With the current cryptocurrency draw down from BTC and all the altcoins there is going to be a greater interest in holding and investing in stable coins. Besides the well known stable coins such as USDT, USDC, BUSD, and DAI none of them have what the next three in discussion that uses algorithms to peg with the US dollar. The three tokens in focus are UST, USN and USDD.

Terra's UST

Currently ranked 9th overall in cryptocurrency market cap based on coinmarketcap.com the longest running algorithmic stable coin out of the three being compared is UST.

Terra and UST brief explaination from decrypt.co :

Terra is a blockchain protocol underpinned by a suite of decentralized stablecoins. The most popular is called TerraUSD, or UST.

The stablecoins maintain their pegs through a coin called LUNA.

LUNA is a volatile cryptocurrency. The elasticity of its supply keeps the prices of its stablecoins in check.

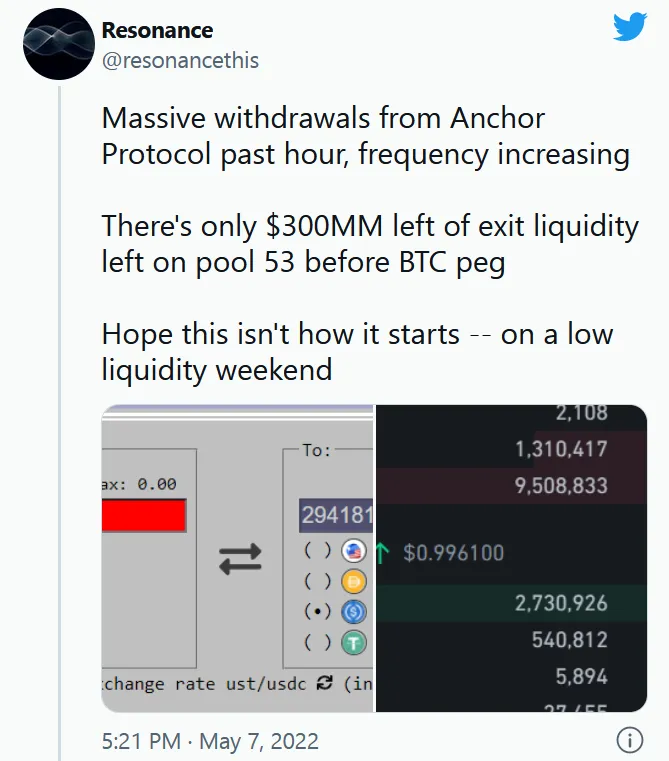

As of now UST is under an attack by whale/s trying to take out its peg. Where over on Anchor protocol large sums of UST is being with draw and same goes with a large Curve Finance pool consisting of over $1 billion in UST and people swapping out UST and into other stable coins such as USDC.

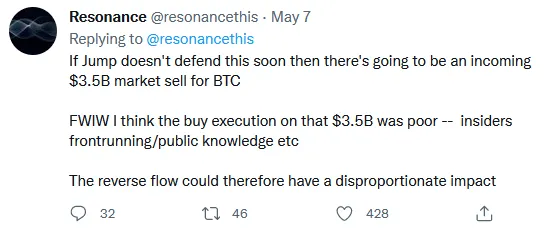

This is leading to an assumption that current UST slight de-pegging is due to the Luna Foundation Guard (LFG) holding a significant BTC amount in the tune of $3.5 billion and someone or group trying to force sell the BTC from LFG to maintain UST peg.

As of now Luna token price has fallen to near $60 while it was just over $80 two days ago. The pressure selling of Luna is also leading to weakness in UST but not by much. It is recommended if one wants to invest in Luna now they should watch carefully as to how UST is performing and how the draw down over on Anchor and Curve Finance is developing before investing.

Near's USN

Link to Medium Article about USN

There has been a lot of speculation as to USN providing a 20% APY yield before it came out. After it did come out the truth was USN was going to earn yield based on NEAR APY.

The floor APY for USN holders will be ~11%, which is NEAR’s current PoS staking reward rate.

This then implies that USN yield will be effected on what price of NEAR would be. For instance:

if there are 100 million NEAR staked by the USN contract, but only 100 million USN in circulation, and the NEAR price is $12, then the effective APY for USN holders would be higher than 120%!

The way NEAR and USN are correlated depends on the price of NEAR. This is different than Luna and UST on the premise that no matter what Luna price is there would be more UST created for every Luna burned. The price of Luna being higher would result in more UST and vise versa.

On the other hand for NEAR to hold up in value will yield more USN, but if NEAR price falls there is less USN earned. In fact since the cryptocurrency market is currently facing a down turn the yield on staked USN is trending down.

One maybe then wondering in a bull run NEAR rising would mean more USN yield and indeed that is the objective. In fact NEAR protocol is providing opportunities for investors to leverage their stable coin yields when earning more USN. Rather than going to the details as the projects are still in the work there has been rumors that the protocol can allow investors in to earn 200% in USN yields.

$USN is a NEAR-native stablecoin soft-pegged to the US Dollar, backed by a Reserve Fund that contains $NEAR, as well as $USDT initially. $USN’s core stability mechanisms consist of on-chain arbitrage and the Reserve Fund based on the Currency Board principle.

Tron's USDD

USDD is circulating as a decentralized TRC token on the TRON blockchain. The issuance and administration of reserves are overseen by the TRON DAO Reserve transparently. USDD is algorithmically pegged to the U.S. dollar to achieve the overarching goal of financial freedom for everyone. As a TRC-20 standard token, USDD can trade without brokers; it depends solely on the TRON network.

Qoute is straight from theblockcrypto.com and it is worth noting that Tron has advanced knowledge in stable coins since there is over $40 billion of Tether USDT flowing through and around on Tron network. This majority of USDT in existence.

With the familiarity and advertised 30% APY yield in staking USDD it is initially a stand out in stable coins yields compare to all three discussed. However warning flags should be waving since Tron's founder Justin Sun has done wrong in the crypto space before. In the USDD roll out caution is advised as its it still new and the peg of USDD has yet to be tested.

The Tron DAO reserve was created to ensure that USDD stays pegged to the US dollar. The reserve would use crypto holdings such as TRON and what ever cryptos it has to keep the stable coin USDD peg to the dollar. Very similar to what LFG is doing for UST.

Conclusions

Even though the cryptocurrency market is falling there are areas in the industry that is still profitable if invested. One of those is in stable coins as the focus is to main a peg to the US dollar while also earning double digit % APY in yields.

Still stable coins has its own risks. For instance if they de-peg from the US dollar or the % APY yields crashing. In the end it is not necessarily full proof to go with investing in algo stable coins. However hopefully this post serves as a decent start guild for readers on what options are out there.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token