Introduction

Bitcoin was created 11 years ago as a defiance of a corrupt and dysfunctional banking system. It was founded by a group called Satoshi Nakamoto. Since then, various groups of software developers have launched thousands of new cryptocurrencies.

Some are based on Bitcoin and are its software forks, such as Litecoin or Zcash. Others were created by a hard fork such as Bitcoin Cash or Bitcoin Gold. Others have completely new consensus algorithm such as Proof-of-Stake (PoS, DPoS, PPoS, etc.) or Directed Acyclic Graph (DAG). Development goes by leaps and bounds, such a Bitcoin can literally be surpassed in a few years, even Ethereum. No one knows what it will come up with in 5 or 10 years when quantum computers appear.

The year 2020 will be marked by developments and technological advances. Many of the cryptocurrencies that came to light in the ICO world in 2017–18 are already or are gradually getting into the mainnet phase and applying specific features, partnering and launching the real use of cryptocurrencies.

DeFi | Decentralized finance

So, what will be the trends in 2020? In my opinion, DeFi will play a big role. And the main player in this field is Ethereum, which has prepared a lot of news for this year. Upgrading to Ethereum 2.0, fully supporting Proof-of-Stake instead of existing Proof-of-Work and implementing sharding for better scaling. If anyone uses decentralized loans and stablecoin emissions, it will be through the Ethereum. MakerDAO's Stablecoin DAI is already at the top of this list, and there are now more and more decentralized banks such as Nexo or Compound where there is no need to lock the Ether but Bitcoin or other cryptocurrency. MakerDAO goes further in this and comes up with a new multi-collateral concept, where the collateral for the loan is not necessarily Ethereum, but also some other real-world asset such as gold.

This is not to say that other projects cannot come up with the concept of decentralized finance. Certainly, they will, and may have a more decentralized structure than that of MakerDAO. Many others simply won't want to be behind DeFi.

If it is better to borrow in a decentralized way, people will benefit from it. This is even more worthwhile in the case of the upcoming rise in cryptocurrency prices, and if a borrowed stablecoin DAI is reinvested, the user can find a nice extra profit. Especially when the crypto price will go higher. With the locked crypto, one can purchase more crypto for borrowed DAI.

Staking coins as passive income

Many projects based on PoS and DPoS or PPoS algorithms have already started or are starting to trigger the possibility of staking / delegating coins and thus their multiplication.

That's how it works here on Steemit. Here, when you lock STEEM into STEEM POWER, you get around two percent annually.

For coins based on staking such as Tezos, VeChain, NEO, Wanchain, ICON or Atom, there is already a possibility. Others such as Cardano now allow testnet packs and will be launched on the mainnet in the next quarter. And also, Ethereum itself has switched to a hybrid consensus system through a hard fork called Muir Glacier. And some 2% -10% per year are a nice passive income. Especially knowing that these cryptocurrencies are mostly cost-effective, and hence what is now worth $ 100 may be worth 10 times higher in a few years. Or even more. Many people think about it and prepare positions for future staking and thus passive income.

Cryptocurrencies are no longer merely a means of peer-to-peer sending financial value, as it did in 2010 when Bitcoin began to be used. Today it is programmable money with the possibility of smart contracts and other gadgets, such as mentioned coin staking.

Attacks by central banks and governments on private cryptocurrencies

Banks, governments through central banks, corporations led by FANG (Facebook, Amazon, Netflix, Google) will build their so-called cryptocurrencies, like Libra. Better call them digital currencies. Certainly, they will not have all the qualities of Bitcoin, they will not be there for everyone and it will be possible to censor or track them. In fact, it is convenient for them to create them for their own profit or whatever reasons.

At the same time, they will try to intervene where they can by means of regulators. That is, at the level of centralized cryptocurrency exchanges and exchange offices. They begin by regulating and limiting anonymous cryptocurrencies such as Monero, Zcash, Dash, and more. Others may come.

Price prediction

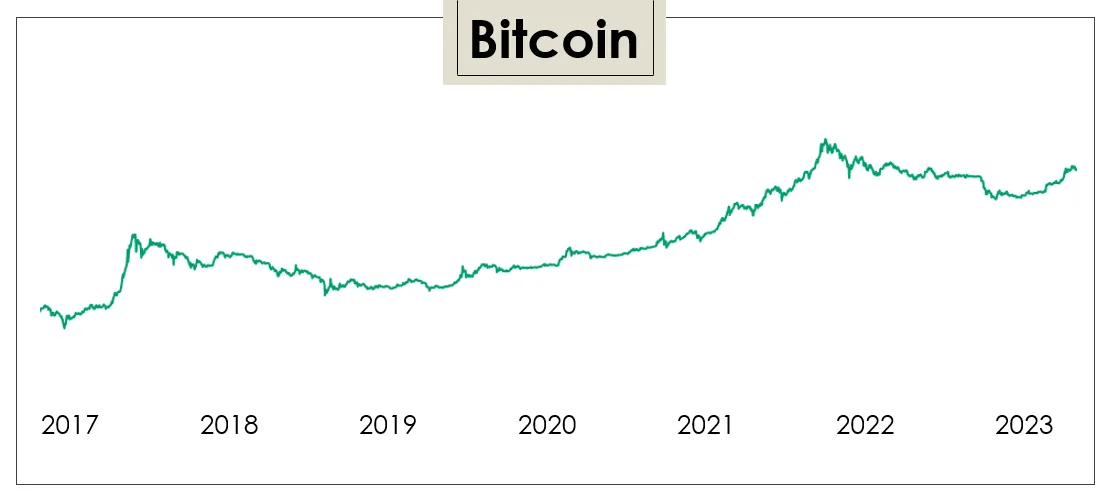

My estimation for the new ATH Bitcoin, and therefore most of the cryptocurrencies I estimate for 2022. Because of the four-year cycles of Bitcoin. Yes, the halving is already this year. But take a good look at what Bitcoin has done in the past, when halvings occurred.

In the year of halving happened nothing, as in the halving of Litecoin last year. Local pump and then dump. I think it will be the same this time.

So, we have a lot of time to prepare, to work, to publish and create content, to accumulate the coins that we want to sell in early 2022, and then to buy them back cheaply in 2024… and to sell them again in 2026?!? Maybe. That's why we publish on Steemit even now, when the price of STEEM is between 0.12-0.14 USD.

Who claims that this year's parabolic rise will be the same as last year and the year before? It can be justified by the New Year, the Chinese New Year, BAKKT, ETF, the progress of Lightning Network development, the flow of new coins or anything else. But it is nothing else than hopes. Yes, I admit that the future does not just follow the past, so the historical chart is not always a leading point. But history can guide the future, trading is about mass psychology and game theory. As we have seen several times in cryptocurrencies.

Bitcoin will be between $ 6,000 and $ 18,000 in my opinion, but it will not exceed its maximum this year. Altcoins can even touch the bottom even more. At the end of the year, however, they could gradually begin to rise a bit.

Bitcoin price prediction

Conclusion

But I like the fact that the development teams are not sleeping and that new and better solutions to all possible problems arise. News, gadgets, mainnets, solved bugs, new cryptocurrencies based on new consensual algorithms. Nobody can say, that the first thing that was invented, Bitcoin, is the best and unbeatable. I think exactly the opposite. Bitcoin has inspired many and even if it can play the main role, there will be still developers bringing better and better solutions. About scaling, decentralization, security etc.

And that is so wonderful in this industry. In many ways, I find positive as well, for a better and better way is being sought. Yes, there will always be negatives and scammers who want to get rich at the expense of other people and do nothing good. Just calculus, resentment and profit for yourself. Perhaps the group of positive developers and creators will prevail in this relatively new industry.

20% of this post is intended to support @project.hope community