The news is out today as US banks alegedly might offer custody for cryptoassets!

This news might justify the sudden pump in cryptocurrencies that we are experiencing today.

Still, I would advise that we take it with care and patience as we might not jump into rushed conclusions be it for good or bad.

The news comes from Coindesksaying that:

"a public letter dated July 22, Senior Deputy Comptroller and Senior Counsel Jonathan Gould wrote that any national bank can hold onto the unique cryptographic keys for a cryptocurrency wallet, clearing the way for national banks to hold digital assets for their clients."

But what can we expect from this?

Well, to start with, the bright side:

The credibility of crypto: safety and regulation

- Adoption: the Bitcoin and cryptoassets ecosystem is becoming more and more mainstream. From a cypherpunk internet means of exchanging value to an world wide asset with old investment agents involved. This is maybe the move the crypto comunity needed to come out of the shadows and become credible in the financial world!

- Custody... with regulation: Custody services in the crypto world aren't new as most of the service providers offer centralized custodial services, be it Coinbase, Binance, Uphold, Gemini, and many others! And for some users it might be the best way to store their crypto as managing long and unreadable private keys, with the risk of losing them might be a problem. Besides the custody that traditional banks might offer, they must obey speciffic regulations... when they actually do.

Going back to the same old financial system: the dark side of this poisoned apple

Lets remember the main narrative of cryptocurrency: decentralized money and finance in a libertarian world movement... or not so much.

We were promised with peer-2-peer censorship free transactions... we expected more dollars.

We were promised with Decentralized autonomous Arganisations... we rolled back the blockchain to retrieve funds lost due to loopholes on the code.

We were promised Unstopable DApps... we jumped from platform to platform in search for the best gains.

I'm in it for the technology

Are you? Really?

- Not your Keys, not your coins: lets just remember the being away from the power of banks was the main selling point for cryptos. Be your own bank, they said... And now the bank takes your private keys, having control over your funds.

- From anonymous transactions to data mining: it is true that using custody acounts on crypto already entagled your identity, through KYC, to your crypto assets, still, they were away from other institutions... or were they?

It has been a long time since crypto were for the cypherpunks and anarchists... Its been a long time since crypto were from the free.

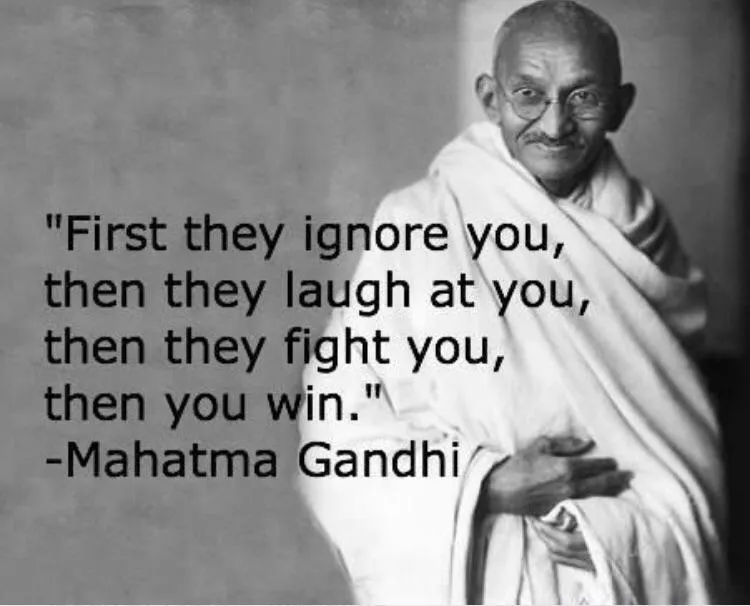

This Gandhi statment is outdated to say the list. The capitalist movement does not fight: it absorves everything. Think about all the movements that came out to fracture it's struture and how it found a way to include them in it's own logic... think about the Hippie movement and how it ended... Think about how banks came out to controll all the money flow in the world, taking custody of people savings and exploiting them.

Think about why you came into crypto, why you stayed, and why might never leave.

Think about control, and what are you willing to sacrifice for just a few more units of fiduciary currency with it's value attached to debt, under the control of the instituions you know you cannot trust.