This is the third part in our series of what gives the Hive Backed Dollar (HBD) value.

There previous two sections covered:

Each of these are part of the advanced financial system. As we saw, these markets are enormous. In that realm, the numbers easily get into the trillions of dollars.

This is where HBD can really establish itself.

Of course, advanced is not always required. Sometimes focusing upon the basics is vital. Here is where the third use case enters.

Fortunately, it is another large market.

Source

$1.9 Trillion In Payment Revenue

The global payment market has revenues of roughly $1.9 trillion. To show how large this is, if it were a country, this would rank in the Top 10 in the world.

Here we see where the industry is ripe for disruption. People pay almost $2 trillion in fees just to send money around the world. It is a highly lucrative busy, something that cryptocurrency can target.

With hundreds of trillions of dollars of monetary exchange taking place, inserting HBD in this arena is very desirable.

Here is where we see the concepts we are discussing moving from financialization-to-commercialization. When people start using HBD for their business and personal purchases, then it becomes evident how a shift takes place.

We now start to get involved in the process of real wealth.

Products And Services

Real wealth is the development of products and services. This is where many seem to go awry. Money is not wealth but, rather, a tool to produce wealth. Tying HBD to wealth is crucial.

Obviously, we do this by getting involved with the commercial applications. When people are receiving HBD as payment for goods or services, it becomes a vital part to the economy. If we look at this in a hierarchical form, this is base layer stuff. From an economic standpoint, it is the baseline which all other factors, including those mentioned in the previous articles, expand from.

Fortunately, HBD has a unit of account that most understand. One of the things that makes the USD so resilient is the fact that 4 generations of people walking the planet grasp what a dollar is. We spent our lives hearing about it. Even if we utilize another currency, much of what our country does still is denominated in USD.

HBD is piggybacking off this. It is not backed by USD, only the accounting mechanism. This provides everyone with instant familiarity.

Elimination Of Banks

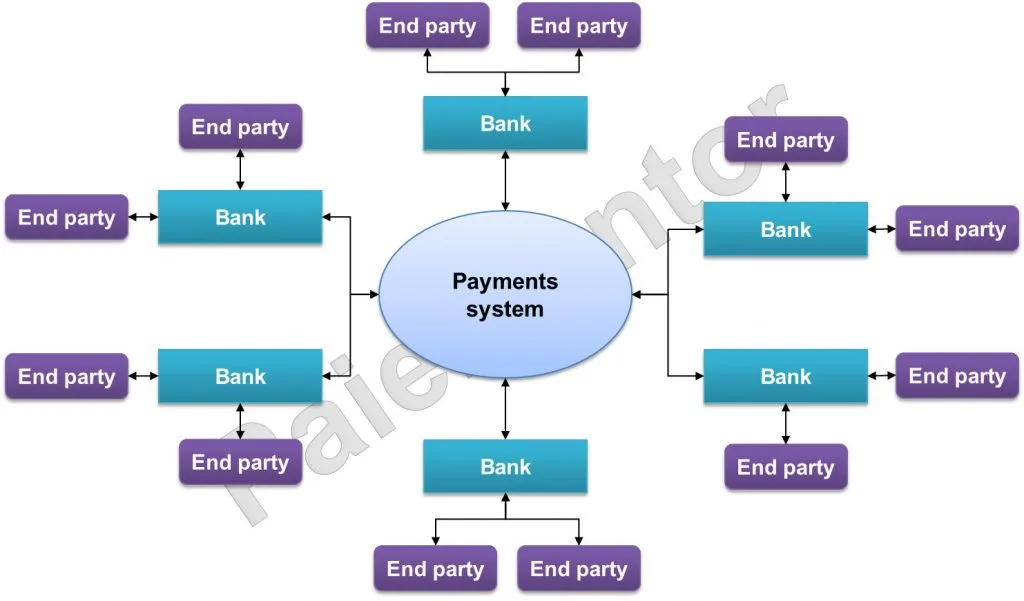

Cryptocurrency was designed with the intention of being able to operate without the banking system. When we look at the graphic above, we see where the banks are firmly established in the payment system. They are the intermediary for all payments. This is something that is very costly.

The $1.9 trillion is coming out of consumers' pockets. While much of this is paid by merchants, those fees end up being passed on in many instances. Of course, when people are sending money themselves, especially cross border, the "rent" comes out of their wallets.

Here we see how all of this is eliminated with cryptocurrency. HBD is a base layer coin which means that it has no third party. There is only the blockchain and the wallet holder. Since transactions are peer-to-peer, HBD can be sent from one wallet to another, with zero cost. On Hive, there are 3 second transaction times along with fee-less sending.

This could be a major disruption to the banking sector and all its arms including PayPal and Visa. The ability to operate without banks is vital since they serve as rent seekers and little else.

Growing The Hive Economy

If money is a tool to generate wealth, what role does HBD serve?

Ultimately, the goal is to grow the Hive economy. This means expanding the ecosystem so that we see value increasing over time. This is done by putting money to work to create products and services people utilize.

One of the key ways a currency does this is in the payment of labor. We are all familiar with getting our paychecks. This is paid in our native currency, giving us money which to spread through the economy. With this, we pay our bills along with some discretionary spending. Thriving economies see the entire pie expand through innovation and technological advancement.

Since HBD operates in the digital realm, it is able to leverage the explosive growth potential that exists. We can see the use cases for the coin expand as more games and applications are developed. This also ties into the idea of online shopping whereby merchants accept HBD as payment.

Money is the foundation for any economic system. Having a fast and dependable payment system is essential. We see this with Hive. The fact that no external wallets are required also reduces risk. Friction is removed from the system as payments are direct. Without fees, we see a great deal more money available to merchants and application owners.

In the end, the health of the economy comes down to how often the money is flowing through a system. When there is a liquidity crisis, economies enter recession. The reason is people are fearful and holding onto their money. Thus, purchases are not being done at the same pace. This causes economic slowdown.

Basically, as the Velocity of Money slows, so does the economy. It is something to be mindful of with HBD.

Derivatives Strengthening HBD

As mentioned in the article about derivatives, these assets can enhance the value of HBD since it is what they are tied to. In the payment realm, they can also provide value.

For example, we have a HBD derivative called pHBD. This exists on the Polygon blockchain. Since it is a 1:1 backing with HBD, it also operates utilizing the same unit of account we are all familiar with.

If, however pHBD started to be used for payments, we see the reach of HBD expand. Even though transactions are taking place in another currency, it is still tied to HBD. The main asset has to exist somewhere. Therefore, as the value (utility) of pHBD grows, this rolls over, in part, to HBD.

The international banking system does this all the time. There are trillions in payments made between financial institutions that are priced in USD yet go outside the established payment system. Instead of utilizing normal channels, one bank will simply enter an agreement with another bank to send the money, say $1 million, in another form. For example, they might send over 3 month LIBOR futures as settlement.

pHBD and whatever other derivatives that are created could be used for similar purposes. The key is having them tied to HBD. If that happens, a lot of inherent value is fed into the main coin. This also creates a great deal more resiliency.

Increasing HBD Transactions

The key is to increase the number of HBD transactions. Here is where we get to the core of it all. For a currency of this nature to thrive, it has to be moving around. This means developing use cases where the coin is accepted as payment.

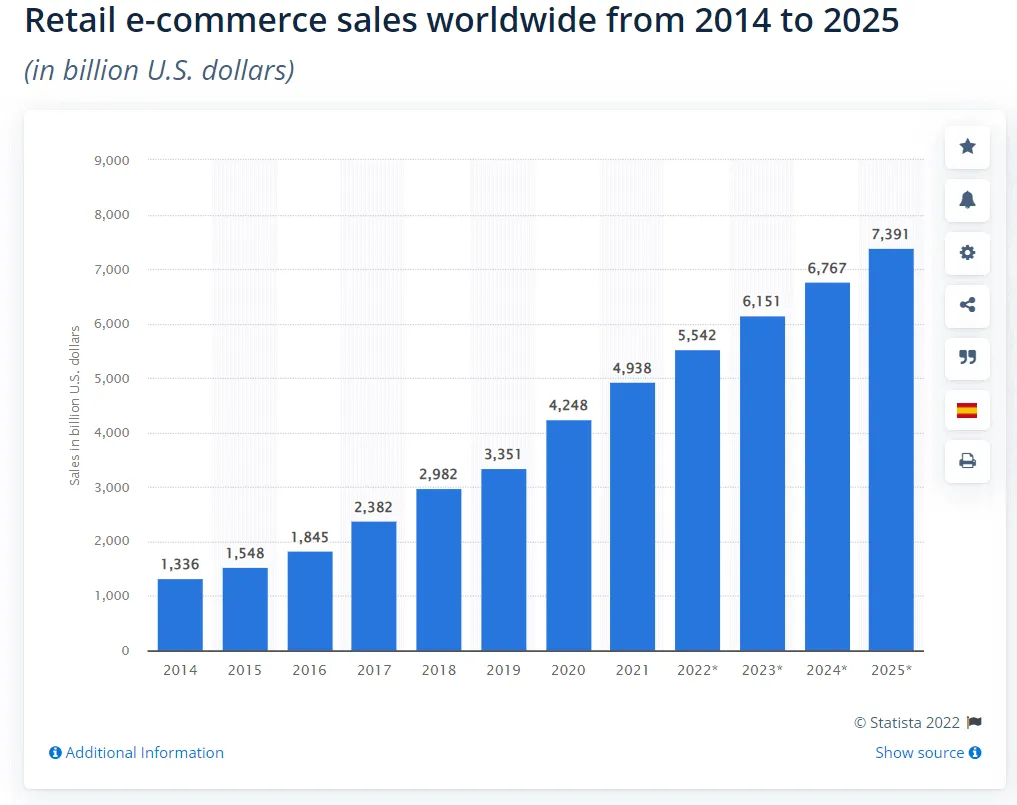

With trillions of dollars traveling around the world, in all its forms, we can see an enormous opportunity. There is almost $5 trillion in global e-Commerce alone.

This is a number that will accelerate even beyond the predictions depicted here if cryptocurrency really starts to take off. The amount that will be spent on applications and games probably will increase the growth rate.

Once again, with more money, we will see real wealth, i.e. goods and services, continue to grow. Since cryptocurrency is the money of the internet, this will help to feed the expansion.

HBD certainly has a role to play in this. Making it part of a fast and feeless payment system holds real advantages. There are trillions of dollars at stake and we need to develop the use cases to take advantage of that.

What are your thoughts? Can you see HBD becoming a valuable payment mechanism?

Let us know your thoughts in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z