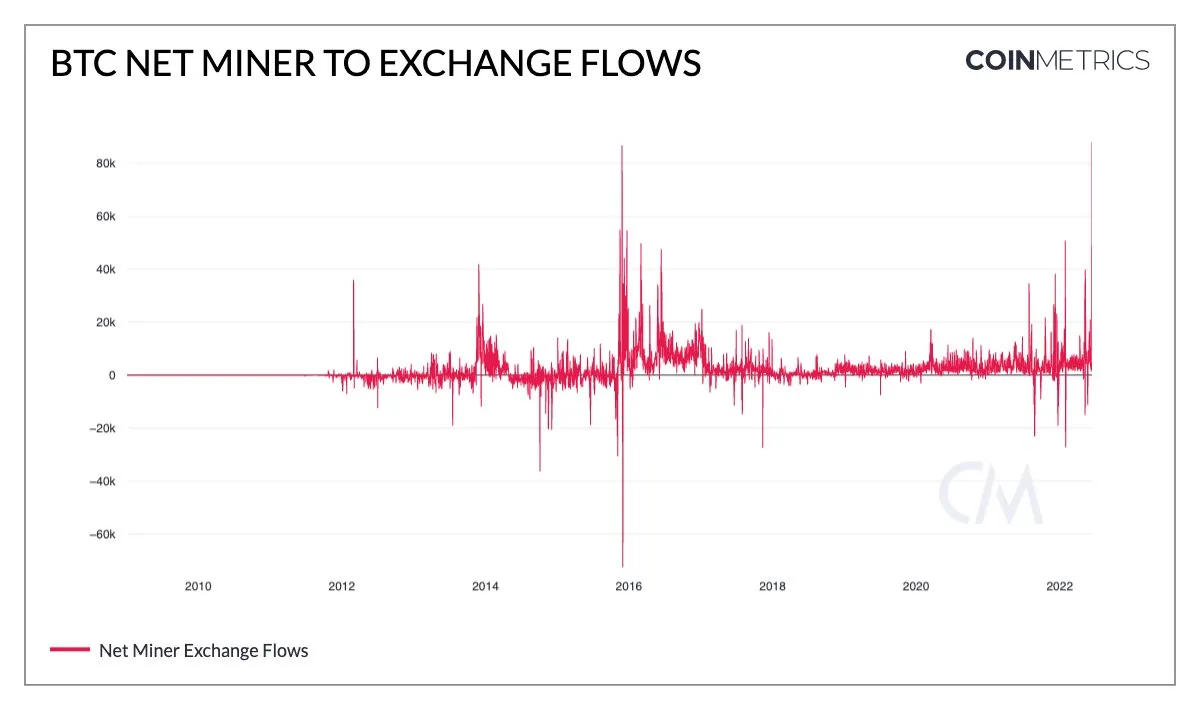

During the past days Tuesday and Wednesday we have seen something unusual in the BITCOIN industry and it is the fact that a new ATH has been reached in the number of BITCOINS that the miners have transferred to the exchanges.

(Source)

Exactly 88,000 BTC have been reached in a single day, a figure only seen previously in 2016 and which, in theory, would indicate a possible capitulation of some of the "weakest" miners in terms of sustaining their infrastructure and for which to mine BITCOIN It would not represent something profitable at the moment.

In fact, many of these miners, who are usually the least efficient, and who have reserved their BTC to sell on the Bull Market are forced off the network as the price drops, and they have to sell these reserve bitcoins, causing the price to drop further.

At the moment we know that the weakest miners are sending large amounts of BTC to the exchanges and the only reason they are doing it can only be to prepare for their liquidation...

On the one hand, the possible capitulation of the miners has only just begun and although there are no precise signs that this has affected the price yet, I fear that it will in the next few days or, if you rush me, a few weeks from now. ..so any "breather" to the upside could mean a good time for these miner-submitted reserves to be sold on centralized exchanges. The consequence will be a new abrupt fall and don't make me say how far it will fall, but I don't see clear support between $20,000 and $13,000, even if this means breaking the historical trend that BTC has never before fallen below the ATH of the previous cycle...

On the other hand, and from a positive point of view, if the miners are already beginning to distribute their reserves, it could mean that the BOTTOM is very close in time.

Patience.