What comes to mind when Web3 is mentioned?

For most, it is Bitcoin, mooning, Lambos, and bull markets. This is what the financial media espouses as well as the main topic most discuss within the crypto community. What are most focused upon? The price of whatever token they are shilling.

History has a way of rhyming. Anyone who is old enough will remember the dotcom bubble and how that unfolded. We saw a mania that went into the history books with some of the great crashes. If not for the Great Financial Crisis, it might be talked about with more frequency.

This is the casino. It is marked by a market focus, ignoring most everything else. technology, platforms, and development are only used as a basis for "fundamental" research. In other words, most use this information to justify their belief in a particular coin or token.

Nevertheless, they are still playing the casino. This is where 90%+ of the crypto industry resides. We can see it in their vocabulary. Words such as bull, bear, market capitalization, and charting are all evident of this. business owners do not talk about things in these terms.

Unfortunately, Web3 is not a casino. Instead, it is something much bigger.

The Computer Versus The Casino

Ethereum was introduced as the world's computer .

Whether we believe this or not, it does point to the reality of what we are dealing with. The casino is nonsense. While it gets the focus, it is the computer that is the core development. Ironically, this is also where all the money is.

Tokens are nothing new. This is something that anyone involved in computer science understands. Regulators are looking at crypto, many with a skeptical eye. There are some who feel it has to be banned.

The problem is we cannot have blockchain without tokens. Tokens are ownership and, for one to have it, the ability to trade is crucial. If you cannot sell an asset, whether it is something physical or intellectual property, you do not have ownership.

What this means is markets are going to be present. Of course, once again, history is the example.

Let us look at the Internet.

In spite of the Dotcom era, we saw a massive change in how society operates. Entire industries were completely upended.

There are many people involved in the bubble activity, i.e. the Internet casino of the late 1990s/early 2000s. However, the number pales in comparison to the billions of people who use the Internet today.

The Computer

We are looking at the next generation of the Internet.

Much of what we are dealing with is simply an extension of what Big Tech is working on. A great deal of the transition is not novel, nor exclusive to Web3.

For example, compute is something that most entities in this realm are chasing. We see billions being spent to get NVIDIA processors. LLMs are popping up, a gold rush according to many. Storage is still vital. AI is being incorporated into more of what we utilize.

Ultimately, like Marc Andreeson said, software is eating the world.

This is something that is being driven by networks. Blockchain simply provides a sensible organizational structure. It affords a new ownership model to emerge.

The challenge is how many people are focused upon the computer. We know the casino gets all the attention. Nevertheless, the future is not there.

Of course, this is foolishness. People are chasing the riches when, in reality, it is fool's gold.

Where The Money Is

Certainly, some are going to make money through the casino. Many are successful market players. Unfortunately, for most, they are going to lose.

The Dotcom bubble was a windfall for a few. Going through that period, the truth is most lost big time. There were people buying stocks using credit cards, since the 3%-5% monthly increase was higher than the fees charged on the card.

Of course, when it all turned south, they were caught holding the bag.

History rhymes.

How many times have we seen this with crypto? Each cycle we have people who lose their shirts on the same nonsense. Sure, the center of action might change. The latest was the NFT craze. We see people all over social media trying to pump their worthless holdings.

It is this era's WebVan.

Very few people were able to get wealthy off the Dotcom bubble. There were, however many more who made a fortune off "the computer".

How many people are on the billionaire list because of their trading during the dotcom era? Compare this to those who made it off the Internet.

We have names such as Musk, Zuckerberg, Google boys, Bezos, Cuban, and Huang.

These people are, in their own way, focused upon the computer and not the casino. In the long run, they, along with thousands of others, made a fortune.

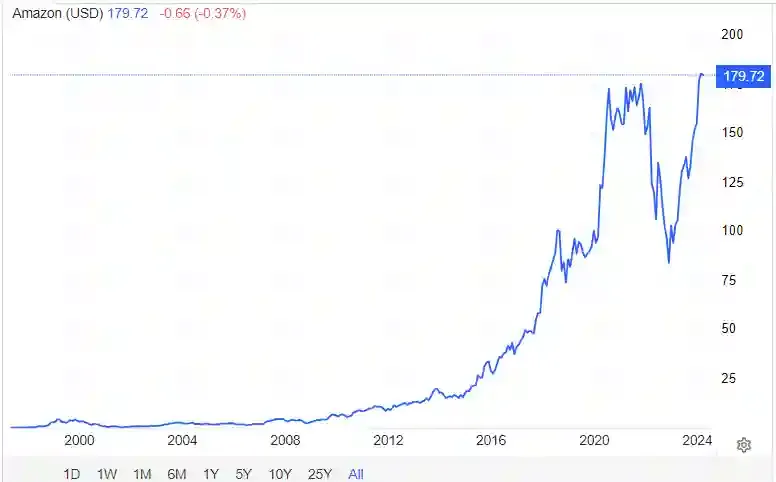

Amazon is a chart that tells the entire story. At the time of the dotcom, adjusted for splits, Amazon very cheap. In many instances, it was under a dollar. As we see here 20+ years later, we can see how it really grew. What is interesting is that, for a long time, the stock didn't do a great deal, at least compared to what would eventually come.

How much money is generated off a 150x-300x move?

That said, for much of its history, Amazon (the stock) was not exciting.

Source: YouTube

Web3

The casino, on the other hand, is exciting. People like to right the emotions. However, it is not the pathway forward.

As they say, the house always wins. This is essentially what Buffett was saying.

The computer is not sexy. It requires long term thinking. Yet, when it comes to the discussion, few are bringing this up, including regulators. They are looking at the casino and trying to apply pre-Internet securities laws. Their focus, for the most part, is not on what is being built.

We do have one difference between today and the dotcom era.

Unlike the original Internet, we all have a hand in building Web3. There is a lot more here than simply technical development. The computer encompasses other factors that push it forward.

In an era where data and compute are crucial, here is where average individuals play a role. Sadly, they do not realize that. Instead, it is back to the casino.