Analysts think that the SEC may approve numerous Spot Bitcoin ETFs at the same time. While many do not give an exact date for this, giant bank JPMorgan says one or more spot Bitcoin ETFs could be approved before January 10, 2024.

Wall Street analysts at JPMorgan and Bloomberg Intelligence expressed this prediction in a report. The report stated that the SEC will most likely approve a Bitcoin ETF before January 10, 2024.

Crypto markets are eagerly waiting for the SEC to approve the spot Bitcoin exchange-traded fund proposals. Earlier this week, an inaccurate report that the SEC had already approved a spot Bitcoin ETF caused the BTC price to soar to $30,000. Investors are wondering how much the Bitcoin price will rise if the SEC approves Bitcoin ETFs. Institutional and individual investors need SEC approval to add cryptocurrencies to their portfolios, but many have already begun doing so.

Paul Grewal, Coinbase's chief legal officer, told CNBC on Friday that he is very hopeful that the SEC will approve a Bitcoin ETF soon. source

Ark Invest CEO Cathie Wood said in a recent interview with Bloomberg that she expects the SEC to approve more than one Bitcoin ETF proposal at the same time. source

Many analysts think the SEC will soon approve a Bitcoin ETF, and it is noteworthy that Wall Street analysts at JPMorgan and Bloomberg Intelligence say a Bitcoin ETF will likely be approved before January 10, 2024. It looks like we may get news of a Bitcoin ETF being approved very soon, we'll have to wait and see.

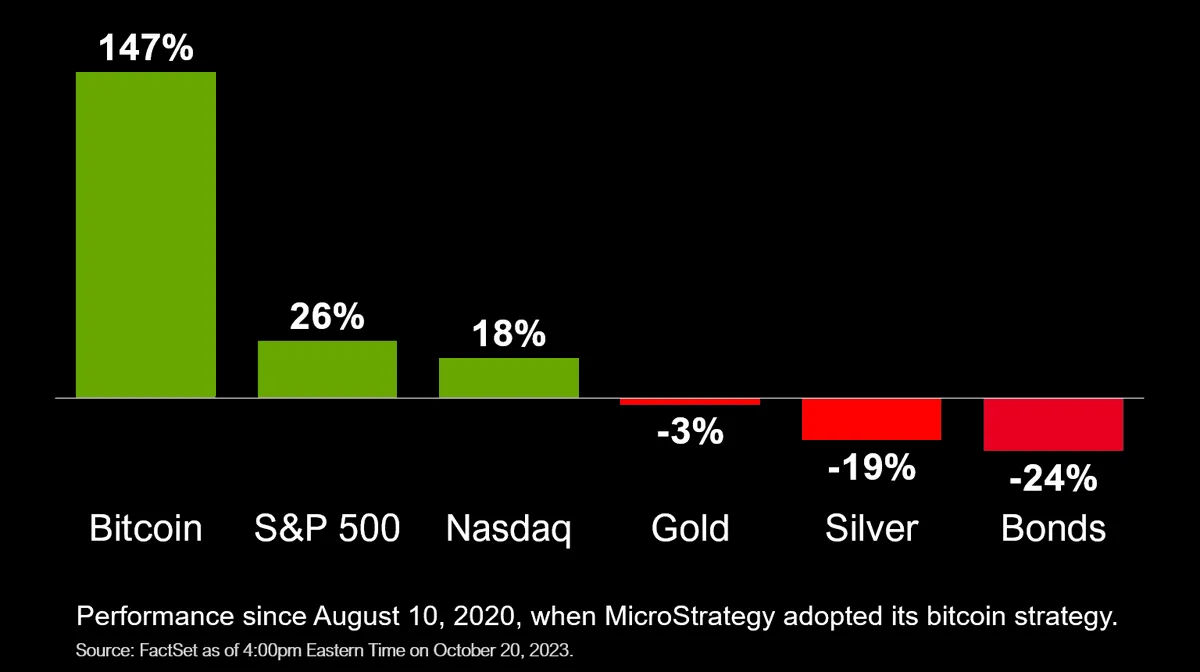

Michael Saylor, one of the founders of MicroStrategy, Bitcoin's largest institutional investor, shared a chart on X to prove why Bitcoin is a good investment.

Taking August 10, 2020, when Bitcoin was accepted as a treasury reserve asset by the company, as the starting date, the chart revealed the performance of the leading cryptocurrency. Michael Saylor's chart shows that Bitcoin has increased by 147% since August 2020. Additionally, the table shows that the S&P 500 index increased by 26% and the Nasdaq Composite increased by 18%. It shows that Gold, Silver and Bonds are falling.

Bitcoin Dominance (BTC.D) has reached the highest levels since April 2021, currently at 52.38%. This reveals that investors are showing more interest in Bitcoin. I would like to point out that not only Bitcoin but also many cryptos are rising, even some cryptos seem to be rising more than Bitcoin. The rise in Bitcoin Dominance reveals that Bitcoin continues to remain strong.

Bitcoin is currently trading at $29836 and is struggling to break the $30,000 resistance. Even though it rose above $ 30,000 a few times, it was not successful, but if the positive atmosphere in the markets continues, it may soon achieve this and move higher.

The SEC's approval of spot Bitcoin ETFs looks set to fire up the crypto markets even more, and their approval could even trigger a bull run. On the other hand, rejection of Bitcoin ETFs could lead to sharp declines. I hope that at least one Bitcoin ETF will be approved this year or in the first quarter of 2024.

What do you think about Bitcoin ETFs? And what is your Bitcoin price prediction for 2024?