I've really enjoyed some of the Defi returns I've been getting the past couple of weeks, even though they are down recently because of the Bitcoin crash, and possibly even one of the causes that led to said crash!

Like many of you I could not resist a little punt on some of those 100% (+) return vaults and pools on Pancake and Auto, but the key word for me there is 'punt' - when I see anything offering a return of more than 100% I know getting it into is a risk, and that it's probably not going to last.

Hence why I didn't 'punt' that much money into those crazy pools, tempted though I have been by a few mental calculations about how much money I could make if I just shoved my whole stack into them.

Simple common sense tells my that returns of 100% can't last for ever, competition flooding in will see to that, but I think there will be very high returns on offer somewhere in the DEFI landscape for a while yet, it's just a matter of moving your stake around to take advantage of said returns.

But to my mind, I see those crazy Defi environments as punty - somewhere to only put a small amount of yer coin!

Personally I'm not banking on being able to yield >100% from anything for the long term, it's just not possible!

So I'm putting (or more like keeping) most of my funds in the following:

Hive and LEO for a 15% return on average

In the grand scheme of things, a 15% return on these two platforms - OK slightly higher on LEO than on Hive if you're talking curation - is immense compared to most 'stable' investments you'll make in the fiat world - and there's still scope for the price of the tokens to go higher, either of them, I still haven't given up on Hive!

And there are numerous ways you can earn that 15% ish curation - delegation, curation, wleo (if you leave it staked for 5 years to cover the ETH fees).

And that's even before yer blogging earnings! I'm a blogger at heart, these sites are just a great fit for me!

AVA for a 24% return on staking

Travala.com - the crypto friendly travel platform is awesome - you get a 24% return just for staking AVA and then further reductions on flights and holidays booked with them - it has a real use case, a token buy back and burn policy and the price has been performing well recently.

This is still a buy for me!

A realistic 30% return for Stable coin vaults and pooling?

I've got various stable coins and some BTC vaulted and returning 30-100% - it varies, but I think it's going to settle down at 30% - and you get no impermanent loss with vaults.

I've got no idea if a 30% perpetual return is realistic, but there's a lot of competition currently above that rate.

A 50% return for staking AKT

AKT powers the Akash network - the world's first decentralized cloud computing marketplace, and the DeCloud for DeFi - think AWS meets DEFI.

this has more than doubled in price since I bought it and i get a more than 50% return for staking it!

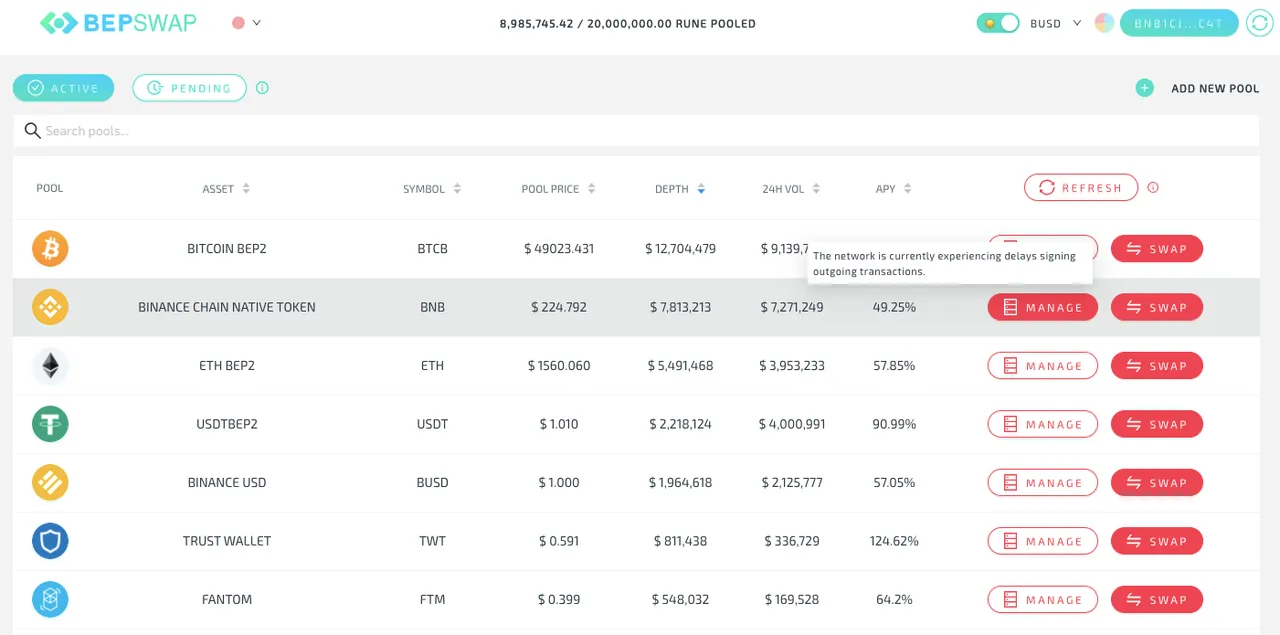

A varied 50-90% return in the RUNE pools on BepSwap

I think I'm actually in love with Rune Pools - I've held back and only pooled 30% of my Rune in total - most of this is 'New Rune' anyway as I asymmetrically pooled some BNB, LTC, USDT and BAT swapping for new Rune - so even if all of that gets drained and I end up with some of the other tokens, ALL of which I don't mind more of anyway, I'm happy.

Having said that, I recently pulled out some rune from three of those pools, thinking the price is going up hard sometime soon.

The only tokens I pooled 50-50 was AVA-Rune - I think they're gonna moon together!

ATM BepSwap is offering a 40-90% return in fees depending on the coin - which is pretty sweet, but I don't think this is going to last forever - so maybe this is one for NOW - and you might want to pull your RUNE out if it starts to really moon!

I am banking on Rune as being the Defi coin that's going to see some radical success in the next couple of years - this is where I'm going to pool (some) of my BTC for hopefully a decent return, and then just rebalance between BTC and Rune as the prices go up and down and skim a little off.

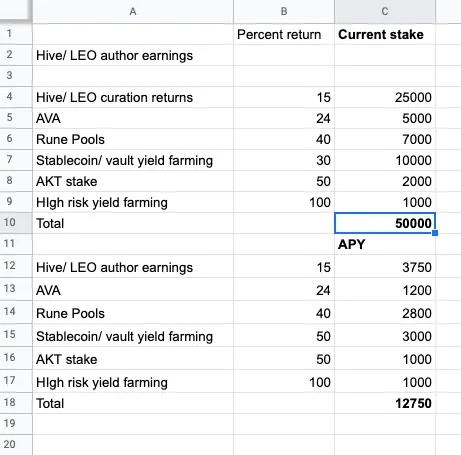

A nice spread of risk and potential returns?

I've been messing around with some calculations for dollar stakes in various projects with different returns - the figures below aren't my own targets, but they give you an idea of what $50K of crypto could yield you:

Even with half your stake in something like Hive/LEO, and a further 20% in stables, you could still earn a decent $12K income per annum from a diversified yield - with only $1000 risked in the DEFI wild west, which i'm sure will be around for years to come. (Actually we need a Cowboy defi platform me thinks).

The figures are in dollar amounts btw.

NB - the amounts shown aren't what I've got invested, and they are not the proportions I'm aiming for either. Personally I'd want to be a bit heavier in Rune and AVA compared to Hive/ LEO, but this is just to show you that a relatively small pot can yield fairly well even if it's mostly somewhere safe like LEO.

Of course in crypto land, you might well start off with the above balances, do nothing for a month and one or two price shifts has radically altered everything - which might prompt a further rebalancing.

And you'd need to think about what proportion you'd want pooled and staked and working for you and what proportion just in cold storage.

Of course this is one final advantage of Hive and LEO - your stake works without the capital being at risk!

So personally I will always keep a decent chunk of my Crypto here!