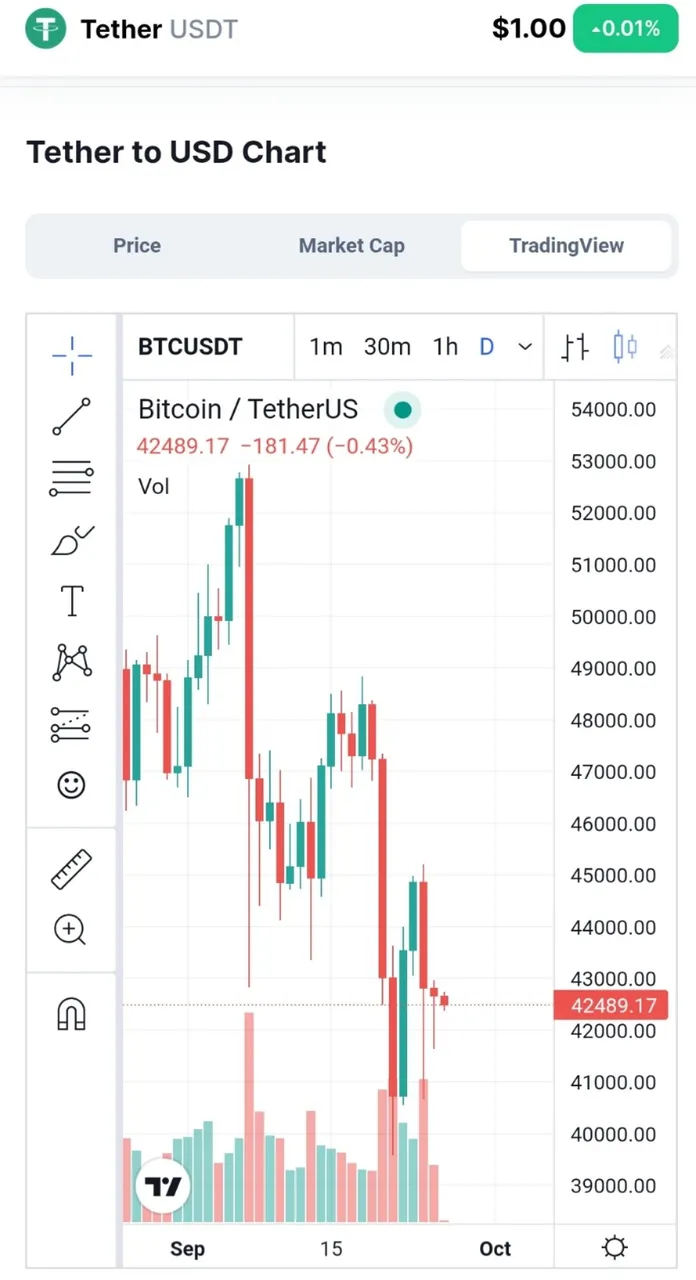

As China's cryptocurrency ban takes effect it has caused a significant market crash which has begun to recover. However, there are still some signs to be weary of including that of USDT which not to long ago was central to an investigation which highlighted that the stable coin didn't have enough assets to retain its peg.

It's unreported if USDT has fully recovered and built its assets to maintain its peg and the current bitcoin and crypto flash sell off from Chinese nationalists will test the currencies ability to remain pegged.

USDT is the main stable coin utilised by mainland Chinese nationals to trade fiat and withdrawl their currency as cash. This latest ban has seen high volumes of USDT dumping and its Yuan to dollar value decline as the stable coin begins to feel the impacts of the China ban Source

A swing to Singapore

Many Chinese exchanges have commenced relocation of their businesses to continue trading and provide services. As they have now been declared illegal as China states that Cryptocurrency is used for illegal activities such as gambling, fraud, pyramid schemes and other damaging activity Source.

The actions by China has seen Huobi lose 18% of its token value instantly as mainland Chinese begin dumping their tokens. Huobi has relocated its business to Singapore which is emerging as the global leader in Cryptocurrency enabling legalised trading and investment.

As many Chinese nationals move to remain in Cryptocurrency and secure their net position the token of choice is Luna (Terra) which saw a bull run recovering from its dip to almost breaching its All time high set only 10 days ago.

Terra has been working with banks and regulators to go mainstream and is well underway to becoming the first globally recognised Cryptocurrency and utilised in mainstream adoption which is already able to be used to purchase items from stores across the globe.

US to capitalise on China's ban

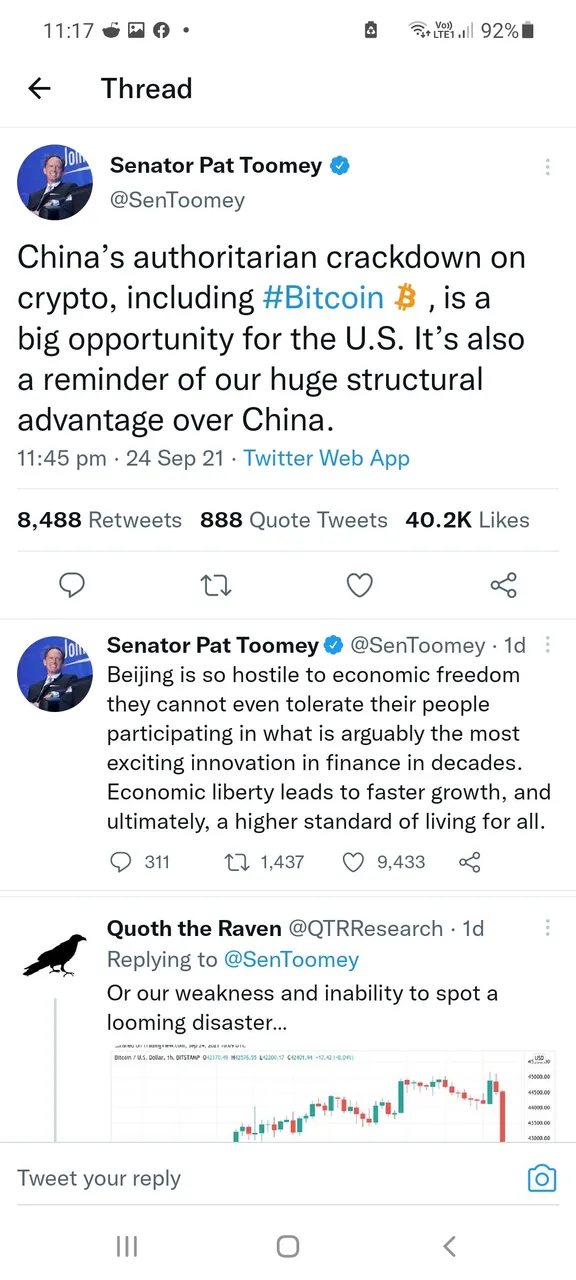

Senator Pat Toomey was quick to capitalise off China's ban and sees the action as a point of success for the US stating that Cryptocurrency is exciting and the largest innovation in finance we have seen Source.

He sees China's attack on their nation's ability to participate in economic freedom as hostile noting that it poses a huge advantage to Americans.

The Senators tweet received over 8000 retweets and over 40,000 likes which indicates that Americans are supportive of the move to invest in cryptocurrancy.

We can see that China's move has caused some impacts on the market but it was also apparent that alot more investors were waiting on the sidelines and captured much of the dip restoring a significant portion of the market.

As September is typically a down period I'd anticipate the buy back was undertaken by seasons investors who sold much of their high period earnings and were awaiting a Q3 dip which is still unseen. But China has delivered the perfect opportunity to return to a net position with more gains.

With many nations moving to legalise investment opportunities within block chain technology and constant news of US, Europe and many other nations wanting a mainstream approach to Cryptocurrency it is not a sector those have worked hard in and invested years of resources and time want to back away from.

As witnessed in the above article sources many Chinese firms are relocating their operations which won't prevent Chinese nationals continuing to invest but provide future options to continue to enable trading.

China has a fight on its hands that is pushing Cryptocurrency into the shadows and a Decentralised anonymous network will prove challenging for the Authoritarian nation to track and block as we're already seeing major players relocate to legal and politically safe nations to continue their operations.

This is simply a transitional phase which will see China lose its advantage over Cryptocurrency and block chain technology and deliver it to other nations.

With a total market cap of $US1.9 Trillion that is no tiny market when you consider that the global market is currently sitting at $US147 Trillion dollars.

Cryptocurrency is here to stay.

Image sources provided, supplement by Canva Pro Subscription. This is not financial advice and I urge people to do their own research or access a credible investment service