(Courtesy of US Herald)

For BTC enthusiasts who are curious of the top BTC holders there are sites out that lists current wallets that hold the most BTC. A richlist of top holders. Site Link Here

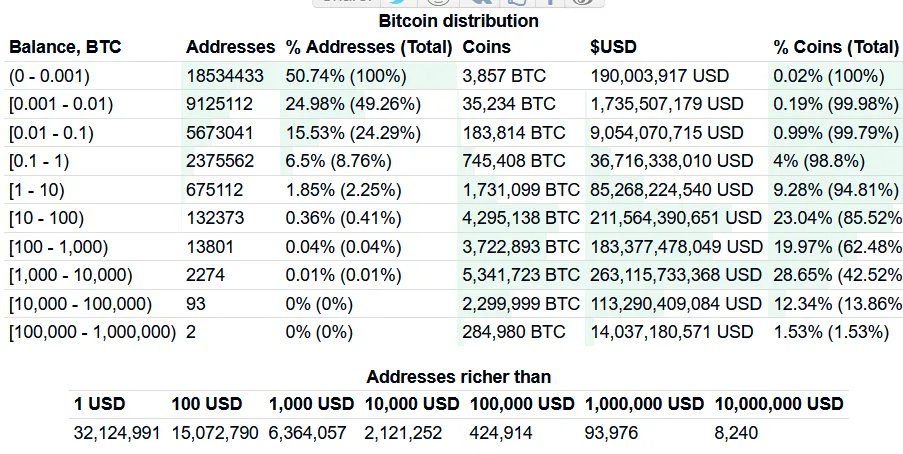

(Courtesy of Bitinfocharts.com 3/7/2021)

In 2010 Chamath came out publicly admitting he had purchased over 1,000,000 BTC. At the time BTC was still under $100. Source article Since none of the top richlist wallets hold more than 1,000,000 BTC I would presume Chamath had sold some if not all his BTC holdings. Still it would be amazing to imagine if he held all that BTC and at today's prices. That is basically $50,000,000,000 or $50 billion!

In 2013 Chamath in a Tech Crunch interview discuss his beliefs as to why BTC would rise in value in the not so distant future. Source article I mention this because back then what he explained in his beliefs of BTC and what it holds in the future came into fruition. He call it "the red pill", similar to the Matrix where if you took the red pill you would come to realize the world in a totally different form than what is considered normal.

Video clip courtesy of youtube, and if you go to minute 19 of the video, you will see him discuss and explain why he thought BTC was going to go parabolic. Here is a summary of what he said back then:

Better store of value than gold, It is gold 2.0

Used by governments all over the world as a store of value and fend off local currency devaluation

Use as a payment mechanism

All these points sounds familiar?

Gold Losing to BTC is a Fact

As gold is currently $1700 an ounce BTC has moon to nearly $50,000 per token. Looking back in 2013 gold price was between $1600 and $1200, where near end of the year it fell. While BTC in 2013 was in the range of low teens to low $100s. Its night and day comparison today as gold prices have almost remain the same price while BTC went up 500x!

BTC as a Universal Currency

With a lot of central banks doing interventions in order to stabilize economies it has come down to a race to devalue fiat currencies in order to inflate the economy.

Since 2008 financial crisis the global economy has accelerated in its push to weaken fiat currency while increase debt and risk in investments. This is all to push the economy to prosper but not all countries are thriving.

Crisis of Venezuela since 2010, government has been printing more fiat to support its spending and spur inflation. The consequence was a currency collapse making the entire country fallen into bankruptcy several times.

Greek Crisis, 2009-2018, where the government was unable to pay its debt and was later force to negotiate with the European Union to determine how to pay their debt and have the country avoid bankruptcy. It's country people would struggle as they were left the burden to pay the debt even to today.

Zimbabwe's Hyperinflation, 2007 and again 2020. Even before the 2008 financial crisis Zimbabwe was printing their fiat currency to the point where it cause hyperinflation to an astonishing rate of 89.7 sextillion percent year-on-year. sextillion is 19 zeros after 1. Although Zimbabwe reform their economy to rely more on foreign fiat such as the US dollar in around 2019 the local government started printing a new fiat currency. Hyperinflation return soon after and as of July 2020 it has risen over 700%. Source article

Many other countries are facing local fiat money printing issues and even developed countries such as the USA is facing issues. BTC used by any of these countries would also be accepted by many as a form of asset that could be exchanged hence the demand and use of BTC.

Payment Method

In 2013 not many stores were accepting BTC for goods and services. Since e-commerce has boomed and digital assets have increased attention BTC has become very popular as a form of currency that can be use to exchange for goods and services. As of end of 2020:

According to coinmap.org, there are currently just over 15,000 businesses that accept bitcoin or that offer bitcoin ATMs around the world. Around 2,300 US businesses accept bitcoin.

What does Chamath Think of BTC in 2021

Mr. Palihapitiya a month ago said this:

Where is it going it's probably to a $100k then $150k, then $200 thousand, in what period? I don't know, 5 years, 10 years, but it's going there.

If he was correct in predicting BTC in 2013 what is not to say what his recent thinking of BTC price would mean in the near future.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!