The best way to save money, is to make money.

We can only cut back so much after all, so while creating efficiencies, scaling back unnecessary expenditures and optimizing the way we use resources is a step in a good direction, we also should consider taking a step in the other direction simultaneously. Saving on one side, generating on the other.

He who buys what he does not need steals from himself.

Swedish Proverb

The Swedes tend to do okay financially, though I am pretty sure that looking at how many of them dress, this proverb has been left by the wayside. Though, just because it is out of fashion, doesn't mean that it is irrelevant.

I was talking with a friend about my difficulty with sweet food the other day and how it would be great to have a "craving checkbox" system, where I would be able to switch off cravings for certain foods without willpower. And, I wish it was the same for savings, where without feeling the pinch, it would be possible to make cutbacks.

What is interesting is that we are heavily influenced to consume, yet it is much, much harder to influence us to save. We love to collect, but we tend to love to collect meaningless nonsense. But, consumption makes advertisers money, saving doesn't. The corporate world doesn't want savvy investors, because if everyone was good with money and looking to generate income, there wouldn't be mush to generate - because no one would be consuming. The only reason that companies are able to make money, is to encourage people to spend money, to consume.

And, this is also what an individual needs to do in order to take that generating step to empower the saving step. They need to be able to convince someone to spend money with them, one way or another. There are many mechanisms for this, but the easiest one is to increase paid working output to generate more income.

A second job, a side hobby gig, down at the docks on a Saturday evening when the sailors arrive.

For something, you have to do something.

What are you trading?

On Hive, people think they are trading their time for income, but that is only part of the story. For example, I trade my perspective gained through my experience in an attempt to convince people to vote on my content. Weirdly, there is unlikely anyone in the world that is doing what I do in the way that I do it, but it isn't scarcity alone that makes it valuable, it is also that it tends to create engagement and perhaps even, give people something to think about for the day that they may not have thought about otherwise. It is kind of like a thought prompt that hopefully nudges people to improve their own processes through life.

At work however, I am only partially using this side of my experience professionally, and instead I am trading my ability to facilitate conversation and well, help people improve their professional processes to get a better result - to be more effective at trading their time spent to generate more value for themselves, and the company for which they work. Without the company's product, their skills don't have an outlet and without them, my role isn't required either.

We are all trading something.

At home, I am also trading my experiences with my wife, where I am also supporting her to improve her processes (she hates this most of the time). And what I get in return, is a better quality of life for our family, and she gets a better quality of life too. A good relationship is one where participants are able to empower people to be their best and increase the general wellbeing of all.

A rising tide lifts all boats

Applied at a micro economic level, with us helping each other succeed, creating the swell to lift our ship. I would be incredibly happy if I could help my wife earn more than I do, as not only would it be good for the family, it would also increase her own confidence in her abilities and give her the extra capital to start expanding her investment horizon. One of the reasons that she isn't as interested in investing as perhaps she should be, is because she doesn't feel she has extra to invest, so why bother?

I wonder how much of an impact this has on the difference in wealth between men and women.

Regardless of gender, most of us don't spend enough time understanding finance, economics or how best to utilize the resources we have available and instead, run on our learned defaults. So many people will make choices for things that they consider quality of life reasons, that end up costing them quality of life. For example, quitting a job they don't like, but liking not having a job even less. Similarly, people avoid working some jobs because they think they will like it less than not liking not having enough money.

However, what they fail to consider is while a job can suck, the job doesn't live in a vacuum, it is part of a life experience. Not liking a job but doing it, can give that additional income to invest that means that in the future, an individual can more easily change jobs or do a job they like for less money, because they have built up a supplementary income from investments. It can also bring the satisfaction of helping other people cared, so they can pick a job that they like.

Is it a sacrifice?

Yes.

Because it is a trade. All trade is a sacrifice, because one thing is given up in order to get another thing.

Banana for apple, shield for spear, skill for money.

Saving is sacrifice.

Making is a sacrifice.

It is about energy transfer, where the energy that could have gone elsewhere, is sent in another direction. The money for buying the new phone, gets directed to buying some tokens. The time for sitting watching TV, gets directed to doing a shift at the supermarket.

Wealth transfer.

We get convinced to trade our wealth, our investment potential, our time resources, our attention - and give it to those who will benefit from us, while they give us not much in return. And we feel like it is worth it.

If we really wanted to break the traditional economy, we would undermine it by severely changing our demand, redirecting our portfolio of resources into values that lay outside of the traditional system. Just imagine if for the next year, instead of buying whatever it does now, all disposable income was spent on buying Bitcoin.

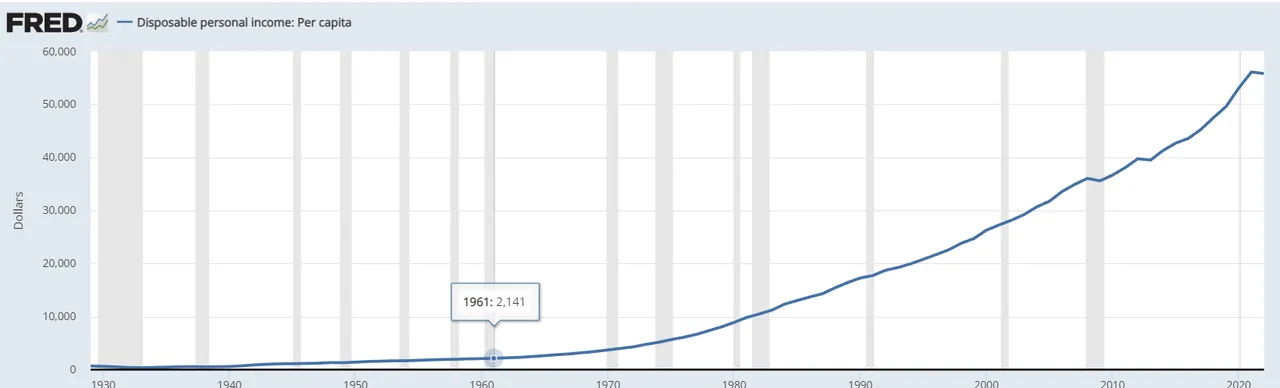

That is a graph for the disposable income in the US, which is over $55,000 per capita. How much does that work out to??

$16,500,000,000,000

16.5 trillion dollars.

Which in an unrealistic straight line evaluation of Bitcoin based on today's price, puts it 33x up - at $891,000 per BTC. Straight line doesn't work though for obvious supply reasons, so it would more likely be in the 5-10M per BTC range.

However, if that were to happen, it would be 16.5 trillion dollars that isn't going into the corporate world and the consequences would be severe, with companies failing, most people fired, banks collapsing and the entire financial world so utterly disrupted, recovery wouldn't be possible, only a ground-up rebuild would suffice. The economy is far more fragile than we are led to believe - all we need to do is stop supporting it, and the value of everything that has a value, freefalls.

It wouldn't be pretty.

But at some point, it is a trade we are likely going to have to make. Trading our individual comfort, for something wholly better.

Before we get to those extremes though, we might want to learn all we can and without resources, we don't have the capabilities to learn anything at all, because we have nothing to trade for the lesson.

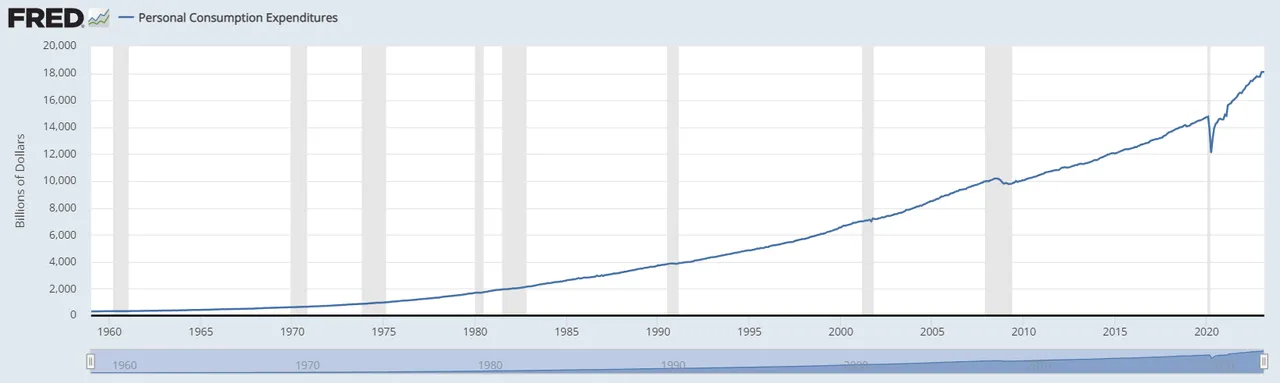

This graph looks similar to the one above, but with a key difference. Whilst there is about 16.5 trillion of disposable income, there is also about 18 trillion in personal expenditure.

That gap, is the rich getting richer.

We make that trade daily.

Taraz

[ Gen1: Hive ]