A lot of news has been covering the FED's rate hikes and anticipation of future hikes. Yet there are other tools the FED has in its disposal to tighten the credit markets. Another tool is the FED balance sheet.

FED's Balance Sheet

When the real economy has assets that are unable to sell between banks and investors the FED steps in to purchase such assets. This is so that the FED provides the demand while the economy can continue to operate with liquidity. However asset prices may fall in price based on supply and demand. The FED would have to take a lose if they are unable to sell asset at face value.

The focus now though is the FED is planning not to purchase more assets and instead start selling what they have in their holdings. This means their balance sheet would be reduced while the real economy will have to absorb the assets and have $ removed out of the economy.

This process of FED buying assets and selling assets are known as Quantitative Easing and Quantitative Tightening respectively. They were introduced during the Great Financial Crisis when the FED came in to support the real economy by being mostly a buyer. Over the decades when the real economy struggled the FED came in to save the day by buying. Yet times are changing and FED is anticipating to perform Quantitative Tightening.

Quantitative tightening (QT), also known as balance sheet normalization, refers to monetary policies that contract or reduce the Federal Reserve (Fed) balance sheet. QT is the opposite of quantitative easing (QE).

Definition of QT via Investopedia.com

Balance Sheet Roll Off Begins

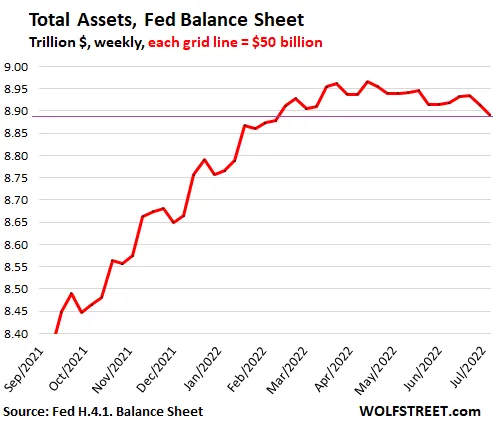

June 2022 the FED started to sell some of the assets but it has created somewhat of unstable prices in the stock market. The trend over the past two years with QE was a rise in stock prices. Now the opposite is true but FED has only begun to start selling.

In May 2022 FED disclosed its road map for the forthcoming QT, QT Schedule Link Here and I will extract the key points here.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

The first sells were in July, and by October the selling will accelerate. From $47.5 billion in the first three months to $95 billion by October. Note currently there is nearly $9 trillion so there is plenty of assets needed to sell.

The objective of FED selling assets is to reduce inflation. The goal will result in extract liquidity out of the real economy which can be problematic to the stock markets.

Last time the FED did QT it did not take long for them to stop. This was because the effects on the stock market prices were not good. Prices fell and feel too quickly. Now we are in 2022 and QT has been initiated. Moving forward in the following months it will be interesting to see how this plays out. History does not repeat but rhymes.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token