Hi communities!

I write about nothing and everything. Economics and finance are however my favorite topics, especially economic indicators. I will spend some time writing about different types of economic indicators. Firstly because I need to refresh my knowledge, secondly because I believe the indicators suits us all in the time being. The economic indicators are important to look at so you get an overview where the market is going, meaning are we heading into a bull/bear/consolidation market or even worse - a crash. Anyways, in a time where “everything” seems to be hoovering around all time highs it would be a good idea to have a look at certain economic indicators. If you are smart, you might be the one who predicts the next crash. Therefore, mowing forward I will review some economic indicators that I believe you should have a look at.

It is in the nature of financial markets that we try to price all available information. An interesting question is therefore how much you can get out of following economic indicators yourself. What do we really add of extra value? The answer is probably not in the numbers but how to work with the numbers and how to use them to draw conclusions about the future. The articles ahead will try to capture all the relevant indicators in all of the information out there. What I have learned so far is that the economic indicators are very important. They can determine whether you lose or make money as a private investor, how much housing you can afford to buy, how to plan the growth of your private finances, what kind of career you choose - maybe even where you go on vacation this year. Much is linked to being able to measure how economic growth will be in the future.

If you really want your numbers to be correct, I suggest you dive into this page: Shadowstats. The web page tries to find representative numbers for such as unemployment, money supply growth and inflation. They also expose and analyze flaws in the current U.S. government economic data and reporting.

Leading indicators like GDP, the main indices, long-term interest rates, housing prices, employment, inflation, money exchange rate and etc. will be some of the indicators I will touch up on. I might as well include other indicators as well as they are underestimated and gives you a good pinpoint of the economic growth mowing forward. There is a lot of indicators out there if you deep dive into it, I will give you a thorough examination of the leading indicators, a small introduction to the smaller indicators and how you can exploit them. I will also try to give you a list of everything that exist out there so you got a lot of quality knowledge to attain in the days, months and years to come!

Let’s jump into one of my favorite economic indicators and that will create the first part of my journey through the economic indicators. The first indicator will be GDP and how you can utilize GDP. It is my favorite indicator since it is the most basic economic goal and that it was among those that were first introduced to me when I started my studies within the field of economics. Many investors use GDP to verify their conclusions and decide the best time and place to invest their money.

GDP - Gross Domestic Product

As I said, GDP is the most basic economic target together with unemployment and inflation. I, myself, was fed with this during the studies. Very simply, we can say that GDP is "the total value of everything we produce in a country". Roughly speaking, GDP consists of four components: private consumption of goods and services, public sector consumption of goods and services, gross investments in real capital, and net exports of goods and services abroad. The latter is again defined as the value of exported goods and services minus the value of imported goods and services.

Note that public consumptions do not necessarily reflect value creation. Public consumption are how much the authorities pay for a good, not the market value of the same good. Simply put, if the state builds for 100 million USD, this amount is added to GDP.

The distribution of GDP also has a lot to say for future value creation. When a factory invests in a new, more efficient machine for 10,000 USD, this can help increase profitability in the future. The same is not the case if a person goes out and buys a new car for the same price. What I mean is that GDP mainly measures consumption, and consumption is not growth.

GDP has also been criticized for including purely destructive activities, and incidents, such as wars and earthquakes. However, undeclared work is not included, which means that the GDP figures for many developing countries - where the taxation systems are poorly developed - do not fully reflect their actual production.

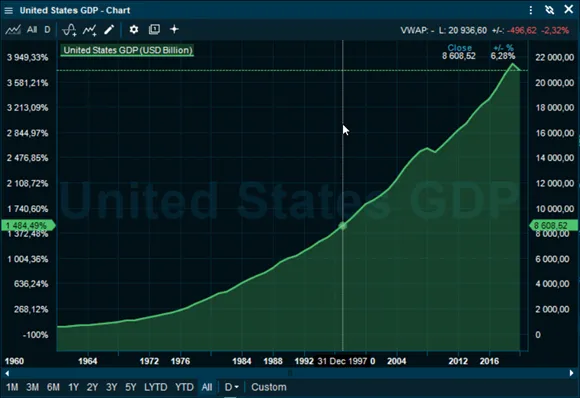

When we try to assess trends in GDP, volume changes are usually considered the most useful. The GDP numbers are often released every quarter, typically seven weeks after each period ends. The significant delay in reporting, as well as the ongoing revisions of GDP figures, means that GDP growth is in itself a lagging indicator of developments in the real economy. Still, it is "insanely" good to use this indicator as pin point of how a country is doing - financially!

What a growth the US have had the last couple of decades, would GDP say something about where we are heading mowing forward? Here, you would probably need more indicators - stay tuned!

Thank you for reading my first post about economic indicators! This post is more of an introduction to the economic indicators and did not review GDP thoroughly. The next parts will go more in depth.

Cheers

-Olebulls