We are seeing things changing rapidly. This means that many long held concepts are going out the window. Unfortunately, when it comes to what people believe, change is like moving an oil tanker from a set position. It is very slow.

There is little doubt the digital world is rapidly expanding. The formation of this realm takes things to an entirely new level. Whereas we were previously dealing with scarcity, the world we are seeing unfold is based upon abundance.

Obviously, this is a process that started to unfold a few decades ago. This sent a lot of long-held beliefs into obsolescence. We will cover a couple in this article.

Introduction of Cryptocurrency

We all know that we are mired in a world of fiat currency. This is money that is controlled by Central Banks. They have the authority to expand or contract the money supply as needed. It appears that many people feel money supplies should never expand.

Nevertheless, we see cryptocurrency changing all of this. Here we have a realm where, suddenly, anyone can create money out of thin air. This is no longer monopolized by the Central Banks of the world. Today, anyone with a laptop or smartphone can do this.

Of course, this all kicked off with Satoshi more than a decade ago. Since that time, thousands of different fungible currencies were created. Naturally, many of them went to zero, mostly due to the fact there was nothing to them from the start.

Many cryptocurrency skeptics claim there is nothing backing them. They believe the intrinsic value is zero and hence will reflect that at some point.

Here is the key point that is missed: Cryptocurrency and fiat both derive their value from the same place.

Read that again: cryptocurrency and fiat both derive their value from the same place.

What makes any of this have value is the economy that is behind a particular currency. It is that simple. The USD is used for trillions of transactions. In addition to being the currency for a $21 trillion economy, it is the reserve for the entire global market. Compare this to what is backing the Venezuelan Bolivar and we can easily see where the separation enters.

At the same time, we can look at what is taking place with Bitcoin, the volume of transactions along with the number of wallet holders. The amount of activity surrounding Bitcoin eclipses all other cryptocurrency. Hence, we can see how it has the greatest value at this point. Nothing is even close to it.

Now, contrast that with some token that has 5 users. The total number of transactions is 10. When we look at it from an economic standpoint, in USD, that equates to $15. What do you think the value of that currency is?

Again, there is no way this even compares to Bitcoin on any level. Notice how we do not have to mention circulating supply, inflation rate, or distribution. While that comes into play, the difference maker is the economic activity tied to each.

Here is where we see the ever-expansion of the digital world taking place.

Printing Cryptocurrency Into Oblivion

If we used the same logic people take with fiat, we would have to say that the industry is printing cryptocurrency into oblivion. There is no way this will have any value since the inflation rate, overall, is enormous. Tokens keep popping up everywhere.

For example, picking an arbitrary date of January 4, 2015, we see there were 501 coins listed on Coinmarketcap. Today, the site lists 6637. Not to be outdone, Coingecko has 9849.

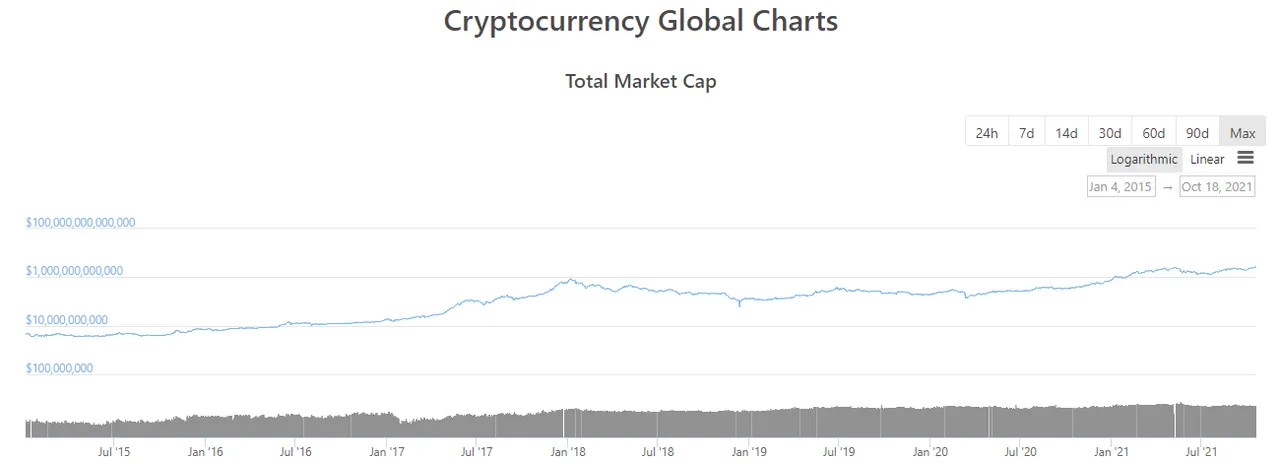

This is just the total numbers of tokens listed. Yet, when we look at the total value on a [logarithmic chart](https://www.coingecko.com/en/global_charts), this is what we see.

For those unaccustomed to looking at logarithmic charts, note that each iteration on the left hand side is 100x the previous one. So we started the chart with a total market cap of around 8 billion and end with the present value of $2.6 trillion.

How could that be? We have an insane inflation rate and that much printing is making it worthless. Yet we see things going up.

And no it isnt because the USD fell off a cliff in comparison.

Expansion Of The World

What few consider is how the world is expanding. The reason why the old beliefs that were fostered in the 1970s (or earlier) do not hold true, is because we are in a different world.

Look at this list:

- Mobile phone plans

- Netflix/Disney+

- Laptops

- Smartphones

- Printers/scanners

- Cloud storage

- MMORPHs

- Satellite Radio

- Applications from ITunes or Play Store

This is a brief list of what is tied to the digital world. What all this has in common is none of this was available for purchase in the 1970s. Basically the total revenue amounted to zero. Now we see industries that total in the trillions.

There is something else that was not available back then: cryptocurrencies.

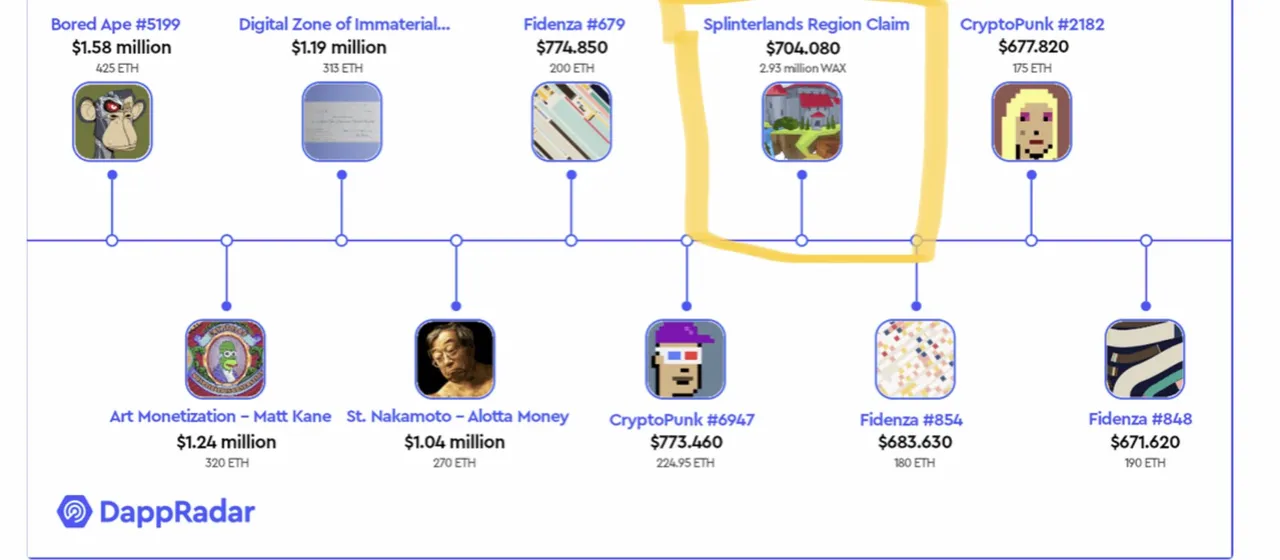

Now we can get specific because currency is not the only thing printed out of thin air; so are the products. Here we see fungible tokens exchanges for non-fungible.

Source

This follows up another transaction that was Tweeted out a couple days ago.

Source

Just doing a bit of calculation, that is roughly $10 million in 11 transactions for something that was created out of thin air. We obviously can debate the perceived value of these assets yet it is clear people thought they were worth it.

The point is that while these could be scarce items for what they apply to, the reality is there is an infinite (near) number of NFTs that can be created. We are likely limited by storage and bandwidth. This means that we can purchase NFTs until we are blue in the face, and still not run out.

It is nothing new when you think about it. The Federal Reserve could print all the money it dreamed of to pay off its credit that it used to download music from ITunes. It literally could spend trillions of dollars buying music in this manner and, somehow, Apple would still have more to sell to everyone. Again, we are dealing with the limitation of bandwidth, not physical resources.

This is something the detractors of cryptocurrency do not realize. In fact, it is something advocates of it are missing. The simply reality is we are expanding our digital capabilities. That means we are dealing with near infinite world which only increases since bandwidth and computational power are ever increasing.

Therefore, we need a near infinite monetary supply to keep up. Naturally, as we evolve towards the virtual world, this is only going to compound. The age of scarcity is rapidly dwindling. When we factor in the push towards automation (leaving aside the discussion of who owns said automation), we can see how this concept is also entering the physical world.

All of this will be clear as we forge ahead, moving closer to the Metaverse. That realm is going to completely upend most of the long standing concepts that people have.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z