Cross-chain asset bridge and application hub for smart chains cryptocurrency Chainswap (ASAP) has been exploited for the second time this month, losing about $8 million to exploits.

Brief Analysis

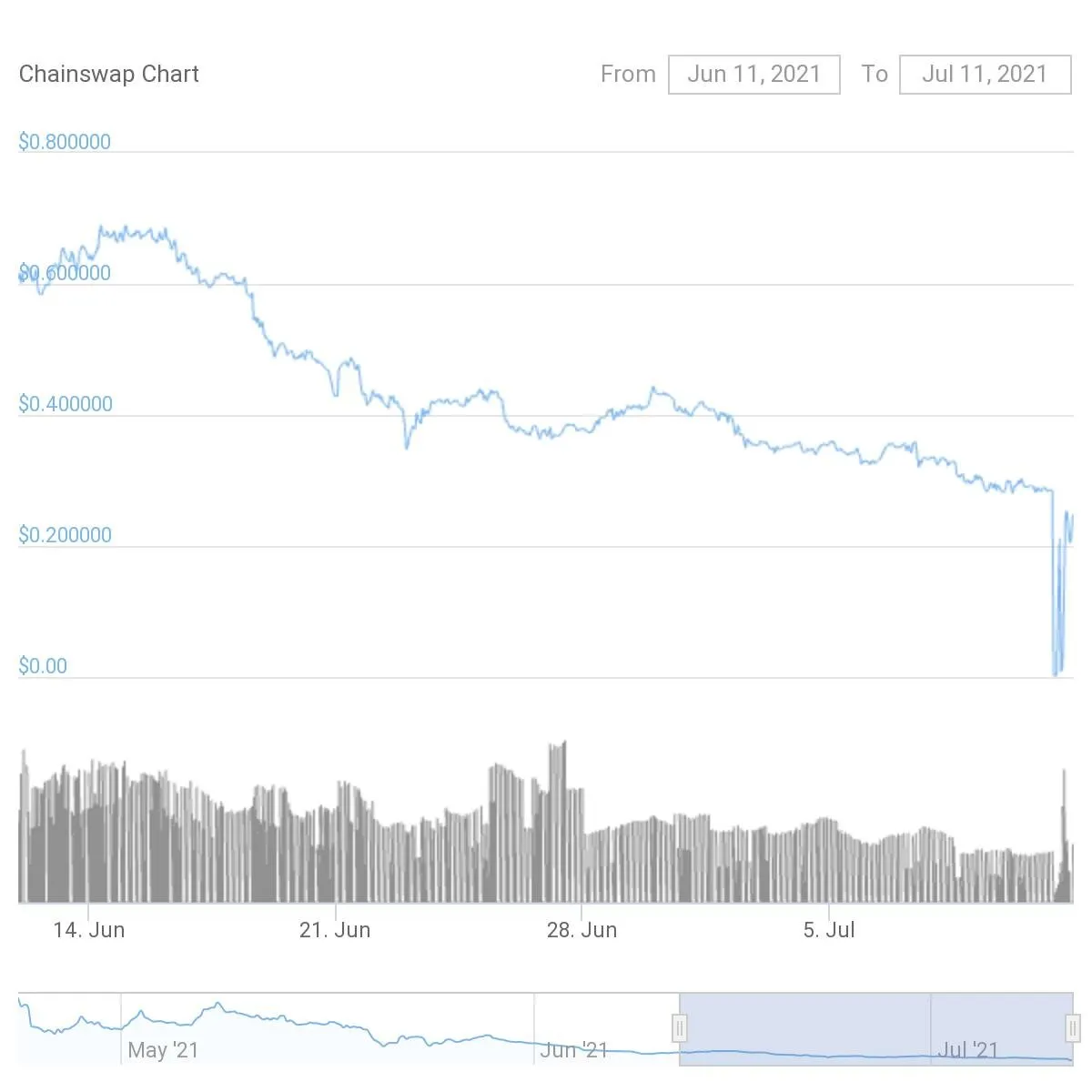

ASAP was not found within TradingView, so CoinGecko's charts will be used. The listing of ASAP given on CoinGecko states for it to only have started in April, so a full year analysis will not be available. However, the trend remains valuable for making observations to form patterns and predict its future.

Beginning with the maximum trend, ASAP overall has a negative decline that indicates a range of negative contributors. Two include inflation of the cryptocurrency that increases supply, and so decreases the price if there is an equal demand, and utility, fewer people using overtime, possibly from the lack of potential ASAP provides, though this cannot be guaranteed and is pointed out as a possibility. ASAP begins its highest from the beginning above the $3 mark, but within a day it quickly tumbles down, losing more than $1 to settle below the $2 mark. ASAP gradually recovers thereon but from the 8th of May starts a bearish trend. The bearish trend ASAP has is relatively linear with little recovery along with the trend. Mid-May ASAP gains momentum to its losing trend and dips below the $1 mark. Recovery follows for the following days in two periods but is soon lost towards the end of May. ASAP has continued to decline, and can be expected to do so. Looking recently there is a small V-shape in the trend, and that would be the effect of the exploit for ASAP. Although appearing not much, the scale has made it less visible and will become more noticeable when zooming into the trend scopes.

Looking at the monthly (30 days) trend, the crash ASAP becomes more visible. The constant declination of ASAP is shown for the majority of the graph, starting from over $0.60 and around $0.30 towards its crash. The crash of ASAP is devastating, its value becomes virtually zero. Its ATL (All-Time Low) was $0.00207009 on the 10th of July, but since then has quickly recovered close to its original state. ASAP can be expected to continue its gradual decline from the consistent trend observed earlier, moving away from the crash.

Within the 24-hour trend of ASAP, the crash becomes more detailed. From the beginning, ASAP appears relatively stable but falls straight downwards close to the $0 mark. The line follows almost horizontally, over the following hours ticking up. ASAP spikes over $0.20 for around 30 minutes, through quickly drops down to its original crash position. ASAP spontaneously rises back from the dead in the next few hours, a little under its original position from the beginning of the trend.

The statistics of ASAP at the time of writing are as follows:

- Price - $0.248173

- Market cap - $1,488,095

- Trading volume - $155,546

- 24h low / 24h high - $0.00207009 / $0.293034

- Market cap rank - 1630th

ASAP's Exploits

The first exploit of ASAP came on the 2nd of July with the platform reporting that the total damage was around $800000. In the announcement of the exploit made by ASAP, it was claimed that full compensation to those affected was almost completed, originating from the ChainSwap treasury. This exploit originated from 'an anomaly on the bridge' where some users reported that coins were actively taken away from wallets interacting with ChainSwap. When the ChainSwap team recognised the exploit, the bridge and nodes were frozen with a fix brought out within 30 minutes. Centralised exchanges Huobi and OKeX were contacted being that the exploiter interacted with these exchanges.

In less than a week ASAP become exploited again, losing 10 times the amount than before: ~$8 million. No announcement via Medium has been posted by the ChainSwap team, though tweets were sent through its Twitter account. The first tweet claimed that the liquidity of ASAP was pulled temporarily, advising people not to but any ASAP as the exploit was investigated, though the exploit was not mentioned or speculated. The tweet is shown below and can be visited here:

.https://twitter.com/chain_swap/status/1413973753097293825

- chain_swap

ChainSwap tweeted soon announcing that holders and Liquidity Pools (LPs) before the exploit occurred were recorded and will be airdropped 1:1 with new ASAP, including those on exchanges. ChainSwap once again warns people not to buy ASAP and promise a compensation plan. The tweet is shown below and can be visited here:

.https://twitter.com/chain_swap/status/1413985428336693251

- chain_swap

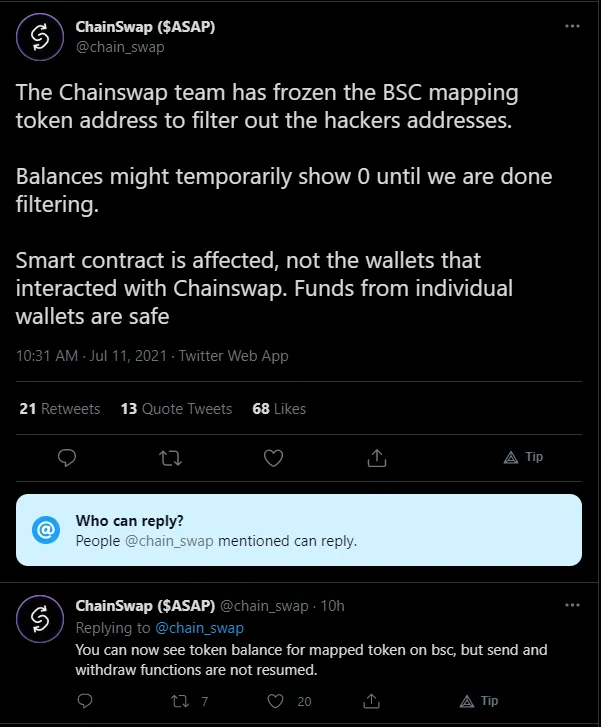

Soon after ChainSwap tweets out that the BSC (Binance Smart Chain) mapping token address has been frozen by the team to track the exploiter's address. They mention that wallets may appear as 0, though are promised to be fixed after the track. Smart contracts were mentioned to be affected, though not wallets. Within a few hours, ChainSwap replied to the tweet announcing the end of the BSC mapping token freeze, making token balance back to normal. However, sending/withdrawing was blocked. The tweet is shown below and can be visited here:

.https://twitter.com/chain_swap/status/1414019554603307017

- chain_swap

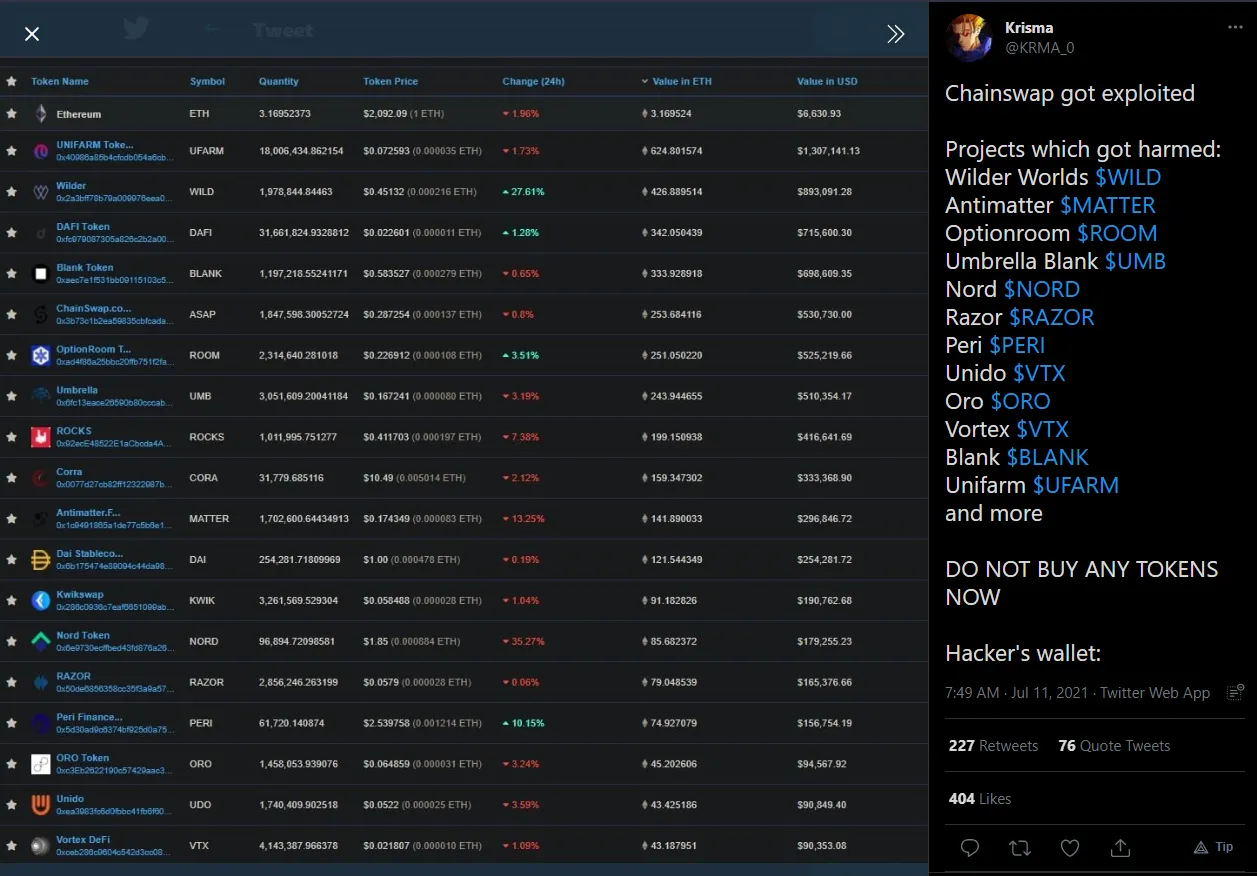

With many services based on the ChainSwap blockchain, many services thus were affected by the exploit. Below is a tweet that outlines some of the projects that were affected due to the exploit with a snapshot of the exploiter's wallet tokens. The wallet is believed by one within the tweet to be 0xEda5066780dE29D00dfb54581A707ef6F52D8113 (explore on Etherscan: https://etherscan.io/address/0xEda5066780dE29D00dfb54581A707ef6F52D8113), and it appeared to be true with a warning given stating that the address was used in a phishing scam.

Further Reading

Medium (ChainSwap) - ChainSwap post-mortem and compensation plan - https://chain-swap.medium.com/chainswap-post-mortem-and-compensation-plan-90cad50898ab

be[in]crypto - Second ChainSwap Exploit Incurs $8M in Losses - https://beincrypto.com/second-chainswap-exploit-incurs-8m-in-losses/

CryptoPotato - ChainSwap Exploited: Projects Using The Bridge Protocol Crashed 99% - https://cryptopotato.com/chainswap-exploited-projects-using-the-bridge-protocol-crashed-99/

Thumbnail Source: https://chainswap.com/