Few days ago I successfully brought in a lot new hovers, I love the energy of this new hivers because they seem determined. Although I had to plead with them not to consider the idea of giving up. Whenever I bring in new Hivers, I always tell them to use few days to explore the platform so they can get acquainted with the eco system. I’m glad to see that they did and most of them came back with a lot of questions.

I love it when new hivers are inquisitive and always want to know and learn. Some of them loved the Leofinance community and stumbled upon defi. This person did a research on defi and asked questions relating to Liquidity Pool.

I felt like a proud father, watching his new baby learn how to crawl.

That was a very intelligent question. Because it’s nice to ask questions. We are here to assist each other, we are a loving community.

As a Newbie you must have learnt what DEFIs are and you are eager and ready to invest and start making those passive income. It’s a very sweet feeling when you see the amount of APR you make. But before you jump and take those decisions, it’s nice you understand the risk behind it.

The major risk I find in providing liquidity in liquidity Pools is Impermanent Loss . So being a Newbie am not going to use big words to confuse you. I will explain liquidity pool and Impermanent Loss to you.

Liquidity Pool

These are funds provided by investors, that is me and you, and they are locked in the smart contract. Because you provide it and lock it in the smart contract, the blockchain rewards you for that.

To provide a liquidity pool you need to choose a liquidity pair:

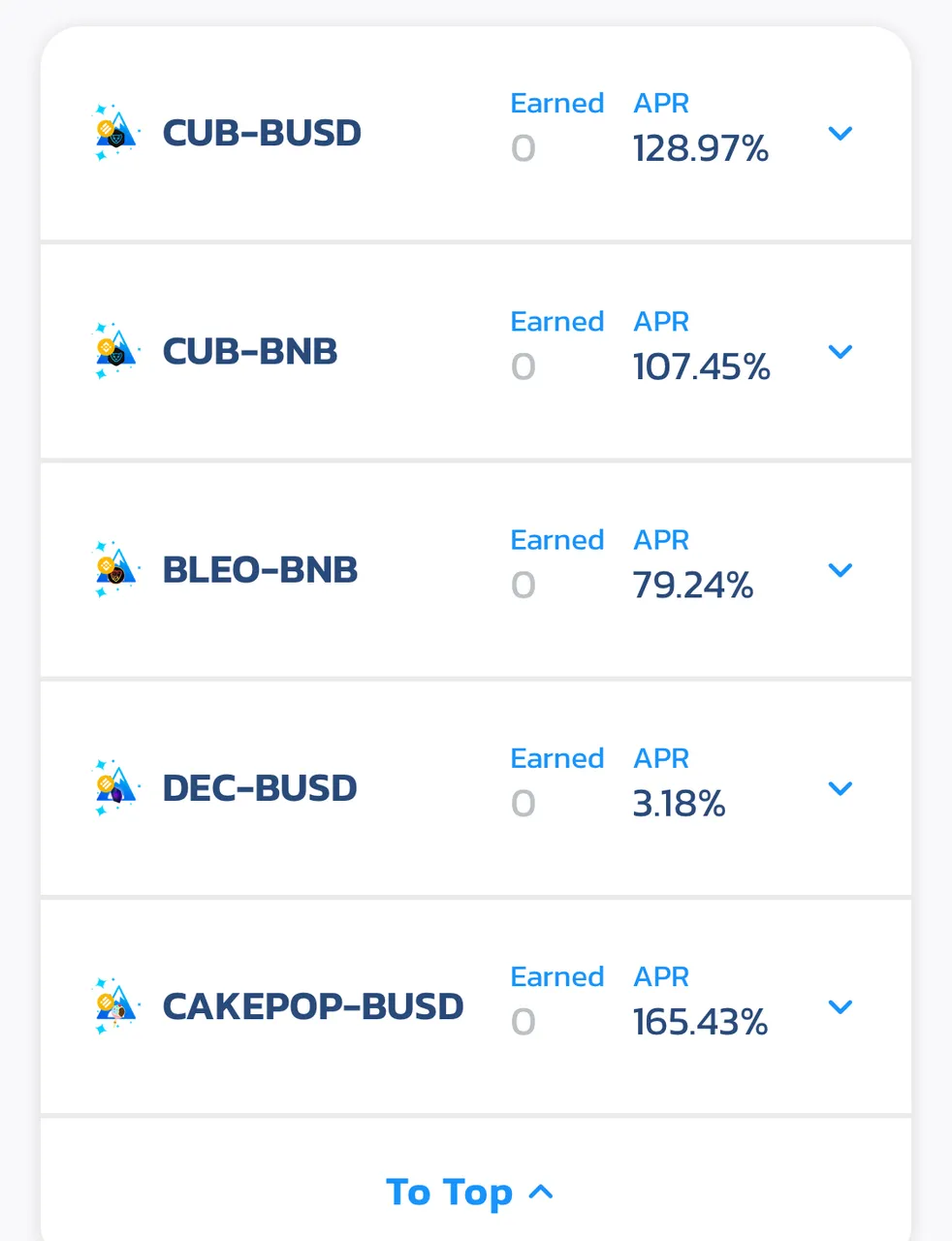

These are the pairs for the liquidity pool in cubdefi

So because they are paired, you need to provide equal value of each in the liquidity pool. For instance, if you have $100 to invest in the liquidity pool, and you choose CUB-BNB, you will have to divide the money equally. That means $50CUB - $50BNB. This is because the liquidity pool has to have an equal ration of 50/50.

What Is Impermanent Loss

This is the loss that can affect your tokens or funds in a liquidity pool. This is because, you are providing two assets with different rate of volatility. The liquidity pool is constantly trying to adjust the 50/50 ratio. So you only lose some of your asset when there is an uneven ration in the asset. If you provide a $200 liquidity pool to CUB-BNB, that is sharing it $100CUB-$100BNB, if the value of BNB goes higher while the value of Cub goes lower or becomes stable, the liquidity pool will short the quantity of BNB tokens and increase the quantity of CUB tokens so as to maintain the 50/50 equal ration. So if you had 20CUB - 1BNB in the liquidity pool, during impermanent loss, when you withdraw your tokens, you might end up with 34CUB and 0.76 BNB because the price of BNB went higher so the pool adjusted the quantity to match the value of the cub token.

So the difference in the quantity between 1BNB and 0.76 is the impermanent loss. I hope you find this helpful.