Hey everyone!

It is great to see that CubDeFi survived "the refining process" from the dumping by short-hands and burning exercise after its first launch with extreme high yield proposals at the beginning.

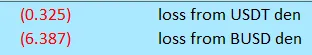

Which I wished that the dens I invested could have last longer with my small capital without losing too much; but I am certain that the LeoFinance team in CubDefi would have understood exactly what needs to be done in order to save the ship....

becoming a good learning path for me to see what to choose on a new yield farming project before things goes side ways when the rubber meets the road where they have to change strategies to survive.

One thing I learned so far from all the different projects, dens / pools, they don't last forever, so if there is a grace period of zero deposit fee within the project site to offer, I have decided to go for the token pairs and stakes that I think could last in the long run.

Just being an underdog supporter on the tokens that are next to $CUBs yield farming and staking offers.

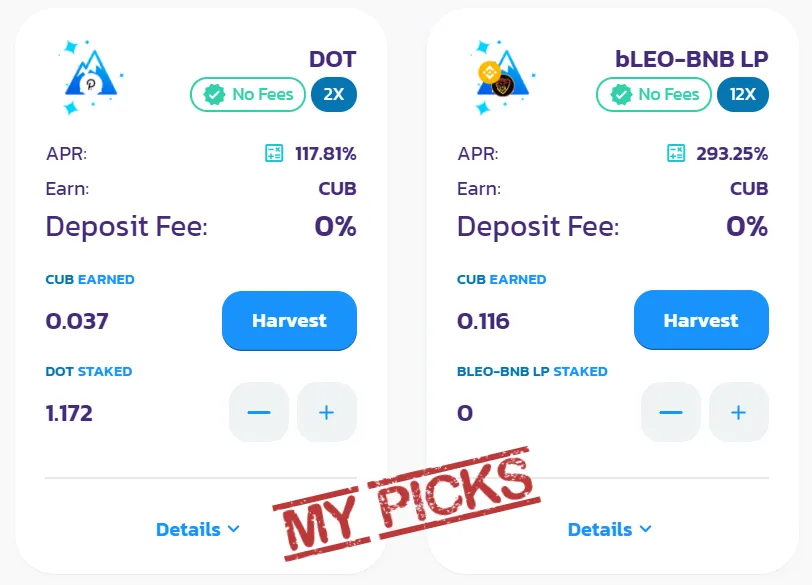

Polkadot could be the next rising star when it migrates as an independent chain where LeoFinance can also collaborate in; and of course, not forgetting the LEO coin who got all this started yet still an underdog priced (in my point of view) with its expanding capabilities, who knows perhaps holding a few extra outside the LEO community ecosystem might do good for its publicity.

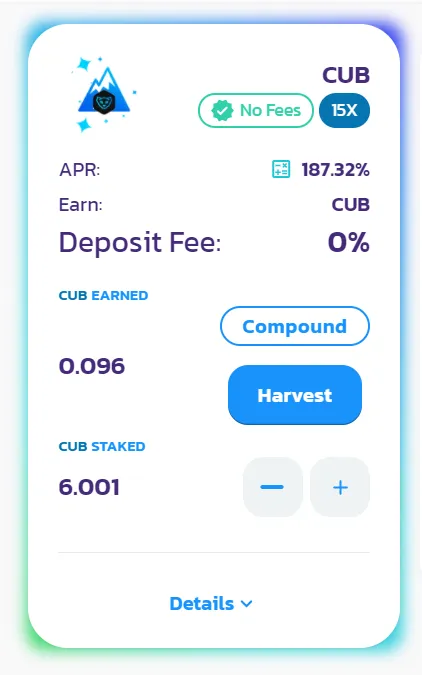

Of course, the main token for the site must not be ignored, fortunately before the bridging ends, though I acquired some with higher price in the HIVE Engine, I got my hands on some $CUBs to keep my stakes rolling, and hopefully from other projects I will have enough to migrate some over pairing with the $CUB when it is ready for harvesting.

All these high risk investment yields does require a lot of learning, especially when one doesn't have much knowledge; however there are some things that I have noticed that is worth noting:

- When a yield farm project starts, many of the big whales / orkras / dolphins would most like goes for a short-hand run, unless they know the project creators (founders) well and are very bullish in the projet they are running.

- If capitals are below $5, pretty much don't even think about profit for at least 30 - 90 days; because the gas fees would have killed a lot more than the investment itself.

- If there's a modest capital around $50 USD, go for the main token staking to generate more revenue for future farms and staking.

This is what I got even with almost $60 USD worth of staking... sigh.

- Optimum way to farm is to use higher valued coin / token (at least one of them with appreciating asset value) than the native token (for this cake, the $CUB) to have a better yield in return; that being said, if the capital is below $50, forget about it, go back to native token staking first and build the wealth from there.

So far so good, for now, I think I am happy with my own choice at the moment as I am neither wealthy nor powerful big deposits, and hopefully something good will come out from this choice to the point I can actually cultivate enough data to round in more investors from outside the HIVE and LEO community to pump in more investment to keep this project running.

Kudos for the brave leap, LEO Team!

Until then