In the United States, since the 1980’s, there has been a growing reliance on easy money, more specifically, easy debt. And one path to easy debt is “Debt monetization.” Debt Monetization has been used to fuel short-term bursts of economic growth at the expense of long term savings, investment and capital formation. This trend in monetary policy has contributed to the wealth inequality, populism and polarization we see today. Europe and Japan have similar monetary policies. And debt expansion has been noticed in other parts of Eurasia, but I will stick with the US today.

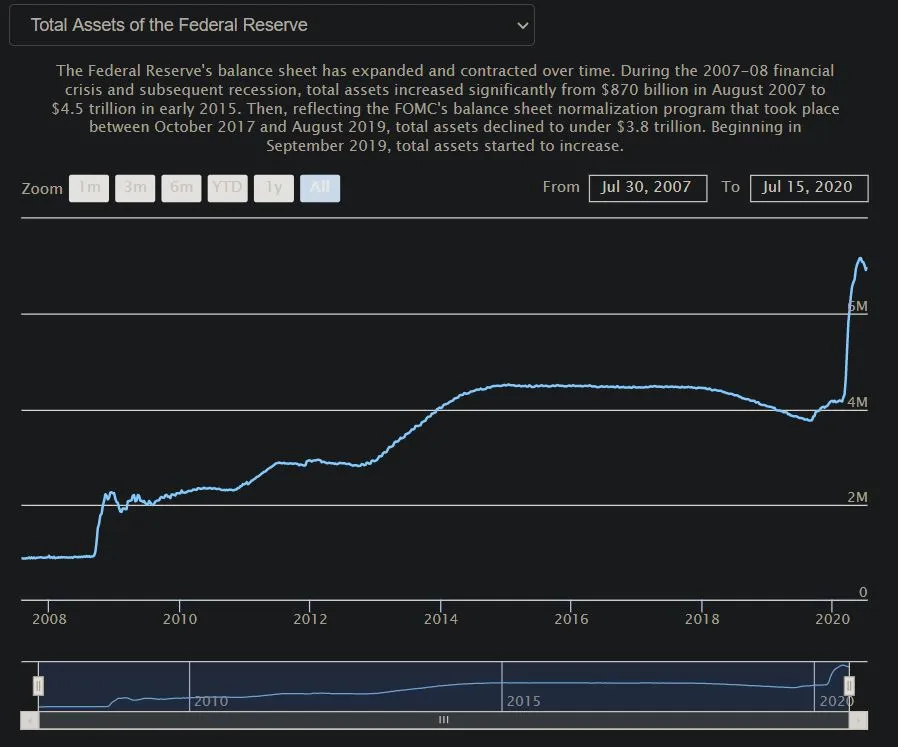

Debt, like stocks, can be bought and sold in capital markets. Debt monetization is when the Central Bank (Federal Reserve or the Fed) creates money -- magically 'poofing' it into existence -- and uses that money to buy debt from commercial banks. The Fed then removes that debt from circulation by storing it on its balance sheet (illustration above). Now, the Fed has the debt, and the banks have the money. When that debt is no longer in circulation, the value increases due to the lower supply; pushing down the interest rate (Federal Funds Rate, above). This lower interest rate encourages more borrowing because it's less expensive.

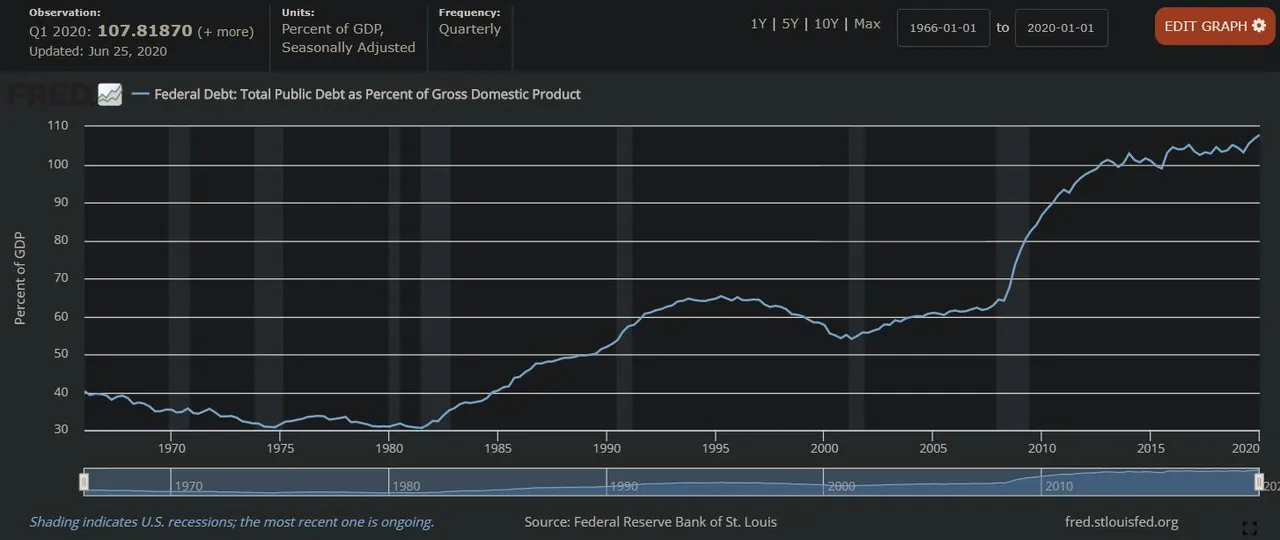

Debt in itself is a good thing. It builds modern economies. We run into trouble though when debt growth continues to outpace income growth over the long term as illustrated in the US Debt to GDP ratio approaching 110%. Easy debt tends to carry with it a momentum; the more debt you have, the more debt you don't mind having.

Warren Buffet said, "Nothing sedates rationality like large doses of effortless money.” The easier access to debt, the more effortless the money. When people don't have to work as hard for the money, they tend to give it a little less value and use it more frivolously. Buying a bass boat rather than investing in stocks or crypto; corporate stock buybacks instead of research & development; funding bloated entitlement or military programs rather than repairing infrastructure; this trend of diminishing returns on debt is growing louder by the decade.

This easy money of near-zero interest debt contributes to wealth inequality by encouraging spending for the short-term at the expense of savings and investment for the long-term. This has disproportionately affected Americans below the top 10%. "The top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of families, it was just under $54,000" - source. This is not a sustainable economic model for a robust middle class and a stable society.

Limiting the Fed from making debt so easily accessible might be a good first step in ameliorating this issue. Less easy debt may encourage individuals, corporations, and governments to channel money to more long term productive initiatives, promoting net capital formation and growth. And creating a future that we can all enjoy.

Have other nations experienced similar issues? Do you agree or disagree? Anything to add? Thanks for reading.

Credit for Photos:

https://pixabay.com/photos/dollar-flying-concept-business-2891817/

https://www.widewalls.ch/magazine/future-cities-green-architecture-environment

https://www.businessinsider.com/americas-crumbling-infrastructure-bridging-the-gap-2014-6

References:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://fred.stlouisfed.org/series/FEDFUNDS