Institutional investors did set Bitcoin’s price booming lately and their entry into Bitcoin investments were facilitated by Grayscale, a digital asset management company. Till now Grayscale was a popular vehicle through which institutional investments got exposure to crypto world’s largest cryptocurrencies Bitcoin and Ethereum.

Now, Grayscale, which is probably one of the largest digital asset management companies looks to expand its crypto investment offerings for its clients.

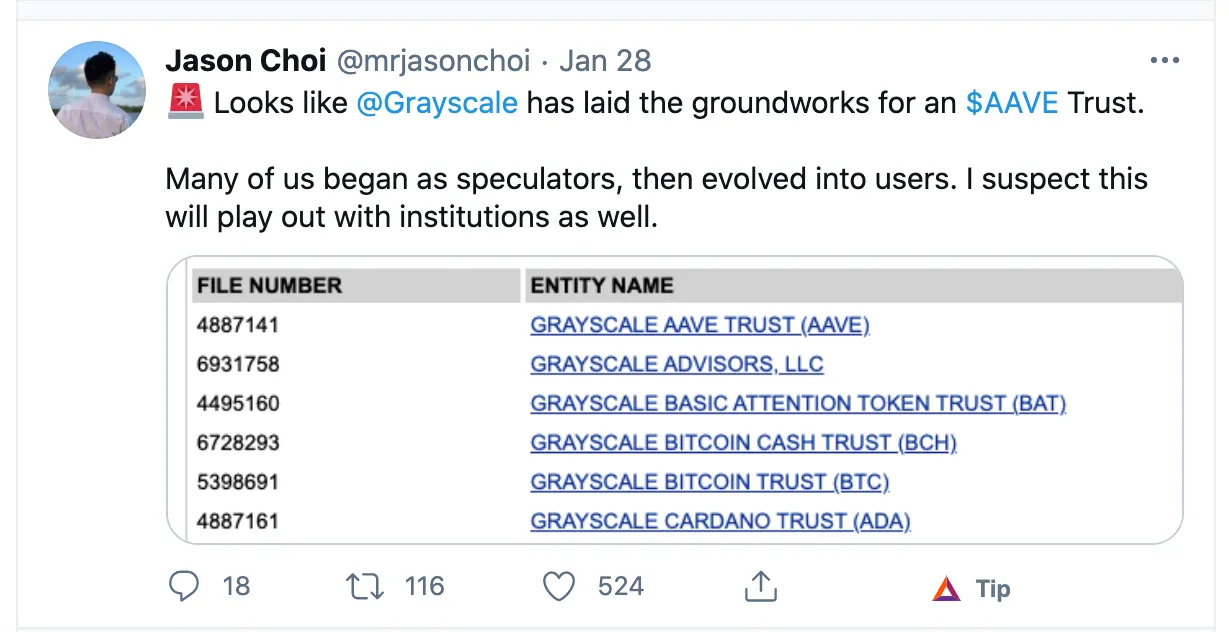

The crypto trusts which Grayscale has filed registrations for recently

This is clear because Grayscale has gone ahead to register trusts for AAVE, Cosmos, Polkadot and privacy coin Monero this month, while earlier Grayscale in the month of December, registered trusts for BAT, Link, Mana and Cardano. These trusts were registered through Delaware Trust Company, the Organisation that registered Grayscale’s Bitcoin and Ethereum trusts, which are driving many institutional investors into investing into these assets.

All this shows that Grayscale is preparing to launch more crypto trusts, diversifying its crypto investment product offerings for institutional investors. Right now Grayscale has just registered trusts for the above mentioned cryptos but its launch may or may not happen.

Institutional Investors’ growing interest in investing in DEFI space like AAVE

Crytos such as AAVE are doing phenomenally price wise even beating BTC, one can imagine more exponential price increases for such cryptos when institutional investors pour into them.

AAVE beats Bitcoin

What is significant here is that AAVE is a DEFI crypto, and institutional interest in DEFI space seems to be cropping up for Grayscale to consider launching AAVE Trust.