Did you know that even after a significant drop in Bitcoin's price on Thursday, the crypto market remained relatively calm? 🤯 It's like the crypto world is holding its breath, waiting to see what happens next.

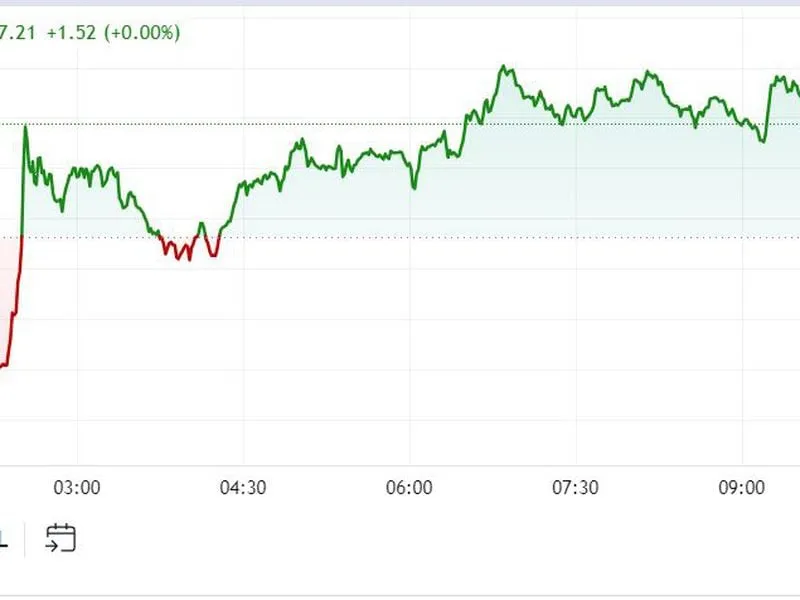

This week's market activity has been a rollercoaster ride, with Bitcoin experiencing a sudden dip below $57,000. While this might seem alarming to some, it's important to understand the context and factors influencing these price fluctuations. This blog post will delve into the recent market movements, exploring the potential reasons behind the dip and the overall sentiment within the crypto community.

The Crypto Market's Calm After the Storm

Background: The crypto market has been known for its volatility, with prices often experiencing sharp swings. However, the recent dip in Bitcoin's price, despite its magnitude, didn't trigger a widespread panic sell-off. This relative calm is intriguing, especially considering the lack of a clear catalyst for the drop.

Analysis: Several factors could be contributing to the market's resilience. One possibility is that investors are becoming more accustomed to volatility and are less likely to react impulsively. Another factor could be the growing institutional interest in crypto, with more traditional investors entering the market and bringing a more measured approach. Additionally, the ongoing development of the crypto ecosystem, with new projects and innovations emerging, might be providing a sense of optimism and confidence.

The Search for a Catalyst

Background: The sudden drop in Bitcoin's price on Thursday left many scratching their heads, as there wasn't any obvious news or event that could explain the decline. This lack of a clear catalyst has fueled speculation and debate within the crypto community.

Analysis: Some analysts believe that the dip could be attributed to profit-taking after a recent rally. Others suggest that it might be related to macroeconomic factors, such as concerns about inflation or interest rate hikes. It's also possible that the drop was simply a technical correction, a natural adjustment after a period of sustained growth. However, without a definitive explanation, the mystery surrounding the dip continues to linger.

Institutional Interest and the Rise of Spot Bitcoin ETFs

Background: The growing institutional interest in crypto has been a significant factor in the market's development. One of the most notable developments in this area has been the launch of spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin through traditional investment vehicles.

Analysis: The launch of spot Bitcoin ETFs has been seen as a major milestone for the crypto industry, as it provides a more accessible and regulated way for institutional investors to invest in Bitcoin. The success of these ETFs has been evident in the significant inflows they have attracted, with BlackRock's iShares ETF recently surpassing Grayscale's Bitcoin Trust as the largest in terms of assets under management. This influx of institutional capital is likely to have a stabilizing effect on the market, as it brings a more long-term perspective and reduces the impact of short-term price fluctuations.

The Future of the Crypto Market

Summary: The recent market activity highlights the ongoing evolution of the crypto space. While volatility remains a characteristic of the market, the growing institutional interest and the development of new technologies are creating a more mature and resilient ecosystem.

Call to Action: As the crypto market continues to evolve, it's important to stay informed and engage with the community. Follow reputable news sources, participate in discussions, and learn about the latest developments. By staying informed and engaged, you can navigate the market with greater confidence and make informed decisions.

Final Thoughts: The crypto market is a dynamic and ever-changing landscape. While the recent dip in Bitcoin's price might have caused some concern, it's important to remember that the market is constantly evolving and adapting. The growing institutional interest, the development of new technologies, and the increasing adoption of crypto are all positive signs for the future of the industry. As we move forward, it's crucial to stay informed, engage with the community, and embrace the exciting possibilities that lie ahead.

*Disclaimer: Created with Gemini AI.