When terra launched a couple of protocols Mirra and Anchor were released right away. I have talked in the past about how you can get 19-20% APR on Anchor with UST deposits and how you can borrow with a net profit at present time. Today I am going to share with you the farming yields you can get with both protocols and how you can double those yields with Spectrum Finance.

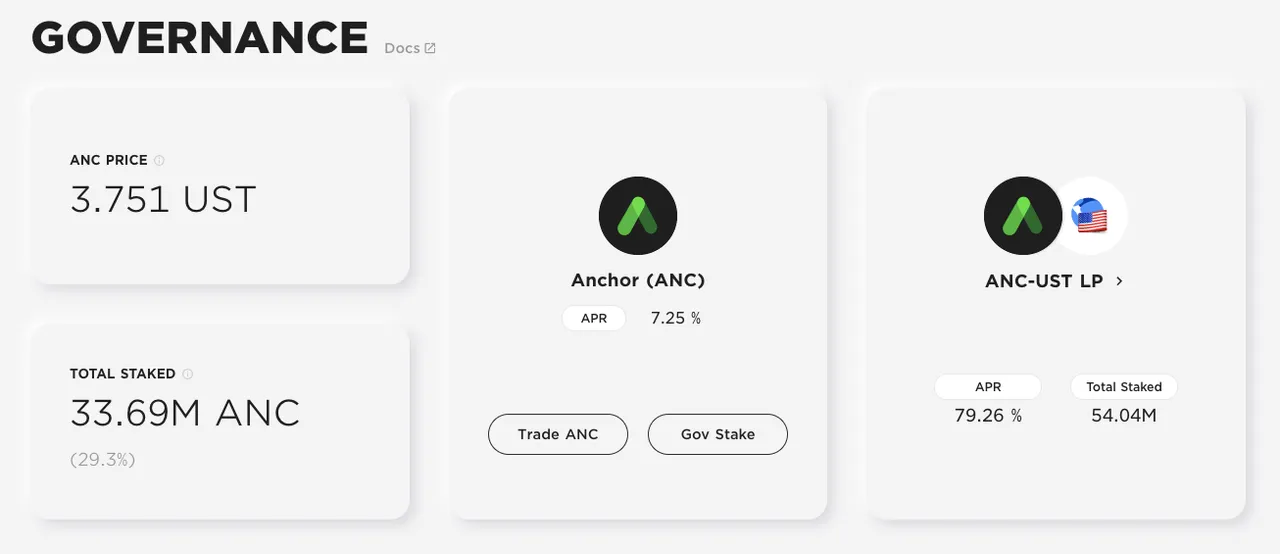

As in other blockchains, DeFi services in Terra incentivize its users with their own token. Anchor for instance gives you a 7,25% APR for staking and a nice 79% APR for providing liquidity and staking it, a two-step process you can execute at its Governance page.

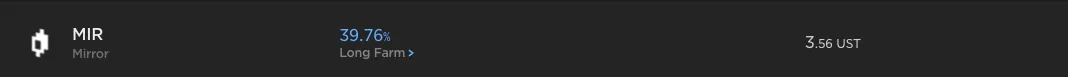

Mirror on its side provides a 9,27% for staking and a 39,7% for providing liquidity

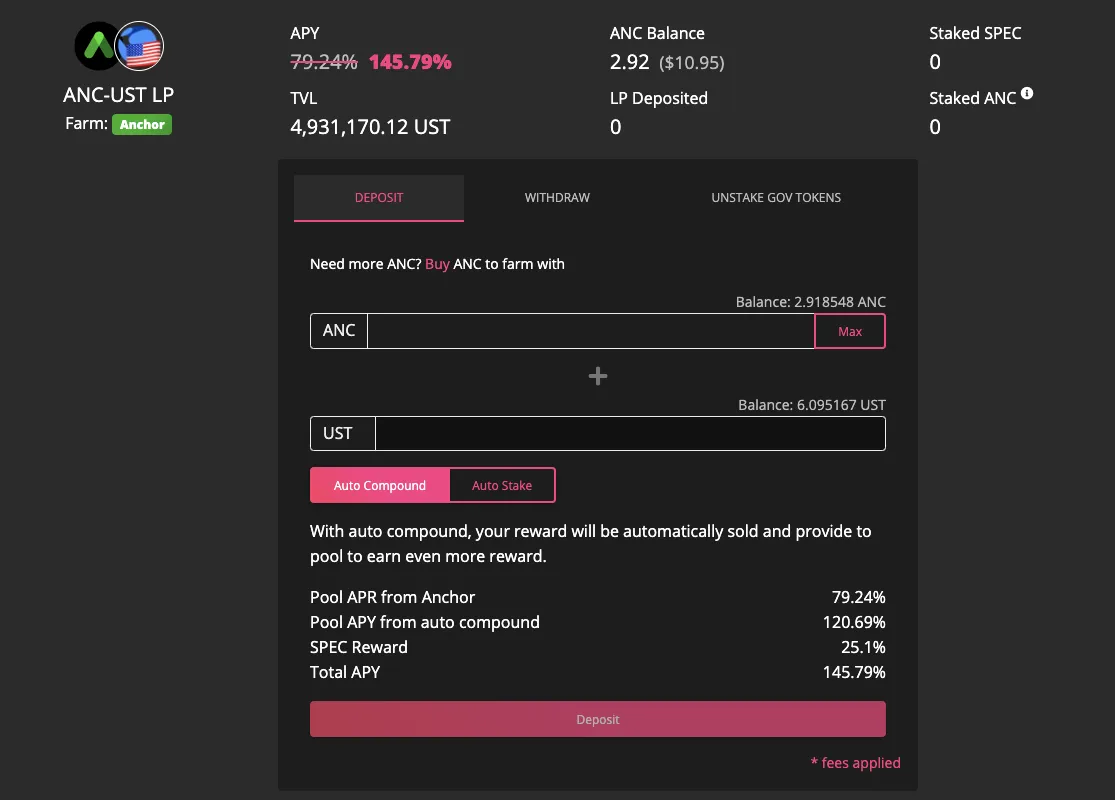

Checking all these protocols to find the best opportunities and going over all the steps to get the best deal is quite annoying, plus, you have to keep claiming your rewards and staking them again if you want to compound and get the best profit out of your strategy. This is where Spectrum Finance comes in.

They offer you a nice way to see all the opportunities in one place and do the compounding work for you, making them real passive income strategies.

We can compare the 79,26% Anchor offers for providing liquidity and staking it, with the 145% Spectrum offers you for providing that same liquidity on its service, as they compound the rewards for you and give you extra Spec rewards from using its service. You can see the details of where the 145% comes from in this screenshot.

Of course all these benefits keep changing as in any other yield farming service but all you will have to do is decide what you will do with your rewards as soon as you start getting them.