Good day Hivers!

Join me in analyzing the crypto markets!

Let's have a look at two coins that I haven't analyzed so far

Unfortunately they still are not listed on tradingview so the chart is very rudimentary. But the most important technique (trend lines) is visible which again shows the power of TA.

For this I am using the log chart with the maximum time available. This technique is very simple as we are just going to use trend lines. But from my experience the simplest techniques are often the best!

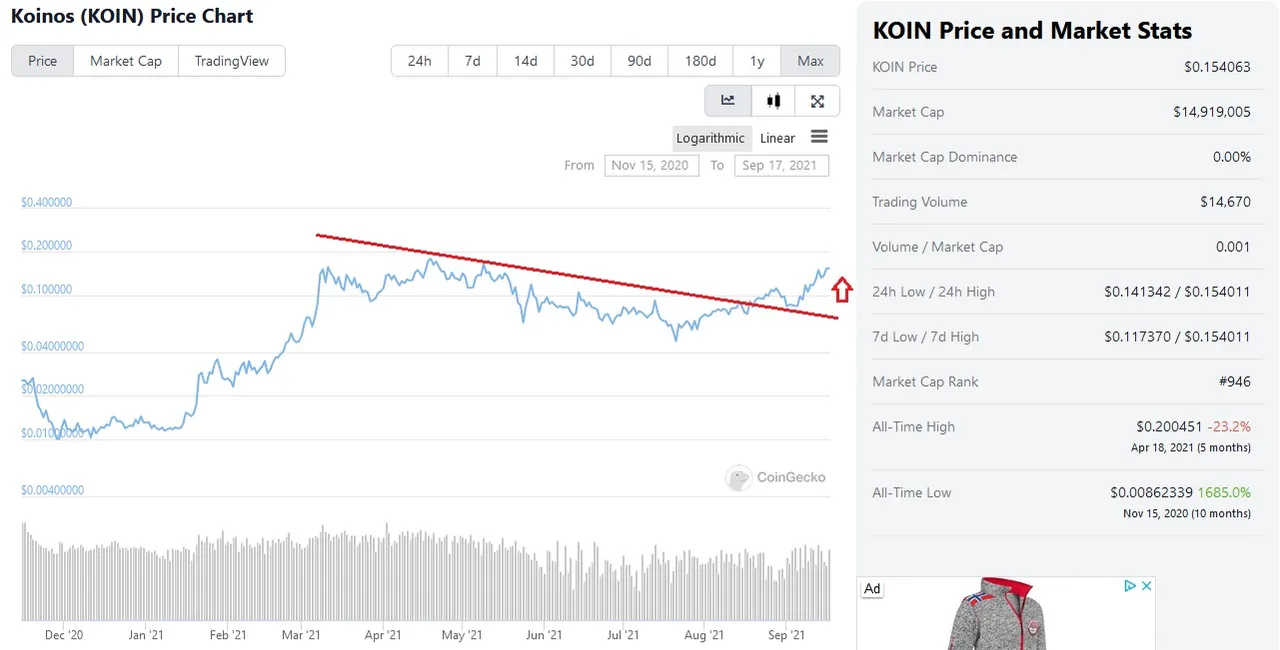

Let's first look at KOIN. If you are not familiar with this project, you can check out their website koinos.io or have a look at their youtube channel which has some videos that explain their project quite well. As I think it looks promising and it also has a low supply of only 100 million, I think there are potentially very large gains to be made here. In any case, it is definitely a lont time hodl coin.

Plotting the trend line from the previous peaks made in Spring of 2021, we can see a resistance that was first broken in August. There is a common feature that forms when a resistance is broken. It is generally always retested. If price does not break downwards the former resistance becomes a support. This is very nicely visible here. After the confirmation of a support prices have gone up by ~50%. I think even with a macro downturn in the market, prices will not break downwards of this support line. So, now would be a great buying opportunity.

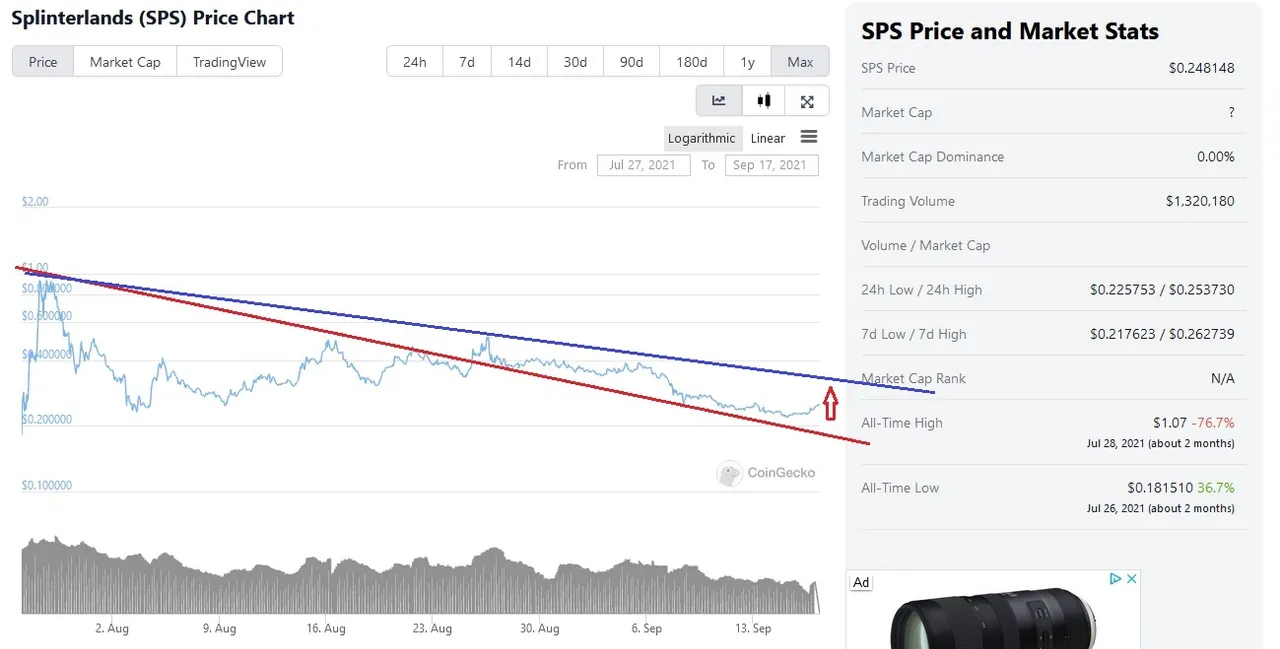

Splinterland Shards is another perhaps more familiar coin to Hive. It is the new governance coin for Splinterlands and seems very promising. We can apply the same technique. However, different to KOIN, SPS has not quite breached the resistance coming from the trend line formed by the previous peaks (blue line). Nevertheless, there is a strong support when we draw a red line one level below that. It has been tested for 2 weeks now and seems to hold up very good. Here I would be more cautious: there is a clear buying opportunity to about 36 cents when price will again encounter the blue line. But it is unclear if it will break that resistance.

However, I think this is not very meaningful when looking at the bigger picture. I think Axie Infinity is a good reference for SPS. They have a similar supply and are both very successful and one of the earliest crypto games out there. When we look at AXS, the chart is staggering:

In almost a year it went from 10 cents to 90$! That is almost a 70k% increase.... There are two similar moments as in the KOIN chart when a former resistance turned to a support (again, we have not seen this for SPS, but I think there is a good chance that this will happen). Moreover, the first 2 months of AXS look quite similar to SPS (although SPS had a much higher first peak). After it broke the resistance price went from 70 cents to ~10$. There is, however, a (small?) caveat: when AXS began its increadible upward push the whole crypto market was in full upward momentum. This might not be the case for the next several months. If so, it is doubtful that SPS will have a similar run up at least for the mid term.

But in the end it comes down to believing in the fundamentals. Does the project hold potential? Is the main idea good? Does it have a good team and is there continual development? etc. If one can check these boxes, I think it is a good investment option and one should look long term rather than to short term fluctuations.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!

</center

</center