts...

Sources

@aggroed/fee-structure-changes-coming-to-hive-engine

@aggroed/diesel-pools-are-generating-money-for-liquidity-providers-and-saving-money-for-traders

@aggroed/diesel-pool-fees-saved-you-money