Hello and Namaste Everyone

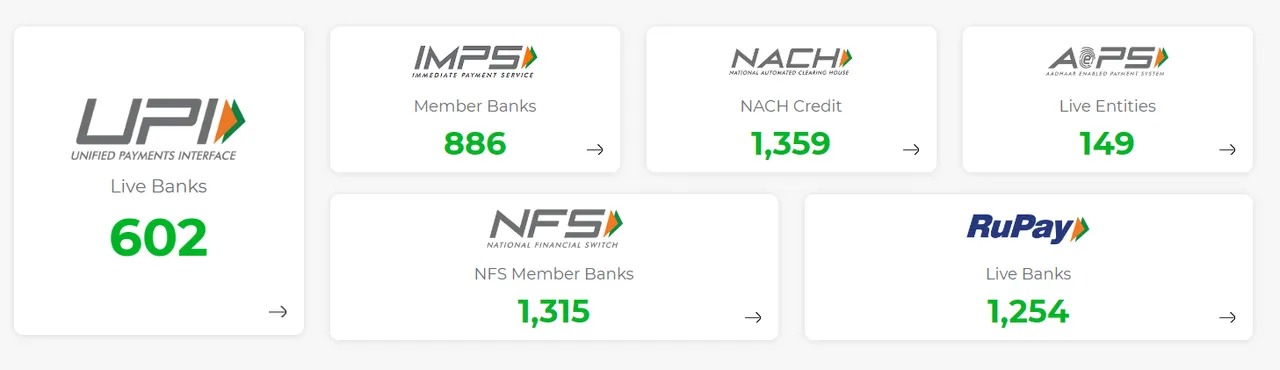

UPI or Unified Payments Interface is a popular payment method in India. This payment is viral in India and can be made using a mobile phone. This is the only device that can be used to make payments using the UPI methods. UPI payment was launched in India in April 2016 and in the next couple of years, this has grown a lot because people like to use it. After the demonization, the usage of UPI has grown multi-fold and now you can pay in almost every shop using the UPI and the payment is also quite easy to use and user friendly.

AI created Image

Over the years, many companies have come into the market and are the payment aggregators that facilitate payments using the UPI mechanism. This payment method is managed by the National Payment Corporation of India which is the government organisation. This payment method is free for all users but there have been some discussions in the past that the government might implement some charges after a certain threshold for the users but so far this has not been applicable.

UPI has been growing a lot and now it is also getting more functionalities by the banks. Earlier we were able to use upi only through the bank account but now some credit cards can also be used for upi payments. Certain requirements need to be in place for any individual to get the credit card from the bank so now the banks are coming up with another function that will allow people to get credit facility even without the credit card. When we use the credit card and repay before the due date then there are no extra charges applied but in the case of a credit facility, there will be some charges according to the usage. This will be called a credit line and some of the banks are trying to launch it soon.

This will help the users who do not have money in their bank account but there is something that they need to pay so they can avail of this facility this is completely optional so they can use it only if they want to use using through the bank account always an option and there is no charge for using the service. It's good to see that the government is focusing more on the improvement and they are bringing a fantastic infrastructure for making instant payments which is good for the users as well as businesses. Payment technology is highly advanced and safe because the payment is linked with the mobile number which is inserted in the phone so there is no way that one can hack it however we need to be careful while scanning the QR because some scammers are trying to tweak it so we need to be careful before making the payment.

I have been using a couple of apps but Paytm is my favorite for UPI payments and I use it easily. When I carry my mobile phone with me then I don't care about the wallet because I know that I can pay in almost every shop whatever I purchase through the UPI and I don't have to worry about the payment or carry my wallet with me all the time.

Thank you so much

Stay Safe