Digital control

As the world hurtles towards a digital future, central banks are exploring the idea of issuing their own digital currencies. While the concept of central bank digital currencies (CBDCs) promises greater efficiency and convenience in financial transactions, it also raises significant concerns about privacy and financial freedom for the common individual.

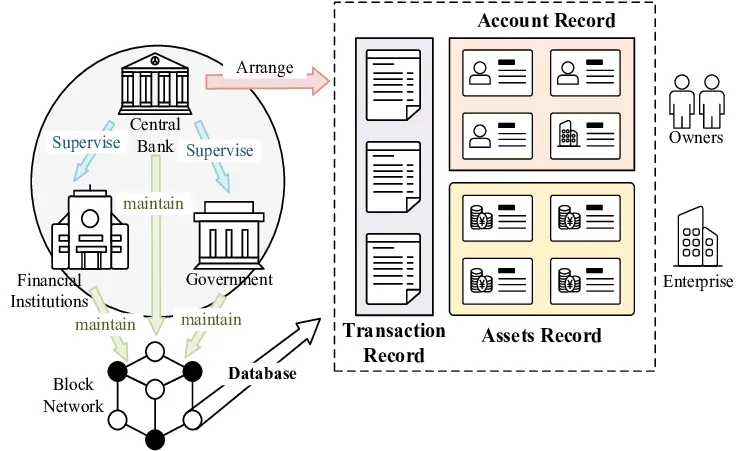

One of the most pressing issues surrounding CBDCs is the erosion of privacy. Unlike physical cash, which allows for anonymous transactions, CBDCs would be fully traceable by central authorities. Every transaction conducted with a CBDC would be recorded on a centralized ledger, providing governments with unprecedented insight into individuals' financial activities. This level of surveillance poses a serious threat to personal privacy, as it opens the door to mass surveillance and potential abuses of power.

Moreover, CBDCs could undermine financial freedom by giving governments the ability to exert greater control over individuals' access to and use of money. Centralized control over digital currencies could enable governments to implement negative interest rates or transaction taxes with ease, effectively manipulating the value of money and restricting individuals' financial autonomy. Furthermore, the ability to track and monitor transactions could lead to censorship of certain activities deemed undesirable by authorities, stifling economic freedom and innovation.

Promoting inequality

Another concern is the potential for CBDCs to exacerbate existing inequalities in the financial system. While digital currencies offer the promise of financial inclusion for the unbanked and underbanked populations, they also have the potential to widen the gap between those who have access to technology and those who do not. Additionally, marginalized communities, such as undocumented immigrants or individuals living under oppressive regimes, may be disproportionately affected by increased surveillance and control over their financial transactions.

In light of these risks, it is crucial to approach the development and implementation of CBDCs with caution. Efforts must be made to ensure that privacy rights are protected, and individuals' financial freedoms are upheld. This may require the adoption of robust encryption and privacy-preserving technologies, as well as clear legal safeguards against government overreach.

Furthermore, transparency and public accountability are essential in the design and governance of CBDCs to prevent abuse of power and ensure that they serve the public interest. Ultimately, the adoption of CBDCs should be guided by principles of democratic governance, respect for human rights, and the promotion of financial inclusion and empowerment for all individuals, rather than centralized control and surveillance.

Sincerely,

Pele23