Have you ever wondered what happens to the crypto market when the stock market takes a tumble? 🤔 It's a question that many crypto enthusiasts ponder, especially when the news is filled with reports of market volatility. Today, we're diving into the fascinating world of crypto market dynamics, specifically exploring how crypto trades reacted to a recent slide in the stock market.

The crypto market is known for its wild swings, often mirroring the movements of traditional financial markets. 📈📉 But the relationship between crypto and stocks isn't always straightforward. While they can sometimes move in tandem, there are instances where they diverge, creating unique opportunities and challenges for investors.

This blog post will examine the recent crypto market activity following a dip in the stock market, analyzing the factors that influenced the price movements and exploring the implications for investors.

The Crypto Market's Response to a Stock Market Slide

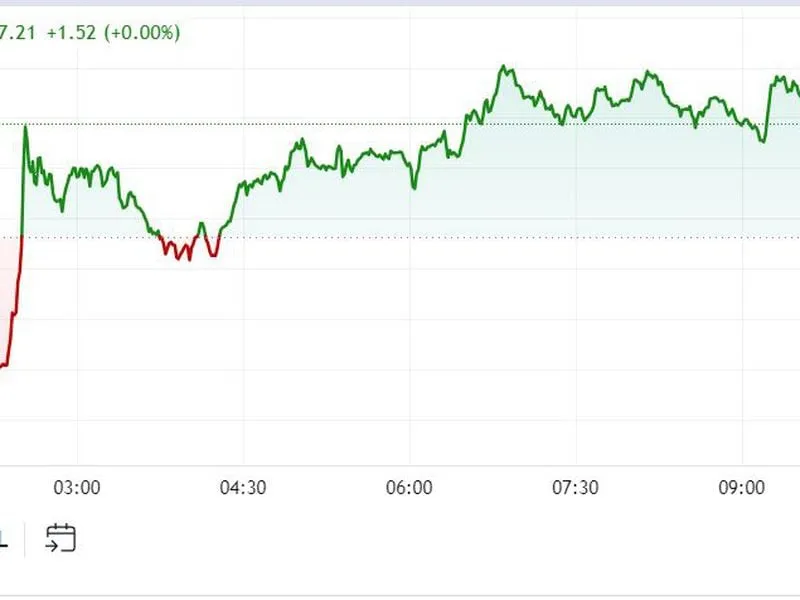

Background: On Thursday, August 15th, 2024, the stock market experienced a significant decline, with major indices like the S&P 500 and Nasdaq falling sharply. This downward trend sparked curiosity about how the crypto market would react.

The Crypto Market's Reaction: Surprisingly, the crypto market remained relatively stable in the immediate aftermath of the stock market slide. Bitcoin, the leading cryptocurrency, experienced a slight dip but quickly recovered, trading near $58,500. Ethereum, the second-largest cryptocurrency, also saw a minor decline but remained above $2,600.

Factors Influencing the Crypto Market's Resilience:

- Decoupling from Traditional Markets: While crypto and stocks have historically shown some correlation, recent trends suggest a growing decoupling. This means that crypto markets are becoming increasingly independent of traditional financial markets, potentially driven by factors like the growing adoption of cryptocurrencies and the increasing institutional interest in the space.

- Strong Fundamentals: The crypto market has been experiencing a period of positive developments, including the launch of new projects, regulatory clarity in some jurisdictions, and increasing adoption of blockchain technology. These positive fundamentals may have contributed to the market's resilience in the face of stock market volatility.

- Investor Sentiment: Investor sentiment plays a crucial role in shaping market movements. Despite the stock market slide, investor confidence in the crypto market remained relatively high, potentially due to the ongoing positive developments and the belief in the long-term potential of cryptocurrencies.

The Implications for Investors

Opportunities: The decoupling of crypto from traditional markets presents opportunities for investors seeking diversification and potentially higher returns. By investing in cryptocurrencies, investors can potentially mitigate the risks associated with traditional asset classes.

Challenges: While the decoupling offers opportunities, it also presents challenges. The crypto market is still relatively young and volatile, making it crucial for investors to conduct thorough research and manage their risk carefully.

The Importance of Diversification: As always, diversification is key to managing risk. Investors should consider allocating a portion of their portfolio to cryptocurrencies while maintaining a balanced approach across different asset classes.

Conclusion

The recent crypto market activity following a stock market slide highlights the growing independence of the crypto market from traditional financial markets. While the decoupling presents opportunities for investors, it also underscores the importance of careful research, risk management, and diversification.

Call to Action: What are your thoughts on the relationship between crypto and traditional markets? Share your insights in the comments below!

Thought-Provoking Statement: The future of the crypto market is uncertain, but one thing is clear: the space is evolving rapidly, and investors need to stay informed and adaptable to navigate the ever-changing landscape.

*Disclaimer: Created with Gemini AI.