When it comes to crypto-passive incomes, I can see lots of talking and writing. I also see many speaking of DeFi, Staking (me included, of course) and Lending. Yet, almost no one gets to even mention trading and trading systems.

WHY?

Trading and Copy-trading are great sources of income too. Although one must have time and money to put into trading, copy trading’s results can be interesting too and can be(come) even comparable to a respectable employment source.

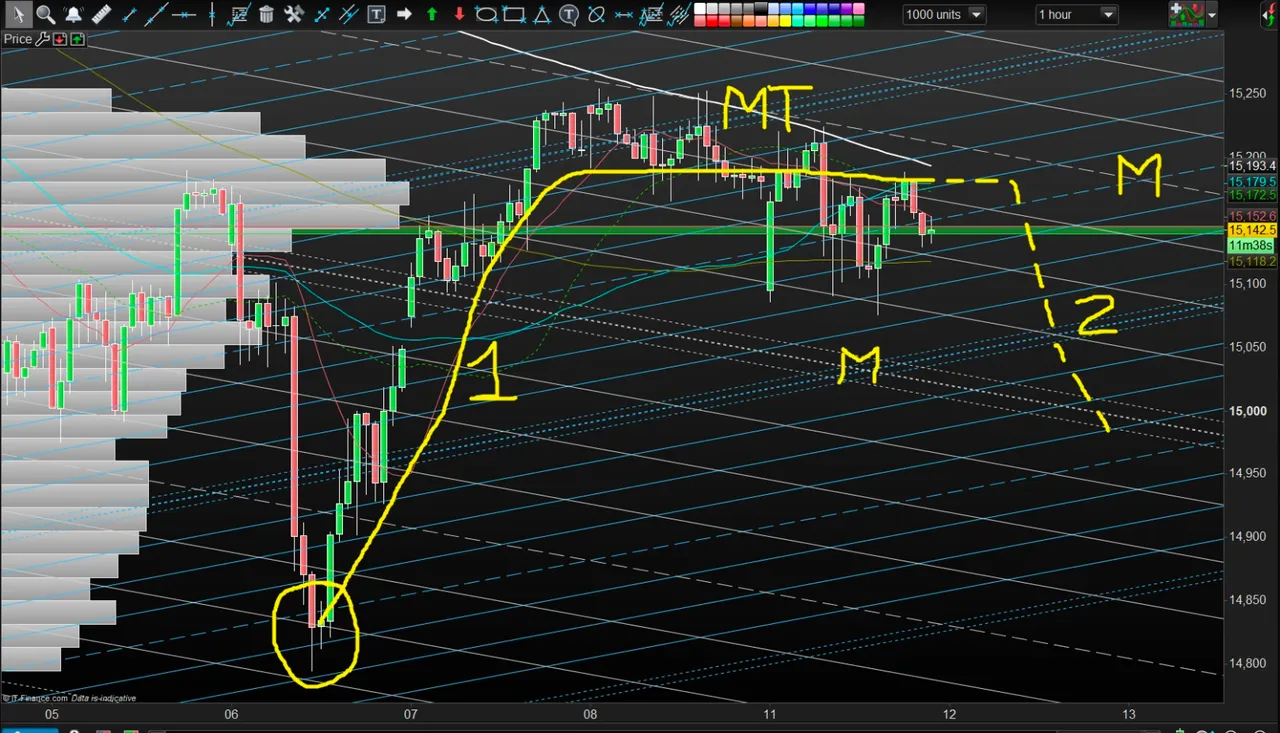

As you have probably noticed, I am also sometimes sharing some trading results, since it’s been some years that I am constantly trading crypto coins. While some results have arrived, even despite having tried out myself in difficult markets, I am now also developing a semi-automatic bot for derivatives trading.

I like trading

It’s something that has much in common with engineering, where I had to design systems by taking several variables into consideration - which, in my opinion, is also the main reason why most people do not consider trading among the possible streams of passive income, or at least not in the form of Profit-Sharing-Trading.

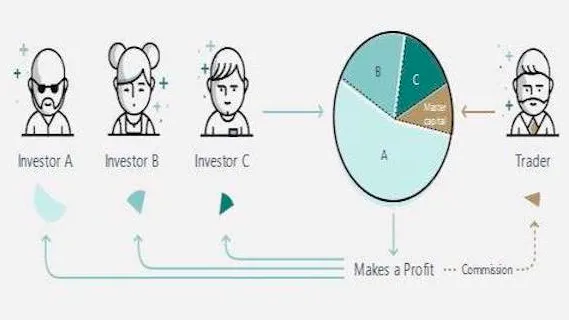

Copy-trading is a way of automatic trading whereby the customer allocates funds that are managed by a remote trader on his/her behalf. Among the main considerations, when assessing a copy-trading setup, the first thing you must check is whether you have to deposit funds (A) on the trader’s own account or rather (B) on another account of yours externally manageable by the trader. The first option is not recommendable, since the trader can run away with your funds. So, the first rule for Copy-trading is that you must have full control on your funds and the trader must not be able to withdraw them but only to trade them.

The second variable you have to check is the platform where the trading would be carried out since there are some very lowly-capitalized platforms out there. Capitalization, as well as stability, safety and number of markets are also fundamental prerequisites for trading to work.

Capitalization will provide stability of the market, with a lower number of spikes and fake breakouts.

Safety (e.g. cyber-security and respectable coins), instead, will ensure that no unnecessary risks will be brought to the money. It’s no coincidence that the biggest trading platforms have really high safety standards, making them advisable to host Trading and Copy-trading activities.

Other than trader access rights to the funds and the safety of the platform, another aspect to bear in mind is that Copy-Trading must be meritocratic. To elaborate: copy-trading can be based on (a) either periodical flat fees or (b) success fees. In the first option, users get to pay the provider a standard fee ranging between a few and hundreds of dollars per month depending, among the others, on the number of provided services, their quality AND how far the reputation of the service provider goes.

The Success Fee, instead, relies on how much profits the Copy-Trading service generates and is typically a percentage of a profit.

Personally, I find the second option much more suitable, since it does not require minimum wallet sizes (especially to cover the service costs) and it is, in fact, meritocratic. The better the trader works, the higher his results. And this is the reason why, for my small copy-trading, I opted for the so-called “Profit Sharing” setup, whereby the fees are based on the profits I bring to the “followers”.

And due to the growing number of platform offering copy-trading with multi-level marketing compensation plans attached without complying with the 4 requirements above, I understand why so few people have trusted copy-trading until now. And why such people are starting more and more to talk a lot about it under the affiliation incentive. Everyone, even the Italian so-called “Nonna Maria” (Grandmother Mary) has started talking about Copy-Trading.

Sharing intel and information about copy-trading requires dedication to the trading activity and not just some persuasive words to make people subscribe something, earning from the customer a passive income.

Profit Sharing provides a Passive Income to the customers BUT it can be an active income for the Trader!

I am not going to mention nor sponsor neither the platform I use nor any other platform here since I understand that this is a very delicate topic.

Leave a comment here with some more considerations or doubts and I will be glad to help.

See ya!