Suspension of withdrawals is becoming the dreaded words that many crypto hodlers on exchanges are fearing the most. One of the first things I do when using any investment service is to test the "exits" to make sure I can get my crypto out and that I am familiar with how to do it.

With FTX and other exchanges blowing up, it is thought that contagion could be spreading also to CDC (crypto.com). The reasons for this are random "tweets" by the CEO of transfering $400m ETH to the wrong address and some skepticism over their crypto holdings.

Anybody who has been involved in transferring large sums of money or worked in any treasury functions, know that this is not something that could in any way be feasible.

In the meantime, the CRO token that is seen as the barometer of health for CDC has taken a spanking.

If we look at the 14 day chart provided by coingecko, we can see there has been a 39% drop in the token price since the 8th of November.

The reason given for this is FUD is the surrounding insecurity on the exchanges. This could well be a cause for some people wanting to sell their CRO, but most CRO is "locked up" in staking either on their exchange or for their visa cards. Could then speculators be responsible for this big market correction?

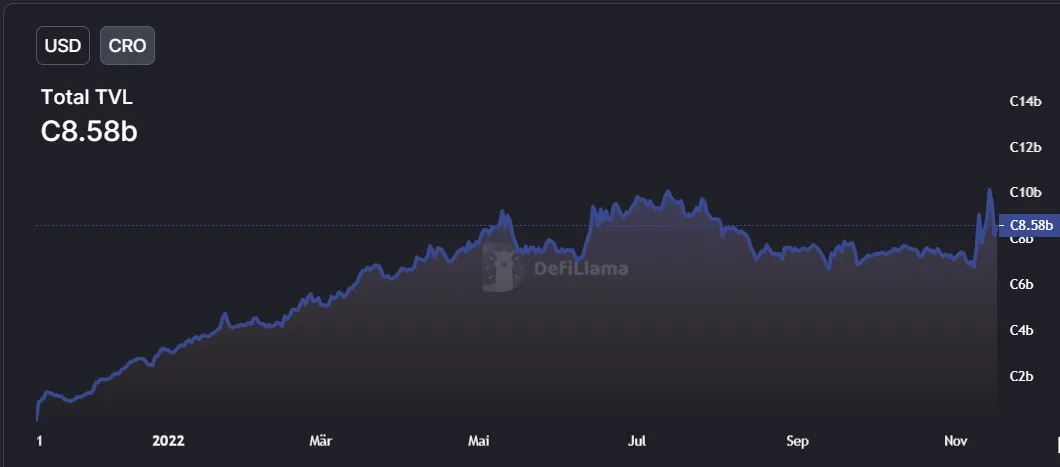

We can see that TVL has actually been increasing with CRO, so this doesn't seem a feasible explanation for the market correction.

CRO is ranked #31 on the market cap ranking of coingecko so it is a popular token. The value has also shrunk by over 80% as you can see thanks to DefiLlama.

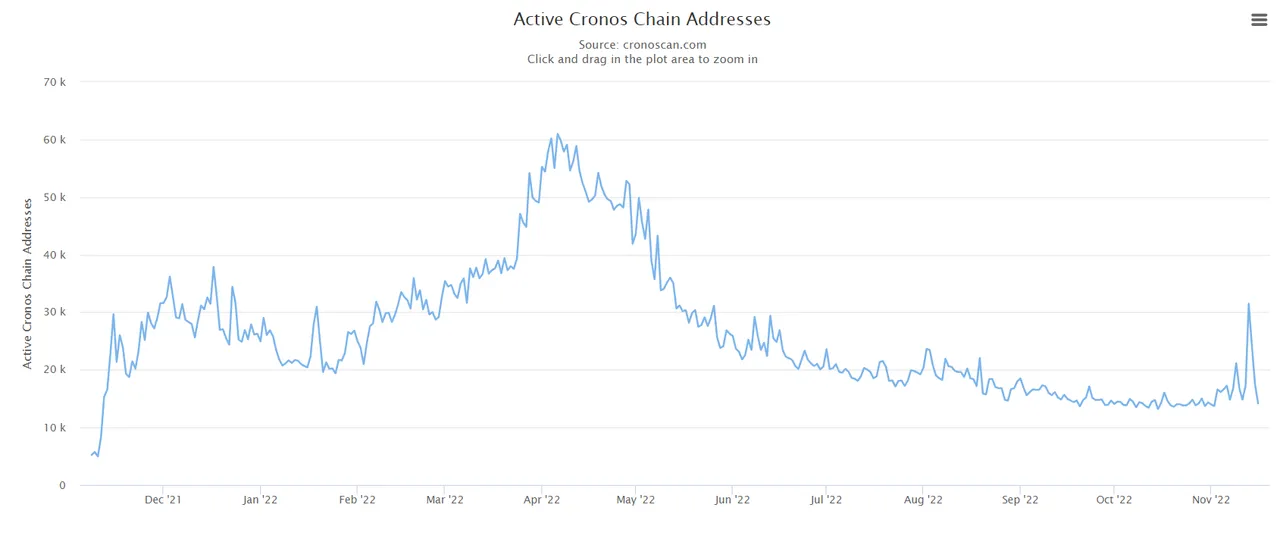

The active wallet addresses after initially spiking remains similar to the current level.

However what is interesting is that there is a supposed 40% of token distribution that is supposed to be vested on the 7th of November according to this report here.

Was the FUD created in order to cover a massive dumping of CRO by insiders to CRO bagholders?

The marketcap according to coingecko fell from $3.1bn to less than $1.4bn. Was this caused by the vesting and insiders making bank?

If there was a huge vesting with 40% of circulating tokens entering the market, this is a huge windfall and it certainly answered the question I had a year ago about where does the yield come from with CRO. You are the yield as it looks like here.

An interesting tactic that could be used by creating FUD with such a large vesting taking place would be to sell the vest onto the market and then buy back your stake at the new lower price with the ensuing panic, thus cashing out a nice chunk of cash whilst still holding your bag. Is that what they call money for nothing?

Thanks for reading.

Credits:

CRO Whitepaper

Title image created in canva using licensed image from canva pro and image source and

source