(Source) Eddie Earner, the EDS mascot, getting rich slow. Check the @eddie-earner account, home to the Saturday Savers Club.

Exploring EDS as a Passive Income Source

I've been investing in the EDS Income token since the first issue of 20,000 EDS about four years ago, adding 50 EDS Miners (EDSM) and 1,500 EDS Mini Miners as they became available. Each of the miners will mint EDS tokens for about 20 years, with the EDS fund guaranteeing a minimum weekly 12% APY liquid HIVE passive income forever.

I've always thought EDS was the perfect token for saving for the future - maybe a retirement income, or perhaps grandparents putting aside an EDS fund to help their grandchildren get through university or a deposit for a home. (Or even grandparents putting a fund aside for their further education, which is what I'm doing).

EDS is a very simple model: each EDS is pegged to 1 HIVE. This means that for every 1 EDS in circulation, there is 1 HIVE sitting in the @eddie-earner wallet. For each new EDS that is issued, another 1 HIVE goes in the wallet.

This pooled EDS fund is staked as HIVE POWER and used to earn HIVE, which is then distributed as weekly passive liquid HIVE income to EDS holders (a proportion each week is used to grow the HIVE POWER fund). Content rewards and sales of other tokens all contribute to the fund.

Growing my EDS Stake

I had a look to see what would be involved if I wanted to grow my share of EDS holdings to 2.5% of the total fund by 2041 when the last of the EDSMMs pays out, which is 12,500 EDS. If I let my EDS grow organically through the miners, I would have a total of 10,531 EDS by 2041, leaving a balance of 1,969 EDS to achieve my goal.

The model below shows a savings plan to achieve my target EDS stake with savings goals or milestones for 2024 and 2025. The plan takes advantage of delegating to @eds-vote and the new soon-to-be-launched EDSD token, each one backed by 1 HSD.

| Savings Plan 2024-2041 | No of EDS | 2024 | Notes |

|---|---|---|---|

| Opening balance 1 January 2024 | 3,031 | 3,031 | Starting balance 2020: 2,000 EDS |

| 50 EDSM x 2 EDS each year x 18 years | 1,800 | 100 | EDS miners (EDSM) |

| 1,500 EDSMM x .2 EDS per year x 19 years | 5,700 | 300 | EDS Mini Miners (EDSMM) |

| Total by 31 December 2041 | 10,531 | 3,431 | 2024 organic growth from miners |

| Balance to achieve by 31 December 2025 | 1,969 | 3,831 | 2025 organic growth from miners |

| 20,000 HP to @eds-vote x 4% x 24 months | 1,600 | 800 | by 31 December 2024 |

| 1,330 EDSD x 10% x 1 year / .36 USD/HIVE | 369 | 369 | will vary according to price of HIVE |

| Total by 31 December 2041 | 12,500 | 4,600 | by 31 December 2024 |

| 5,800 | by 31 December 2025 |

Another option would be to buy more EDS and its miners directly from the market.

The pros of this would be additional passive HIVE income more quickly (it could be a circular fund with HIVE income from EDS used to buy more EDS). The cons would be more income now against greater income later and paying a premium for EDS when it may be possible to acquire them more cheaply through EDSD.

Buying through the market also requires more attention.

More about buying and selling EDS and its miners in the market.

EDS Passive Income

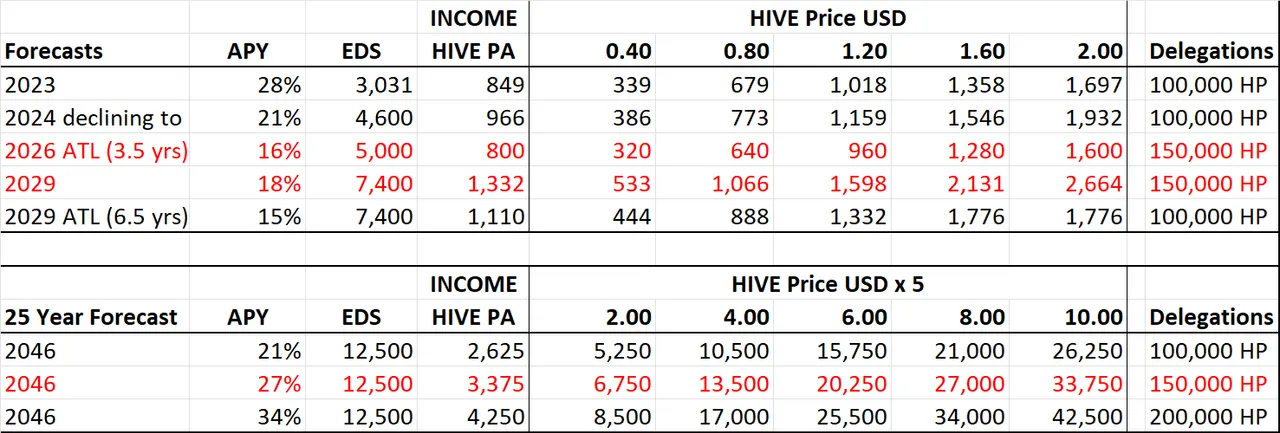

I had a look at what sort of passive income might come from EDS over the next 25 years. I've made fairly conservative forecasts based on assumptions in this post about @eds-vote and how HIVE POWER delegations will affect the EDS fund.

I've noticed some errors in this chart - I'd have about 6,000 EDS in 2026, for example, not 5,000 - but it illustrates the principles.

These assumptions don't take into account the four-year cycle that revolves, roughly, around the Bitcoin halving cycle. I would expect the value of HIVE in 2029 and going into 2030, for example, to be much higher. The forecasts also only takes account of the earning power of the EDS fund itself. They don't include additional income through content rewards, second-layer tokens or airdrops.

The other, much more interesting, aspect of this chart is the effect of achieving 150,000 HP delegations to @eds-vote. You can see by comparing the time taken to achieve the flip (when the EDS APY stops declining and starts increasing) and the effect this has on the subsequent APY - 28.5% more - in 2041. (For 200,000 HP delegations, it would be 61% higher).

From an individual point of view there is also the opportunity cost of delegating to consider, a loss of roughly 4% every year for each year of delegating. However, curation rewards are likely to remain static, while the benefit of bringing forward the EDS APY flip as soon as possible will exceed the opportunity costs by a long way (plus it is passive income).

In the worst case, where delegations remain at about 100,000 HP which we've achieved fairly easily this year, the APY flip will take place in 2029, with an all time low (ATL) of 15% APY. That would be a great time for to pick up under-valued EDS tokens as people offload them.

Fixed and Variable Savings Plans

EDS is introducing a new method to accumulate EDS tokens in 2024. This is EDSD, each one backed by 1 HBD, which is pooled to earn 20% interest. Each month, the interest is exchanged for HIVE, with 50% powered up in @eddie-earner's EDS wallet, and the remaining 50% used to distribute EDS at 1 HIVE (regardless of the price in the market) to EDSD holders over the coming month.

This is a great option for anyone that wants greater flexibility, although along with that goes increased volatility about how many EDS you will earn over time. It's an especially useful option for when the HIVE USD price is low compared to HBD, as there are more HIVE to the dollar and consequently more EDS minted.

It is also a great option for new and small accounts which may not have much HP: HBD rewards from content creation can be used to purchase EDS while building your HIVE POWER. You can also sell back your EDSD very easily at 1 HBD, providing lots of liquidity for when you want to use your resources for another opportunity.

Easy in and easy out.

| Options | Pros | Cons |

|---|---|---|

| HP Delegations to @eds-vote (fixed) | Liquid HIVE income; fewer variables; more predictable growth; not affected by increases in HIVE price; set and forget; no DEX fees. Opportunity to collaborate to increase growth in medium to long-term. | Lower 4% APY; less flexible: 5-day penalty; not able to take advantage of HIVE price reductions; requires HP - less competitive in short-term. Dependent on others delegating for community benefit. |

| EDSD tokens backed by HBD (variable) | Higher 10% APY; liquid HIVE income; 24-hour flexibility: no penalties; open to smaller/more accounts; no DEX fees; opportunity to accumulate EDS when HIVE price is low. | More variables: HIVE price and HBD:HIVE ratio. EDS issued reduces when HIVE price increases. Dependent on keeping a watchful eye. |

Conclusion

There's room for both fixed and variable savings plans to accumulate EDS.

The HP delegation with relatively fixed and predictable returns are great for long-term set and forget plans. These will also speed up the rate at which the APY flip happens for EDS - all EDS holders working together through delegations can make that happen more quickly.

The easy in, easy out, EDSD offers greater flexibility for savers and investors to accumulate more EDS when the USD HIVE price is low.

There will also be opportunities to pick up under-valued EDS in the open market while the APY is declining - this could be as soon as late 2025 into 2026 and may extend until 2030, depending how quickly the APY flips (itself dependent on how much HP is delegated to @eds-vote).

Looks like a perfect swings and roundabouts, umbrellas and ice-cream model!

Happy saving!