A short time ago, @leofinance sent out the first round of bounty payments to those providing liquidity to the WLEO/ETH pool. You can see their full post for all the details.

Since then, I have processed and sent out the first payout to those contributing to the SPEW fund, where a number of users have joined together to share the experience and enable smaller accounts to get involved.

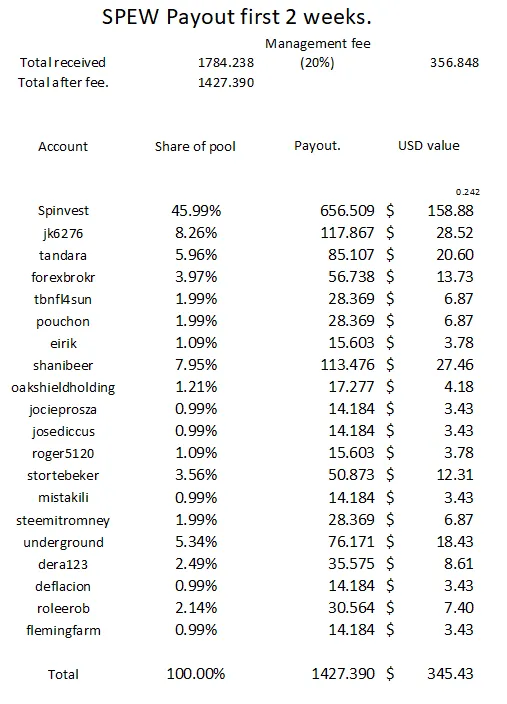

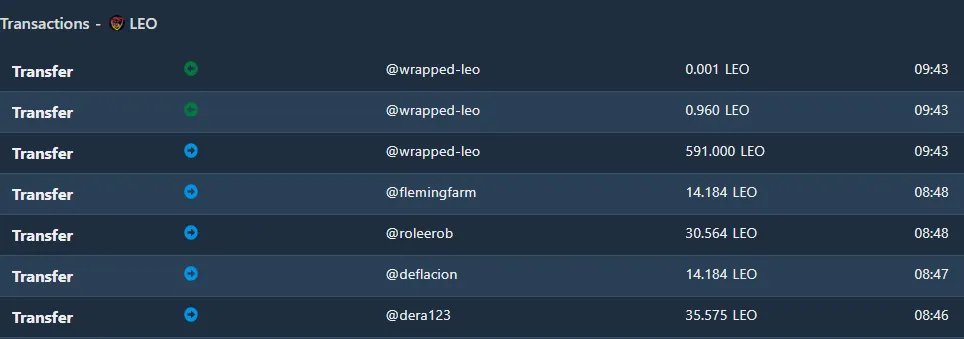

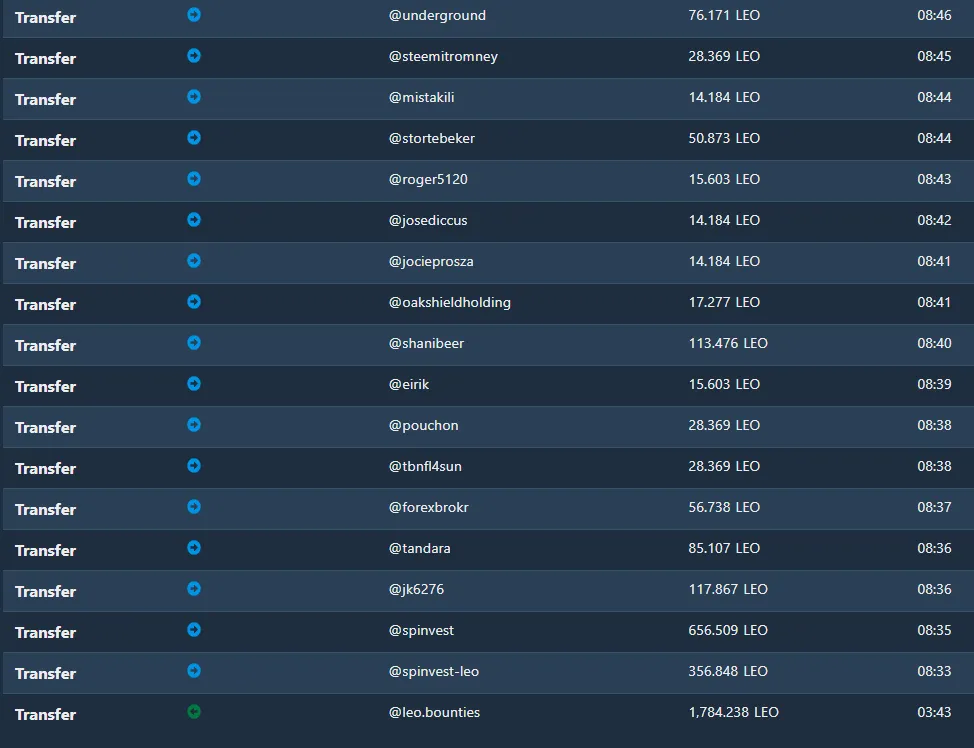

Here is the details of the first payout:

Notes:

- Received 1784.238 LEO total bounty.

- 356.848 LEO sent to @spinvest-leo to cover admin fee.

- 1427.39 LEO distributed to 20 participants - worth a total of $345.43

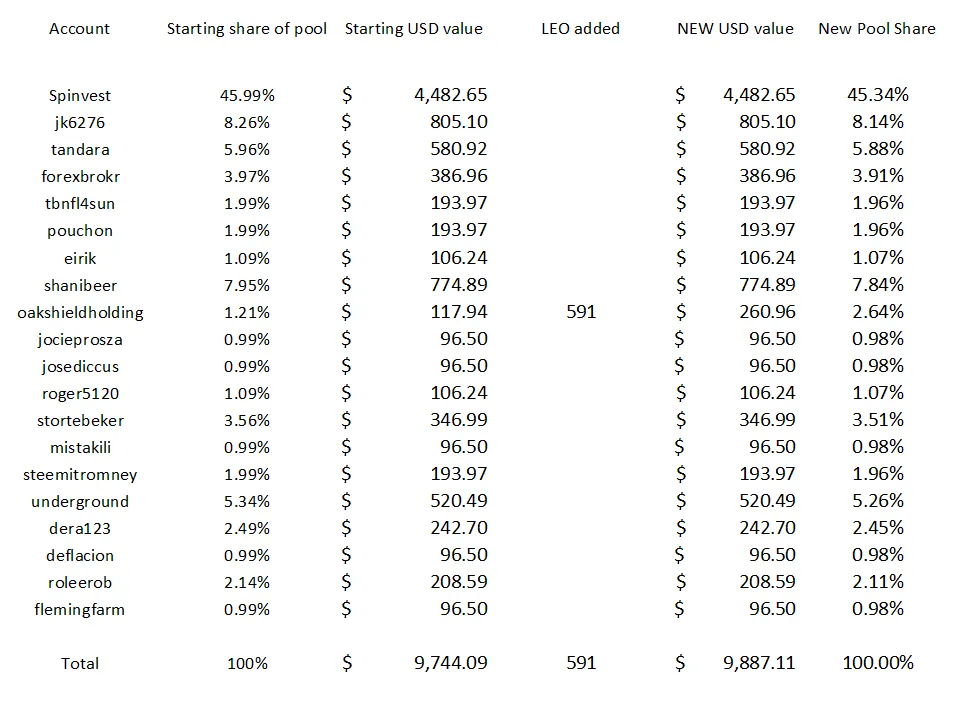

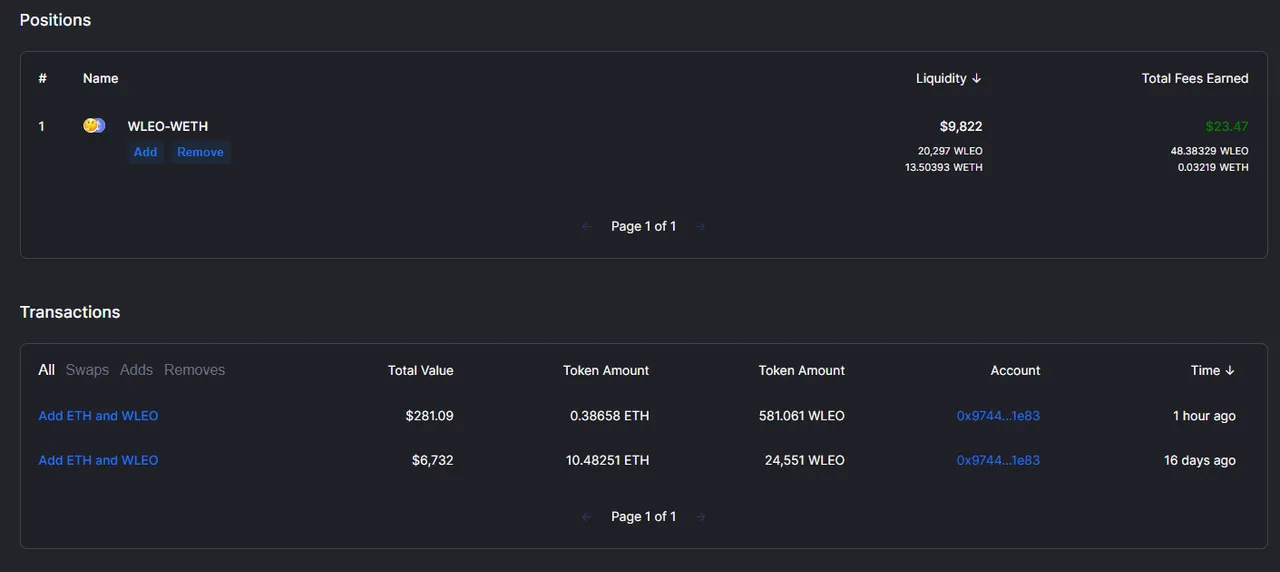

Once these payouts were sent, I have rebalanced the pool info to allow for extra funds received over the last 2 weeks. @oakshielholding has added 591 LEO to there investment, and this means that for the next 2 weeks, the new pool shares are as follows:

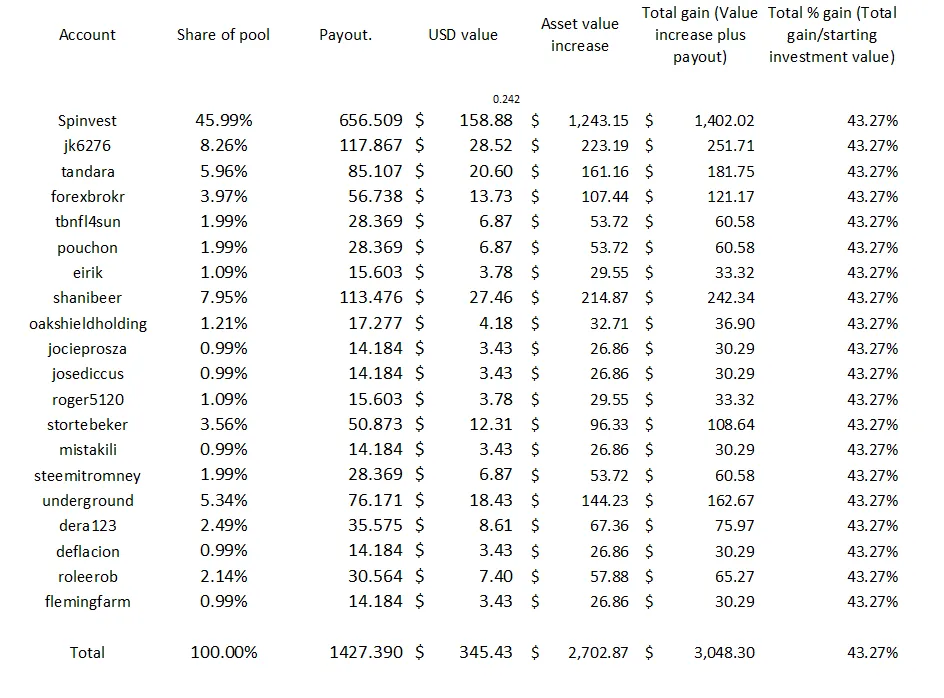

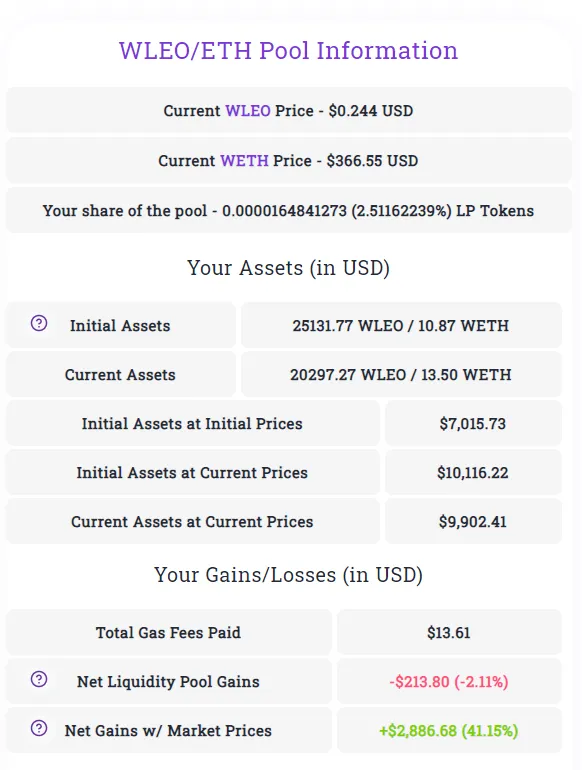

So the total return on investment looks like this for the first two weeks:

43.27% total gain over the 2 weeks. If you had just held you LEO and not joined, you would have gained 73%. Because the value of LEO has increased from $0.14 to $0.242 over the week, and ETH has gone up by less, over the first 2 weeks you actually would have been better off not in the pool, and just holding your liquid assets. This deficit is exaggerated a bit as normally Impermanent Loss is considered based on pooling both assets equally, whereas joining SPEW only required sending one asset - and it just so happened that that asset was the one that went up in value the most.

Every investment has an opportunity cost, and the question to ask yourself are:

- Would you have held for the 2 weeks?

- Would LEO have gone up in value if people had not pooled in to WLEO/ETH in the first place?

- Will the first 2 weeks result (72% increase in LEO price) be repeated.

- Is a 43% 2 week gain really that bad?

- Have you learnt anything from being part of this?

The calculation for those that added ETH would be very different, but after 4 hours of working all this out and sending payments, making this post, etc, my head hurts and I'm done calculating stuff for the day.

I can assure you that unless LEO continues to go up rapidly, being in SPEW will be beneficial in the long run. If anyone does want a "non-urgent"withdrawal, let me know and it will be processed at the next review/payout in 2 weeks.

Remember, you can check and verify any of the transactions at any time by checking the @spinvest-eth HIVE engine wallet, and by checking the etherscan page for our Ethereum wallet: https://etherscan.io/address/0x9744df35394b77860337d4b17a844b87ef341e83

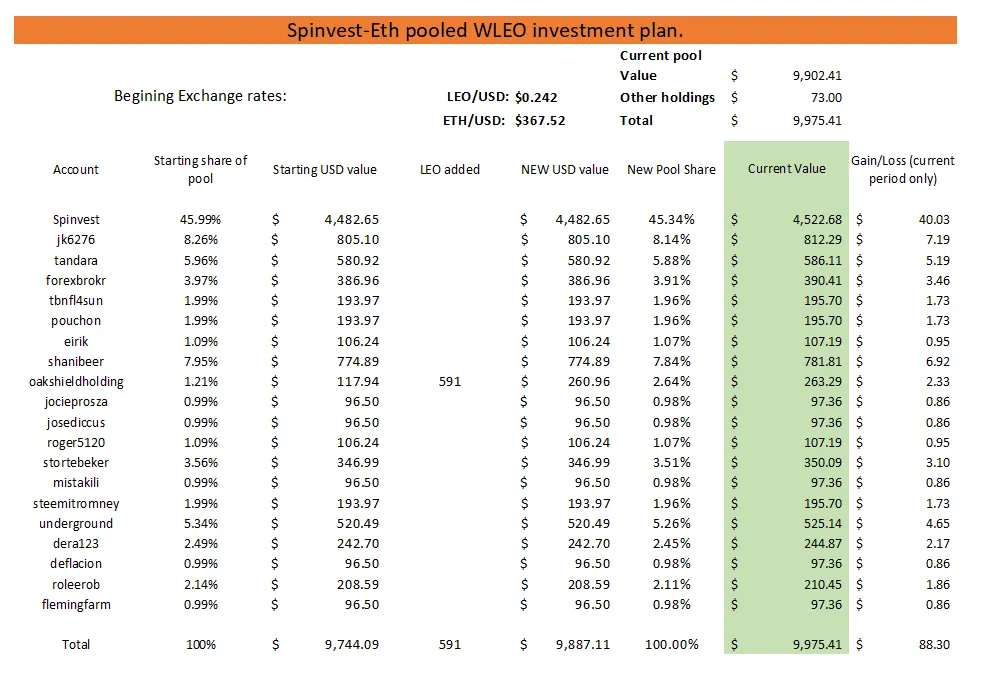

I have rebalanced the pool to account for the new contributions (from @oakshieldholding) and now the starting point for the next two weeks looks like this:

Full transaction record:

Uniswap pool info:

Liquidity Vision pool stats:

OK, that's enough data and stats to sink a battleship. If you have any questions, let me know in the comments. I'll be back this time tomorrow to check in and clarify any questions.

Now, where is my Panadol...

Cheers,

JK

@jk6276 for @spinvest and SPEW.

Tagging all participants:

@spinvest, @jk6276, @tandara, @forexbrokr, @tbnfl4sun, @pouchon, @eirik, @shanibeer, @oakshieldholding, @jocieprosza, @josediccus, @roger5120, @stortebeker, @mistakili, @steemitromney, @underground, @dera123, @deflacion, @roleerob, @flemingfarm.