Our original launch date last Thursday got hijacked by the Uniswap UNI (token) airdrop. Now that the ETH network has cooled down from the meteoric rise in gas fees, we're ready to launch wLEO this week and also have a few important changes to the original launch plans.

While delaying the launch was unexpected, the silver lining is that we got a lot more time to develop the launch strategy, finalize the Beta blogging interface (so that we can move it into production before wLEO launches) and organize a few other marketing/logistical plans to make the Wrapped LEO launch bigger and better.

wLEO Will Launch This Wednesday: September 23rd

The roundtable crew (@nealmcspadden, @rollandthomas, @scaredycatguide and @khaleelkazi) will also host a live wLEO launch party on Wednesday morning where we walk through all the steps for interacting with wLEO, providing liquidity, other details, etc.

Pending an apocalypse or another insert_ethereum_breaking_event_here, this launch date will be kept.

LeoFinance Team Liquidity Pool Commitment

The original plan for launching wLEO stated that LeoFinance would post $20,000 USD to the liquidity pool for wLEO-ETH. We've been talking with some people who are more heavily involved in Uniswap token launches (non-Hivers) and have received a lot of great advice since that original wLEO announcement of an announcement post was released about 3 weeks ago.

Now, LeoFinance will post $25,000 USD in LEO as part of the official team commitment. We'll match this with $25,000 USD in ETH - bringing the total commitment from LeoFinance to $50,000 USD as the starting amount in the wLEO-ETH liquidity pool.

At current prices, this is roughly 208,000 LEO and 70 ETH - these token figures are subject to change pending the actual prices on launch date but the USD commitment will remain the same.

After speaking with these DeFi users and community leaders who are more experienced in the arena of launching tokens on Uniswap successfully - successful in the sense of launching tokens in a sustainable way that brings attention, volume and liquidity in the long-run - we decided to up the ante on our commitment to the pool.

It's also been advised that we lock our liquidity in an ETH smart contract. This is a commitment that serious projects make when launching on Uniswap - it proves to people outside of your core community that you are in the pool for the long haul since the contract makes you unable to withdraw the liquidity that you have deposited into the pool for the set amount of time that is chosen.

We will likely lock the entire $50k in a smart contract for 1 year (which means that the liquidity cannot be removed for that time period), although we're still researching our options for various contract lockers. More details on if/how we decide to lock our liquidity will be released on the wLEO launch day.

300,000 LEO in LP Bounty Rewards

A lot of questions have been asked about the LP bounty rewards program and how it will work. The #1 question I've seen is if the $20,000 $50,000 commitment from LeoFinance will be included in the bounty rewards:

The official team commitment of $50k will be excluded from the 300k bounty rewards pool. Meaning that users could take the total liquidity deposited to the pool (in terms of total LP tokens held) and subtract the official LeoTeam ETH address holdings to get an idea of their fractional share in the total bounty pool.

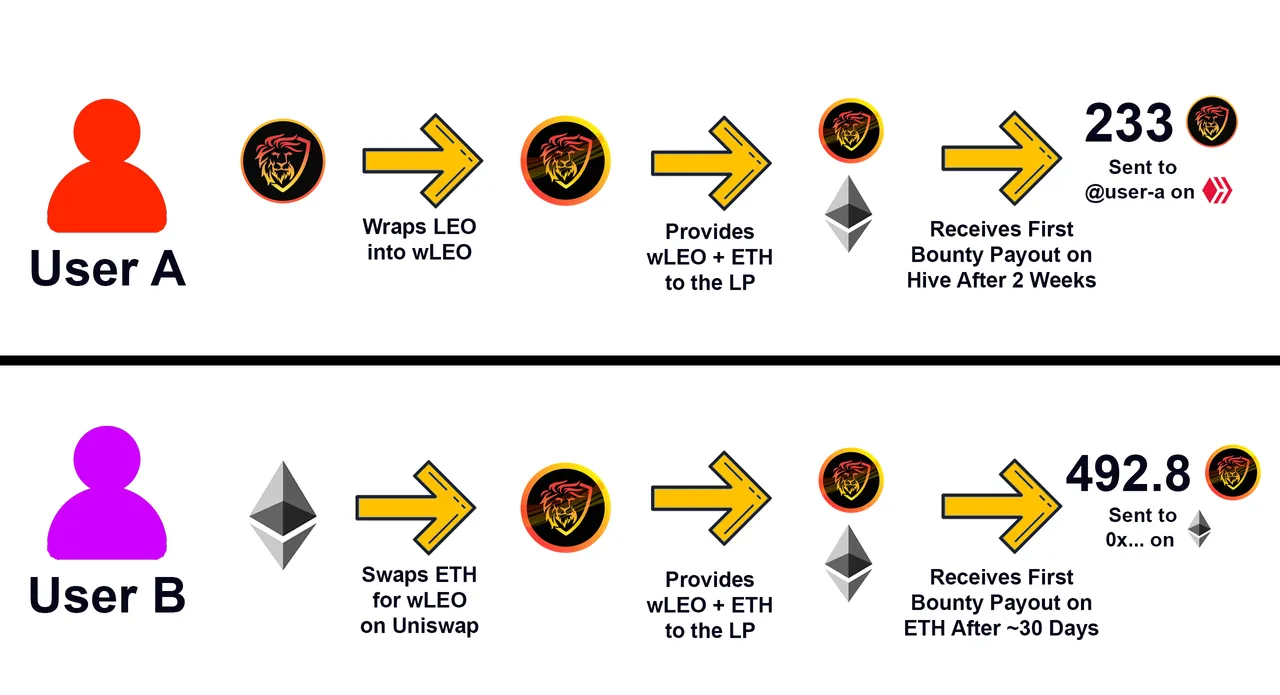

In short, if you deposit liquidity to the wLEO-ETH pool on Uniswap, you will receive a proportional share in a total rewards pool of 300,000 LEO for the first 90 days after launch. We've designed a hybrid distribution plan which will try to deliver your LEO to you on the Hive blockchain (based on your prior interactions with the wLEO smart contract).

If we are unable to link your Hive account to your ETH address that you're providing liquidity from, then we will send your bounty payouts as wLEO straight to your ETH address.

There is an advantage for users who receive bounty payouts on Hive as opposed to ETH: if you get paid out on Hive, then your rewards will be distributed every 2 weeks for 90 days with 0 fees. If you're paid out on ETH, then your rewards will be paid out every ~4 weeks and will have a small fee taken out to pay for gas (it's roughly 4 weeks and a small gas fee because we will choose a time to distribute when ETH fees are low. So 4 weeks give or take 2-3 days).

This system might sound complex, but it is relatively simple. If you wrap any amount of LEO before depositing to the liquidity pool, then we will be able to link your Hive account to your ETH address. If you take ETH, swap it into wLEO and then provide liquidity (as most non-Hivers will do), then we will distribute to your ETH addess since it won't be linked to a Hive account.

See the below graphic to get a visual idea of what's happening. The post we wrote a few days ago also outlines this distribution system in greater detail.

Note: you do not have to wrap all of the LEO you're providing to the pool in order to link your Hive-ETH accounts... You can, for example, wrap 1 LEO into wLEO just for the sake of linking your ETH address and then swap ETH into 500 wLEO on Ethereum to provide to the LP.

Again, sounds very complicated because of the different scenarios involved. If you have a specific scenario that you're curious about, drop a comment below and I'll tell you how your distribution will be paid out.

LeoFinance Beta

We wrote a post the other day outlining many of the major changes we made to the new LeoFinance Beta interface. The wLEO delayed launch was a blessing in disguise as it allowed us to get more things in order both from an interface and from an Ethereum logistics standpoint.

Over the next 3 days (leading up to the wLEO launch), we're going to be implementing the following changes to the new interface:

- Mobile UI Performance Enhancements ✅

- Bug Testing and Patches for Major Defects (In Progress)

- Alternative Image Hosting Solution (In Progress)

- Deployment of Beta Interface into Production (In Progress)

By the time wLEO launches on Wednesday, the LeoFinance interface should be deployed to our main domain (replacing condenser once and for all!).

We're also asking that you please test LeoFinance Beta as much as you possibly can in the next few days and drop all of your bug reports in our Discord (look for a channel called: interface-beta-testing). We'll be rolling out continual patches every day to fix the issues you find.

One of the major issues that has been reported is an inability to upload images when you're logged in with Hivesigner. The image API for hive.blog is not allowing images to be uploaded outside of Hive Keychain, so we have researched alternative image hosting solutions that we will be integrating in the next 1-2 days.

We also have a classified new feature that we're integrating into the interface after the 4 items above are taken care of. This top-secret feature will launch within just a few days of the wLEO launch (most likely by the end of this weekend). We've started the design already and it's pretty 🤯 stuff.

We're gearing up for an exciting week on the interface and on the wLEO front. With some new DeFi friends and an updated launch plan, Wrapped LEO will be an even greater spectacle than we had originally planned.

Earn LEO + HIVE rewards by creating crypto/finance-related content in our PeakD community or directly from our hive-based interface at leofinance.io or LeoFinance Beta

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |