Tokenizing Real Estate

The Real Estate industry has been set in its ways and functioning in the same manner for centuries. In essence, we can compare the present-day system with landlords in medieval times. Where peasants used to have to work the land and give a part of their yields to the owner of the land. Now, people work their job and then spend a part of their income to pay off their rent or mortgage. The system in place has always favored the bigger, or lending party. And with real estate prices ballooning in the last century this has evolved in the lender having to take on 30+ year loans. The word ‘mortgage’, by the way, means ‘death pledge’, something to think about the next time you consider taking on a long-lasting loan with a bank.

It’s fair to say that the sector is ready to get things shaken up a bit and blockchain technology has all the potential to disrupt the real estate industry. As stated in our Blockchain & Real Estate post, blockchain technology has a couple of distinct features that could change the way we invest forever. By tokenizing buildings, the level of entry to invest in real estate can be lowered dramatically. Instead of taking a mortgage, you are able to take part of your income every month and invest it in a part of a property. Furthermore, you are able to diversify your portfolio to every place in the world easily.

Imagine having 1/100th of a house in London, 1/20th of a house in Seoul, another 1/20th in California, and so on. With a looming housing market crash possible in certain parts of the world, other countries may be able to weather that storm better. It instantly creates a global market for both the investor as well as the party seeking investors, increasing the liquidity immensely.

Add all the benefits regarding transactions, smart contracts, and documentation in mind and the benefits become clear. The hardest part is pioneering this transition, enabling blockchain technology to be implemented in such a way that the above-mentioned picture becomes a reality.

Luckily, we found a party that has been doing exactly that. The hard-working people at RealT already have an operational platform where people can invest in real estate. Read more about them in this DeepDive!

What is RealT

In its simplest form, RealT can be seen as a platform where investors can buy real estate. However, this would shortchange them in a big way.

RealT is one of, if not the frontrunner intertwining blockchain technology with real estate investing. The parcels they have available on their platform can be bought and sold with cryptocurrencies, and ownership is stated in the ownership of RealT tokens on the Ethereum blockchain.

They have tokenized real estate, a bold but badly needed move which surely will lead to a schism in the sector. Instead of buying a land deed, investors can buy their RealT token, and where normally in real estate investing you can’t tear up a land deed and share the pieces of paper with 100’s or even 1000’s of other people, you can tokenize property into 100’s or 1000’s of coins. Everyone is now able to buy a fraction of a house and get a fraction of the rent.

Why is this so interesting?

There are a lot of aspects that make fractional real estate investing very interesting. First and foremost it lowers the barrier to entry for an investment. As stated earlier, investing in property almost always means having to take out a loan. Often at a bank. And while rates are favorable at this time, you are still committing yourself to a long relationship with the lender. Being able to simply put away $50, $100, or $1000 each month takes away this risk. Better yet, you are staying out of debt! While it seems to be normal to be in debt for huge sums of money in certain parts of the world, it (obviously?) is a lot better not to have to worry about payments for almost half of your life.

It also makes it possible to spread your risk. Investing, for example, $300.000,- into one single property makes you dependent to that one location. With RealT, when they have enough properties to invest in, it will become possible to diversify into multiple locations, possibly even around the world. This is a gamechanger.

Another interesting aspect to take into account is the liquidity of the property. Normally when you want to buy or sell a house you are waiting for a single entity to make an offer. Again, the amount is high so it takes time to find a suitable counterpart. When tokenizing a house and selling the tokens on a marketplace it is a lot easier to sell and buy those smaller parts of a house instead of the whole thing. In case you want to cash out, or feel there is a better investment available it can be done a lot faster and easier.

And don’t forget the advantages of blockchain technology regarding all the paperwork that is involved. Due to the qualities of a decentralized ledger, it is possible to make transactions in only a fraction of the time it would normally take. And since you don’t need to be approved by a plethora of different entities the whole process will be smoother and faster.

Who started it

RealT has a couple of very smart individuals steering the company. There is a lot of experience to be found in the blockchain and crypto industry, as well as in the real estate industry. With Remy Jacobson and Jean-Marc Jacobson both pioneering in the crypto space since 2011 and even setting up the first Bitcoin embassy in 2013, and Gary Krat on the investor side with over a 100 acres of real estate assemblage forming the board.

We intend to set up an interview in the near future to get the chance to really dig in to their vision and future plans. For now, rest assured that they know what they are doing, and have the accolades to back it up.

Add a group of like-minded and crypto-focused people in the mix and you create a success formula.

How does it work

All the properties that are offered via RealT are a separate LLC. This comes with a couple of key benefits. Most importantly, it ensures that every property can be seen as a separate entity with its own deed. This means that every property can be tied to its own set of RealT tokens; the digital representation of the deed. It also means that in case RealT would go out of business, the properties will still remain their own entity. RealT has made sure that everything has been done to make tokenizing properties compliant and possible with legal regulations.

The RealT tokens are an ERC-20 token that works on the Ethereum blockchain. For every new property, new ERC-20 RealT tokens will be created that are unique to that property. To simplify: The (digital) ownership of a house can be cut into multiple tokens, in which every token represents a part of the house. Blockchain technology makes sure that everyone knows who owns what coins due to its decentralized distributed ledger properties.

These tokens not only represent the ownership of a part of the house, but it also entitles the owner to the rent of that property of which the owner will receive the same percentage as the percentage of ownership of the entire property.

Rent is paid automatically to each wallet that owns the RealToken of that property and is paid daily in the stablecoin DAI which is tied to the US dollar and is always worth $1.00. This guarantees that you are sure how much rent you will get, and aren’t risking the, sometimes huge, price fluctuations of Ethereum and the rest of the crypto space.

On top of that RealT takes advantage of the entire decentralized finance space that is available on the Ethereum blockchain. The ‘DeFi’ space has too many aspects to try and explain in this article, but one that is very interesting and is being used by RealT is the ability to place the stablecoin Dai into Compound. Compound gives yield to Dai, the stablecoin, that is being placed there. On a yearly basis, this increases the ROI for your investments close to 4%.

The same is done with the maintenance reserve. There is a distinct possibility that the maintenance reserve outpaces the costs simply by the compounding interests it receives. Perhaps this could then go into upgrading their existing properties and subsequently raising rents. In essence, it envisions an honest ‘banking system’ where the party lending funds receives yield, in contrast with the current broken system where banks are in some cases even taking your money for holding it (while lending it out against absurd percentages).

Without making this part even more complex, rest assured that RealT is using all the tools available in the ‘DeFi’ shed to give their investors the best yield and ROI available. And with everything that is being built on Ethereum currently, we can only imagine that new opportunities will arise which will favor its users even more.

Besides buying RealTokens on the RealT website, it’s also possible to buy them on an exchange. RealT uses the exchange Uniswap to provide investors with the ability to purchase tokens, increasing the liquidity for properties and enabling a real-time free market for ‘property-shares’. This also means that the value of a property is based on what people are willing to pay at that time instead of the value that a property is listed for. Rest assured, the price fluctuations seem to be limited, as shown in the image below.

It does mean however that buyers looking for a good deal can scan the open marketplace to increase their share of a certain house. In a sense moving towards a marketplace similar to stocks, and crypto.

How to start

Becoming a digital landlord is fairly easy, but there are a couple of things that you need to do to get started. Obviously you will need to make an account (if you use our referral link we will receive a percentage of the management fees RealT normally would get, you will still receive the same amount you would otherwise. It’s a great way to support our research and work!) on the RealT site. Since buying property is an investment you will need to go through a Know Your Customer procedure. This requires you to give them your personal information and send in 2 pictures of your ID or driver’s license, and a selfie. The process shouldn’t take long, and in case it can’t be completed automatically it has to be checked by someone. This was the case in my procedure, but within 12 hours I received a message that I was approved.

You will also need to have an Ethereum wallet so you have an address where your rent can be sent to, and where your tokens can be stored. Make sure you have the private keys to this address, that means that exchange addresses do not work! We recommend Metamask for ease of use, but other wallets are possible as well.

Then it’s time to check for your possible investments in the marketplace! RealT clearly has a background not only in crypto but also as realtors. The site and listings are professionally designed, with enough pictures and a clear description of the property. All the information you need can be found there.

After selecting the property that you want to invest in, simply choose the size of your investment and click the buy token button. In the same way you would purchase an item in a webshop you can now purchase your piece of a property in minutes!

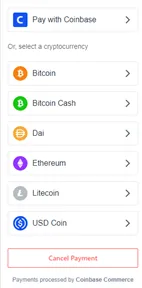

Payments will be done by using cryptocurrency, and currently, Bitcoin, Bitcoin cash, Dai, Ethereum, Litecoin, and USD Coin are accepted. There is also the possibility to pay via Coinbase.

After placing the order you will receive an email stating your purchase and after completing the payment you will receive some legal documents. These can be digitally signed to complete the process.

After signing the document RealT has to do the same. This takes a couple of minutes but it is a process that is already under improvement with the goal of decreasing waiting times. When they reviewed and accepted the transaction you will be the proud owner of a fraction of a property, for us, thousands of miles away! And you will start earning rent daily.

We own a couple of bricks of this magnificent place in Detroit :)

Current projects and future plans

RealT started offering tokenized real estate in December 2019 and has since been able to offer 12 properties, of which currently 8 have been sold out (time of writing June 2020). The properties range from single-family homes to apartment buildings. For now, there are only residential properties available but there are plans to also include commercial real estate, offices, and even hotels in the future offering a wide variety of objects and making sure there is something available for everyone’s taste. They just listed their first property based in Florida, but their main focus is on Detroit. The intention is to continue finding properties across the country, and even abroad if it is legally possible to set up the system in the same manner as in the US.

Looking at the development side it, again, is clear that the RealT team has a lot of knowledge regarding the decentralized finance space. One of the more interesting features they plan on delivering is a debit card from Monolith. The card, which is a DeFi card, is similar to a normal Visa Card, except they enable you to spend DAI from your Monolith wallet. Realt customers will be able to receive rental income straight to their DeFI card. No bank will be needed, or intermediary fees will be taken when spending your earnings.

Conclusion

The real estate industry is about to be shaken up. Where only years ago we were fantasizing about all the possibilities that blockchain technology could bring to the marketplace, we are thrilled to see that RealT has made it into a reality.

Their progress so far has been impressive and the value that is being transacted is growing at a rapid pace. In only 6 months RealT has gone from opening up to US investors in December 2019 to having 8 completely sold out properties with a combined value of well over a million dollars. RealT seems to have developed a gamechanger.

It also means that investing in real estate is becoming available again to a wide range of investors. Being able to start small, with perhaps $100,00 a month, means that the ‘little guy’ finally has a chance to get into the market. With the ability to compound their rent income every month the prospect of having their own passive income streams from real estate can become a reality.

Better yet, it means they can start investing without having to go into lifelong debts, in essence, slaving away for a bank that creates the debt out of thin air.

Add the possibility to invest from almost everywhere in the world and it’s clear that the legacy real estate investment firms and banks simply have to start looking into blockchain possibilities before seriously being left behind.

We’ll be sure to continue our investments with RealT, and follow them for years to come. If any interesting developments occur we will share them with you, so be sure to follow us to stay up to date!

And again, if you are interested in investing yourself and want to support our work, please use our referral link . Don’t hesitate to send us a message if you have any questions to get started!

Working towards a decentralized future,

Jamie

Founder Cryptodeepdive.com

Check out our other communities on Hive

Don’t have a Hive account yet? If you use our referral link, we’ll make sure to send you some Hive Power so you can start posting yourself! Hive referral