Perhaps it is one of the most reliable indicators or signals in the world of trading and it is that, when in the daily chart the curve of 50 Days Moving Average (Fast MA) crosses above that of 200 Days Moving Average (Slow MA), this Event usually indicates that the Bulls are in full swing and more uptrend is expected.

However, there is one aspect that I do not like at all and that is that the volume of trade is not increasing at all but quite the opposite ...

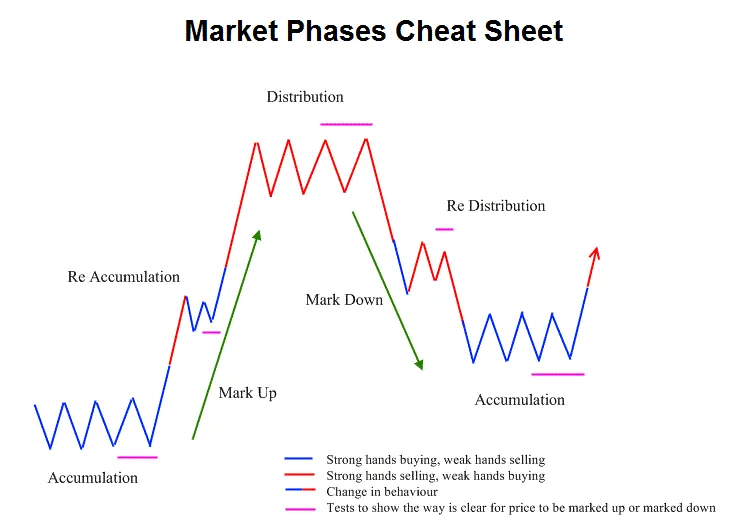

Which makes me think... Are we still in the accumulation / re-accumulation phase or is an imminent distribution phase coming?

(Source)

The behaviour of the "Strong-hands" defines the pace and direction of the market, without volume we cannot reaffirm ourselves in a clear trend and although I expected a kind of "fireworks" when crossing the barrier of $ 51,000, this is not happening at least with the expected acceleration...

Everything seems to indicate that this week will be key again.

Btw, as usual, nothing new that we did not know...

*Disclaimer: This is just my personal point of view, please, do your own assessment and act consequently. Neither this post nor myself is responsible of any of your profit/losses obtained as a result of this information.