I put a few assets into the Osmosis, a defi platform built on Cosmos, during the DEFI summer of 2021 and for the most part just kept them there.

While the overall value of the pooled and staked tokens has halved or worse since the peak of the last bull, they've faired no worse in the last two years than crypto overall.

Naturally the worst performing token is the OSMOSIS token itself: the DEFI token in which you're rewarded for pooling, but because I never held very much of this, I haven't faired too badly.

And two years on staking and pooling on Cosmos and Osmosis is ticking over quite nicely....

You can access Osmosis here.

Current pooling options

There are a few tasty looking pools if you're prepared to risk your Atom, ETH, USDC or BTC with Osmo, generally returning in the 25% APY range.... not too bad!

You would have lost money hard if you'd have had ATOM pooled with OSMO since spring 2021, but more recently it seems that the OSMOSIS price has stablised, so maybe these aren't bad options ATM, NOT financial advice, of course!

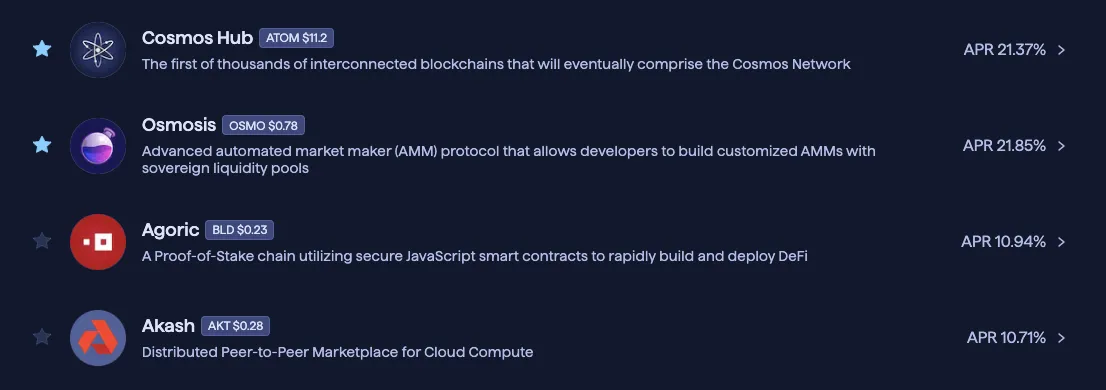

Current staking options

More appealing to me, because of the lower risk are the staking options - a 20% APY for just staking ATOM or Osmosis and a 10% return for staking AKASH.

My allocations

I quite like the look of my portfolio overall - mainly ATOM, then AKT and a little bit of OSMOS, most of which is staked, a smaller fraction of which is pooled.

Oh and this dashboard is new since the last time I looked a few months back, so at least some development work is going on!

Osmosis: final thoughts

For now I'll keep my tokens in here, there's a decent return, the fees are cheap and it's a nice little passive earner.