Last week I read an article in Bitcoin magazine that looks at China's decision to ban Bitcoin through the lens of game theory. Link below so you can read for yourself. Within the realm of game theory study resides the famous 'prisoner's dilemma' analysis. Wikipedia explains the prisoner's dilemma setup as follows:

Two members of a criminal organization are arrested and imprisoned. Each prisoner is in solitary confinement with no means of communicating with the other. The prosecutors lack sufficient evidence to convict the pair on the principal charge, but they have enough to convict both on a lesser charge. Simultaneously, the prosecutors offer each prisoner a bargain. Each prisoner is given the opportunity either to betray the other by testifying that the other committed the crime, or to cooperate with the other by remaining silent.

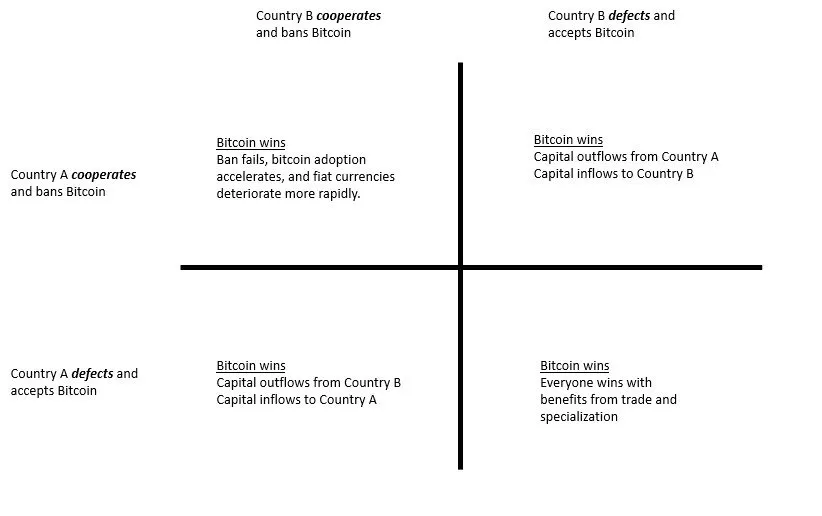

A variety of potential outcomes with different consequences exist based on whether or not each criminal decides to cooperate or betray the other. These outcomes can and often are represented graphically. Below is the analysis Bitcoin Magazine applied to the action of countries banning Bitcoin (recreated for the sake of clarity). We saw a precursor to this earlier in the year with China banning mining and other countries welcoming Bitcoin refugees with open arms. Spend a few moments studying the picture below. If correct, this is obviously comforting and I truly want to believe its this simple. However, it seems to be lacking a few dimensions, the most important I would argue is time.

With so many central banks now charging down the CBDC road, there are definitely more countries that would share the incentive of wanting to kill crypto so that it doesn't compete with their official offering. If these countries all coordinated rapidly and moved with an overwhelming amount of effectiveness, we could see crypto come down hard, generating massive losses for many. Deep wounds that cause scars often change the behaviour of many people (not all). I'm sure we all know s people that bought in early 2018 and who's posture towards crypto now is 'never again'. Currency is truly a game of confidence and confidence can be a fragile thing.

The good news? It seems unlikely to me that coordination of that magnitude can actually happen that quickly. Think of all the various factors that would go into making the decision to cooperate or defect. Each country would likely have to coordinate across a number of different official agencies and the politics of power are hard. Exhibit A? In the US, the SEC and CFTC are fighting in Congress about who gets to regulate crypto. China, with their authoritarian communistic regime has a leg up on other countries in this regard. So even if the incentives and intent exist for many countries to join China, it doesn't strike me as being easy to do. That buys time, which allows the network to spread, which in theory, should make it even harder to kill.

Cheers,

NZFX