I don't know how many of you are familiar with Viewbase.com but if you're not, make sure you check it out.

It's similar to Token Analyst or Cryptoquant only I think it is more user friendly.

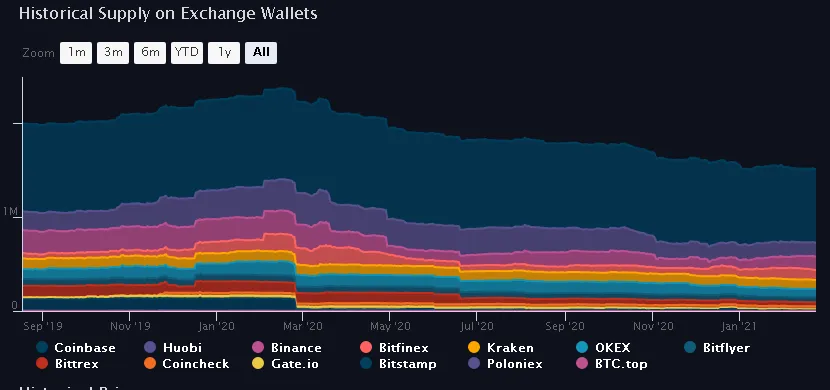

Anyway, essentially it is a website where one can check the flows of BTC / ETH and some of the other big players out there, per day / week / month, to exchange wallets and from exchange wallets, probably to cold storage.

Not all the exchanges are included on their list but only the big ones that probably 99% of people use.

The last couple of months have been completely insane. I guess this is what bull market is all about. Craziness. We've been hanging around with bears for so long that I almost forgot how it is absolutely normal for prices to go 5x - 10x - 20x with in a month when bulls take over.

BTC, the king of them all has had an amazing rally those last 2.5 month. And when BTC goes beast mode it usually drags alts to new highs as well. This time was no different.

From the moment it smashed its previous ATH (2017) it just never looked back. A small correction after it hit $40K only to test the $30K support level and then all the way up to $58K.

You may wonder why was this happening in the first place. The No1 reason was institutions and corporations such as Tesla, or MicroStrategy that had nothing to do with the crypto world up until now have recently become the biggest players and compete one another who's gonna hold the lion share.

Another reason as you can see from the screenshot is that for the past 30 days, sentiment was absolutely clear. After people made their BTC purchases on an exchange they withdrew their holdings to cold storage. Minus 37K BTC is a massive amount and indicates that those BTCs weren't for sale anymore.

That was exactly the case for the past week also. Every single day, investors kept withdrawing their BTC holdings from exchange wallets into cold storage "stating" theat those tokens aren't for grabs no more.

Note that on both screenshots the number of BTC flowed towards Binance is massive and my guess is that it might have to do with the recent BNB rally, an insane rally actually. For those who like stats, BNB was a $43 token 23 days ago...and it climbed as high as $350. BSC and pools have definitely something to do with that and ETH is just pushing everyone away with these outrageous fees...

So what changed the last 48 hours?

Some people suggest that BTC was overbought and to some degree I second that statement. But if it weren't institutions who dumped their tokens then who was it?

It could be a whale or a group of whales or just people taking profits only to buy back in later on.

The thing is something did change the last 48 hours. Maybe this Elon Musk - Peter Schiff war has something to do with it or simply sentiment changed.

Yesterday was the first day after 30 consecutive days that the number of BTC deposited to exchange wallets was higher than the number of tokens people withdrew.

The less available Bitcoins on the exchanges the thiner the order books get.

And the thiner the order books get the easier it is for price to climb higher. Just a bit more expensive each time.

Now just because there are 1660 BTC more on the exchanges than yesterday doesn't necessarily mean that this caused the ~20% correction.

But at some point a correction had to happen in order to move forward, right?

For many days in a row Bitcoin not only kept smashing one ATH after another but even when it didn't it was traded $500 - $1000 lower than its last ATH for hours....every 30 min candle was a candidate for a new ATH. You could just feel it.

48 hours later, do you think that we should expect a new massive correction?

Has sentiment changed indeed?

Lemme know your thoughts in the comment section below.

Have a good one people.

Cheers!