I've decided I've spent way too long over the last few weeks jiggling around micro sums of money into various DEFI platforms. The ridiculously small fees on Polygon and no fees on Hive-Engine have not helped this.

But I've given myself a bit of a talking too and a reality check this morning - it really isn't worth my time putting $50 worth of assets in that pool and $100 worth in this pool and so on on Polygon, and it really isn't worth my time putting in orders for $1 or $2 worth of tokens on Hive-Engine.

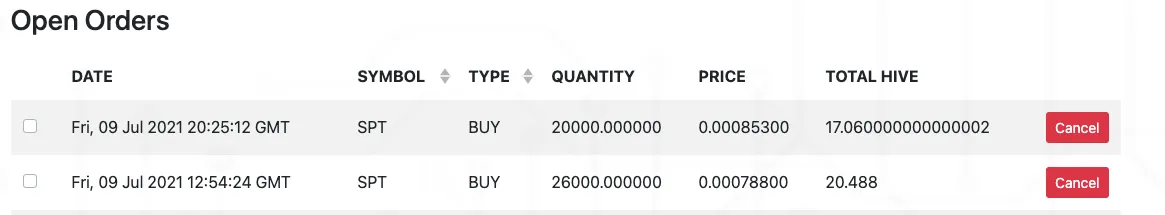

Honestly, the later especially has been getting ridiculous of late....

So from this point forwards I'm going to level up my transfers/ staking/ orders so I'm dealing with more tokens in one go.

I think I'll aim for a minimum of $500 in any one particular pool on Polygon or Cub or any other DEFI platform, actually on Cub I don't think I've got less in any pool I'm in anyway, and for Hive-Engine, well that's a place to dick around so I'll settle for a lower minimum there, say 100 Hive (or$20 worth of tokens if it moons) minimum in any one order.

And maybe $500 dollars worth of each alt...?

The $500 figure is a bit arbitrary given market fluctuations but I think I'm going to apply the same 'higher minimum' holding to all my alts - if I'm not prepared to spend $500 on something then I'm not buying it, similarly if I don't currently have around $500 of any one particular alt I think I'll just cash it in for something else.

That's the price ATW, that doesn't mean I'll sell if one of the 'chosen coins' drops below $500 in total value!

Increasingly tempted by the 'put all your eggs in one basket' strategy

I've heard @nealmcspadden mention this on more than one occasion - if you want to get rich you should put all your eggs in one basket (or maybe two or three) rather than diversifying - which is what I've tended to do with my crypto.

A few months ago the though of risking a substantial proportion of my funds in one or two assets made me shudder, I'm too risk averse for that, but I'm finding the idea increasingly tempting.

So maybe I'll end up putting tens of thousands into one or two moonshots in the coming months, maybe, but certainly in the meantime I'm moving towards that by consolidating my funds into FEWER assets I believe in.

In the meantime I'll do the following...

Besides stacking more stables (which aren't really crypto are they?) I'm looking for more (in this order)....

- Cub and Leo

- Splinterlands assets of all kinds -

- Hive (naturally, Neal wont' be a fan but each to his own) -

- Bitcoin

- Eth

- Rune (stables asymmetrically pooled, makes no sense not to)

- ATOM/ AKT (pooled on Osmosis)

- AVA (staked on ThorChain with Rune actually, 200% return ATM)

- LiteCoin - I can't help myself, sorry.

- Matic (later once the price has dipped)

Part of 'levelling up' by moving larger amounts of funds around means that if I want to rebalnace the above I'll be doing so at a minimum or $500 a time, rather than a few squid at a time which is what I've been doing over the last few months.

Of course I'll still claim my rewards and harvest regularly and probably sell into stables regularly on the Defi platforms, but when it comes to buying something else with those stables I'll let the liquid funds sit until they reach $500 and then buy something else.

Ideally I'll be looking to change my mindset further and up that $500 minimum to $1000 or maybe even more, but given my risk aversion that would be a leap.

At the very least if I add anything, I'll be doing so $500 at a time minimum from this point forwards, life's too short for micro-moves. Although by some people's standards, $500 at a time is a micro amount!

Oh, except for Hive-Engine, I'm happier there to operate with 100 Hive minimum, as I said above, it's a place to dick around.

Old habits die hard I guess?!?