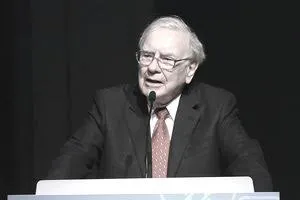

Investment is a good way to safe guard our resources and a great option for growth to occur. We all know Warren Buffet, whenever his name is mentioned we are sure that he is an expert in investment decisions and below are some of the shared secrets to his investment decisions that we also need to learn from.

Rule Number One.

According to Warren, it is safer to have assets than having cash, people who want to show off how much they have been able to acquire are the ones who easily go around with large junks of cash but it is better off to have asset instead of cash since cash is subjected to high inflation rate at any possible time.

Rule Number Two.

While there is an advice for us to own asset, we need to also consider that assets are more productive than the other and according to this very smart investor he is advising us to make investment in assets that are productive, instead of just having an asset with the hope that it will yield returns in few years from the time of purchase, you can actually get a productive asset that will bring in return from time to time and the tax that you will pay on that productive asset will be as a result of how much is made.

Rule Number Three.

New investors are always quick to jump into what other people consider as being trendy and what will yield profit faster, investment requires knowledge and expertise and it is usually better off when investment is made within the range and category of what we know how to do best. It is very much better that large investment are made in the areas that we have a basic knowledge about and not one which we have idea about its operations.

Rule Number Four.

Before making any investment at all, company evaluation is really necessary. You must consider the fact that a company is most likely the total reflection of its team members and its past transactions, do not commence any investment without first carrying out a background check on what the company stands for and what the company stands to gain.

Rule Number Five.

There is always a chance of making good investment opportunities, do not be too careful and then miss those opportunities, check out for opportunities that are golden carry out your own research and then take advantage of the situation.