While regulators around the world are trying to figure out how to control cryptocurrency, we are see explosive growth in terms of the number of users. This is a process that started a couple years ago yet is starting to take off.

This past year saw a lot of discussion surrounding the investigation of Central Banks Digital Currencies (CBDCs). It is something that caught the attention of the crypto community and sparked a race to see who could roll out the infrastructure first.

A big part of the outcome of this race is going to depend upon how many people from around the world embrace decentralized digital assets. Governments effectiveness decreases the more resistance they face. With growing numbers, it is likely that resistance is only going to expand.

A recent survey done by Independent Reserve in Australia revealed that 1 in 5 hold cryptocurrency. This might not be the most populous location on the planet but with a total population of over 25 million, that equates to roughly 5 million people.

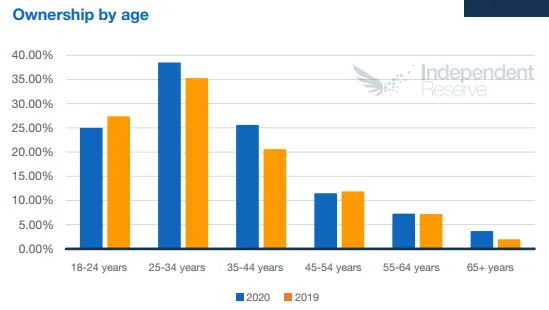

It is no surprise that the younger age groups had a better understanding and high penetration rates than the older ones. This is likely the case across the global. With technology, this is often the case.

However, the awareness of cryptocurrency is impressive.

This is a radical departure from results we saw even a couple years ago.

We do see some growth among different age groups. What is interesting is the 65+ crowd had an increase over 2019.

Contained in the report is this quote:

“Surprising fact: Assuming Bitcoin adoption rate continues its

present 2.2x per year “Moore’s Law” of growth (which it has

for 10 years so far), then 30% of the world population will own

Bitcoin in 4 years time.” - Willy Woo @Woonomic

Here is the full the report for those interested in reading it:

https://www.independentreserve.com/static/independent-reserve-cryptocurrency-index-irci-2020.pdf

Australia is not the only location that is experiencing crypto growth. An article came out mentioning how Africa saw some impressive numbers throughout 2020.

A report highlighted that Ghana, Nigeria, South Africa, Uganda and Kenya are a few of the top 10 countries to Google search about crypto in the world.

Chainalysis, a United States blockchain research company has highlighted that crypto transfers on a monthly basis from and to Africa so an increase of over 55% and peaked at $316 million earlier this year in June.

Obviously the moves of Wall Street Institutions garnered a lot of the headlines. At the same time, we saw massive growth in the DeFi sector throughout the past year.

Both of these are telling a couple different stories.

The first is that speculation is going to be rampant for the next few years. These entities that are buying now, Bitcoin mostly, are doing so because they expect the price to be higher down the road. To them, it is an investment, just like any other asset class.

These institutions are accustomed to dealing with regulation. In fact, one view is that regulation, for the most part, actually protects them. It makes it more difficult for outside entities/newer technologies to penetrate. The reason is the cost associated with compliance. Companies with hundreds of millions of dollars can afford to adhere to what is taking place. Those without the resources tend to get buried.

DeFi is an interesting proposition since it is, for the most part, outside the realm of regulation. As things get more decentralized, the ability to reign things in by entities such as the SEC is going to get tougher.

Here is where we find the crypto Whales. These are not the Wall Street types but, most likely, early adopters. They are looking to grow their bags through returns. This is what fed the trough to the tune of near $15 billion over the past year.

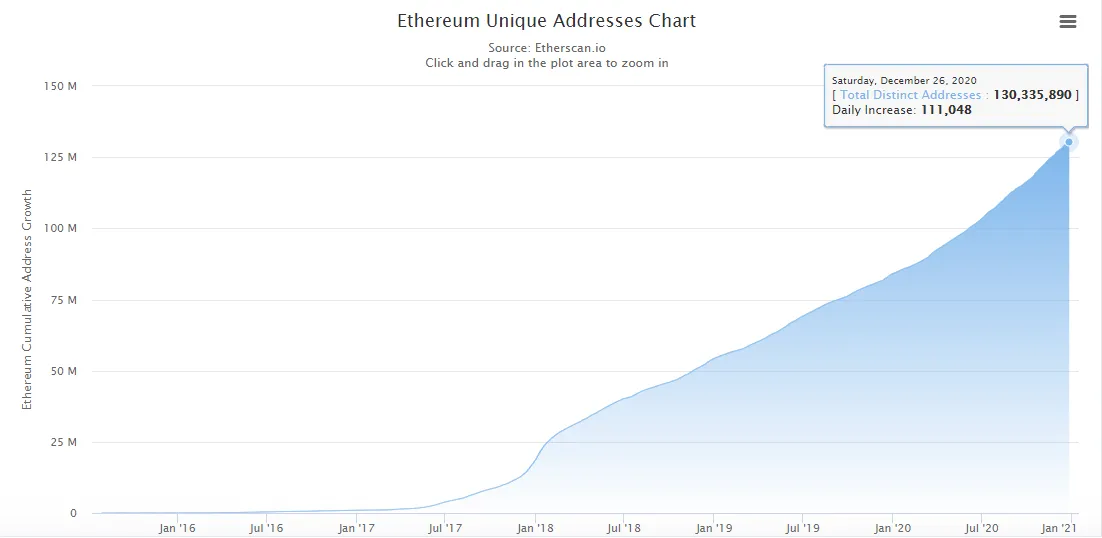

Bitcoin gets a lot of the attention but Ethereum is still forging ahead. The latest Etherscan chart of wallets shows this.

There are now 130 million wallets on Ethereum. As we can see, it is adding over 100,000 per day. This equates to a 28% growth rate over the course of a year.

More Wallets. More users. More money.

That is the story of the past year in cryptocurrency.

At present, we see the established system trying to set up something they can control. The usual players are starting to enter with their big money. Regulation is forthcoming in an effort to get this thing under control. However, as these numbers show, the race on the other side, in the decentralized world, is moving ahead.

As more people get involved with cryptocurrency, especially ones that reward them for activities, the greater the impact will be. Network effect is a powerful mechanism that causes many things to go parabolic. In essence, it breaks down to a numbers game.

One side has money and, because of it, power; the other has the numbers in terms of people.

Which side will prevail is the major question?

Ultimately, it could come down to speed. Who is able to cross the Rubicon first?

Adding another few hundred million people will certainly make life more difficult for those who are trying to centralize all of this.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z