Hive price rose to $0.34, up 36% since the start of the year. As a member of the Hive community, I think the Hive price should be much higher. On the other hand, my engineer side says I should base my claim on data.

Hive, which has a market value of $165 million, is undervalued. I can produce many arguments to support this opinion. However, it is best to accept the price formed in the market. Hive has been active for about three years, and the Hive price followed a fluctuating course during this period. The inherent price volatility of the crypto market reached its extreme in 2022 due to rising interest rates.

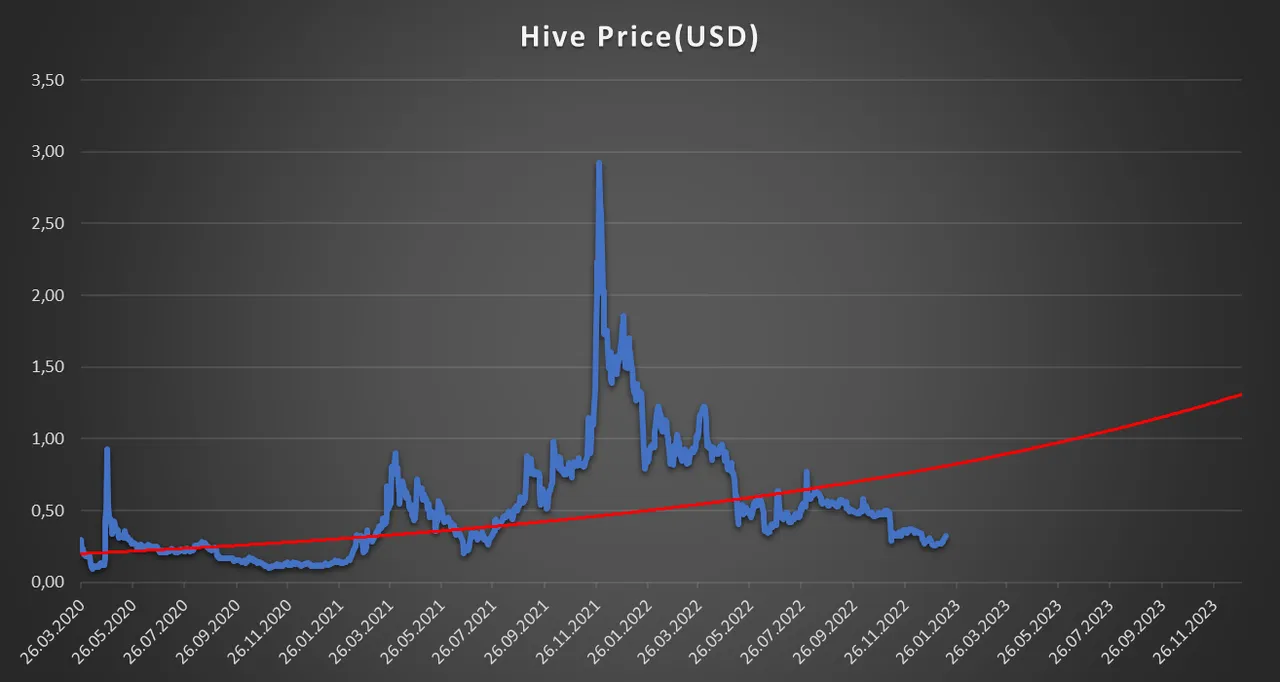

We can calculate Hive's fair price by averaging the prices realized so far. However, in this case, we ignore that Hive is a constantly evolving infrastructure. A more reasonable approach would be to create a linear trendline using Hive's daily prices. On the other hand, such a choice would not be compatible with the exponentially evolving nature of technology and crypto because we know that the values of networks such as Bitcoin, which have a more extended history, increase exponentially.

I have shown the daily prices from the start of Hive to yesterday in blue in the chart below. The red trend line shows the reasonable price of Hive. The chart shows that the Hive should be around 80 cents today. The fair price for the end of 2023 is $1.30.

The trendline may not be in line with the realized prices. When we make the graph's y-axis logarithmic, we see that the price trend becomes more appropriate. The equality of the areas above and below the trend line draws attention.

Exponential trend analysis models become healthier as they include data that has been formed over a long period. For example, at this time last year, the Hive price model was producing more optimistic results. Because almost all of the prices included in the model were formed during the bull market period. When the bear market prices formed last year entered the model, a more balanced outlook emerged.

With technical analysis, it would be appropriate to support such models, which show the prices' levels in the long run. We know that macroeconomic developments and the psychology of the market significantly affect prices.

Hive Technical Analysis

Yesterday was an important day for the crypto market. Bitcoin and Ethereum climbed above their 200-day averages. If this situation is permanent, we can judge that there is a trend change in the crypto market.

On the Hive front, prices have been rising since the beginning of the year. Thus, Hive broke the downward trend that has been valid for about a year.

When we examine the Hive prices, we see that 30 cents is the support level and 38-39 cents is the resistance level. The next resistance may occur at 45 cents if the price crosses that area. The 200-day simple average is still around 45 cents.

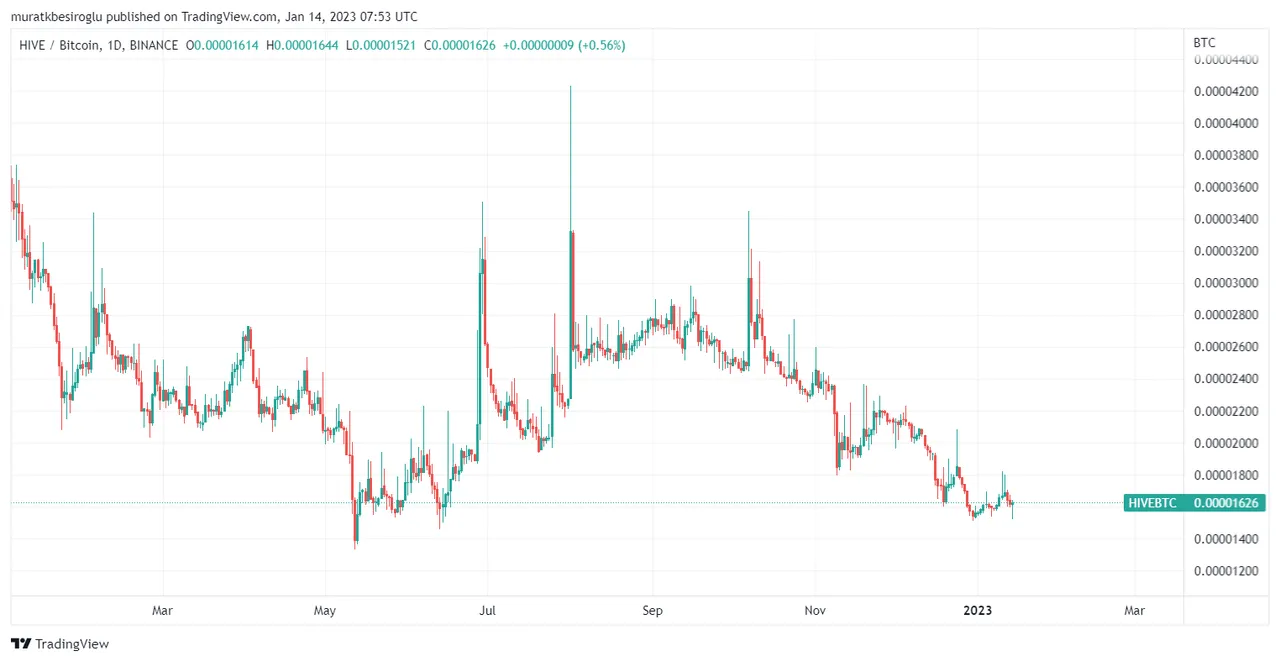

The Bitcoin-based chart shows that Hive has been losing value against Bitcoin since October. Hive's place in the market value rankings has mostly stayed the same. Therefore, it is possible to explain this situation with the desire to avoid risk after FTX's bankruptcy. If the strong outlook in the market continues, investors will turn to altcoins.

The Hive has yet to catch its simple 100 and 200-day averages on the dollar-based daily chart. The calculations made on the 4-hour chart show that the situation is much brighter.

Conclusion

The price movements in the last two days have caused many critical levels to be exceeded in the market. Yesterday, Bitcoin and Ethereum, as well as the S&P 500, broke above their 200-day average.

It is also noteworthy that crypto benefits more from the positive atmosphere in the markets than the stock markets. So investors believe in the potential of crypto. When an upward movement started, many people got involved.

Those who have taken risks beyond what they can bear can sell some at these levels. Although I believe in the potential of the crypto market and Hive, we should not get caught up in FOMO. The gradual purchase still seems to be the most viable option.

I am not a financial advisor. Please do your own research.

Thank you for reading.