Throughout 2020, LeoFinance introduced dozens of major changes, app releases and updates to our project and LEO token economy. One of the major changes that we introduced is the flat curation curve. This curve drastically changed the way curation works on LeoFinance.

The flat curve simplified curation. Instead of everyone trying to frontrun each other with the fastest curation upvoting bots possible (similar to how Hive and many other Hive tokens currently operate), the change introduced a level playing field.

Under this flat curve, the time you vote has 0 impact on your rewards. This makes LEO curation more like a tipping economy. Your LEO POWER dictates how large of a tip you can give to a content creator and how much you will recieve back as the curator. It doesn't matter who upvoted before you or how much a post is already paying out.

It also means that comments are worth upvoting. Under the old curve, it only made sense (from a financial perspective) to upvote the top paid authors as close to 0 seconds as possible. Under the flat curve, it doesn't matter what you upvote, when you upvote or who you upvote. Your upvote is always the same value and you as the curator always receive 50% of that value back.

The incentive to upvote people who engage with your content and people who create valuable content for the platform is stake-based. This means that spreading your upvotes to new users to encourage growth, upvoting consistent authors who create high quality, lead generating content, etc. is the most valuable way to use your stake to benefit the LEO Token Price and growth of LeoFinance as a platform & ecosystem.

In this report, we will rank LeoFinance's top curators by the following data:

- Earnings From Curation Rewards

- Number of Votes Distributed

- Number of Unique Authors Voted

- Vote Diversification

The data presented in this report is for the month of January (1/1/21 - 1/31/21)

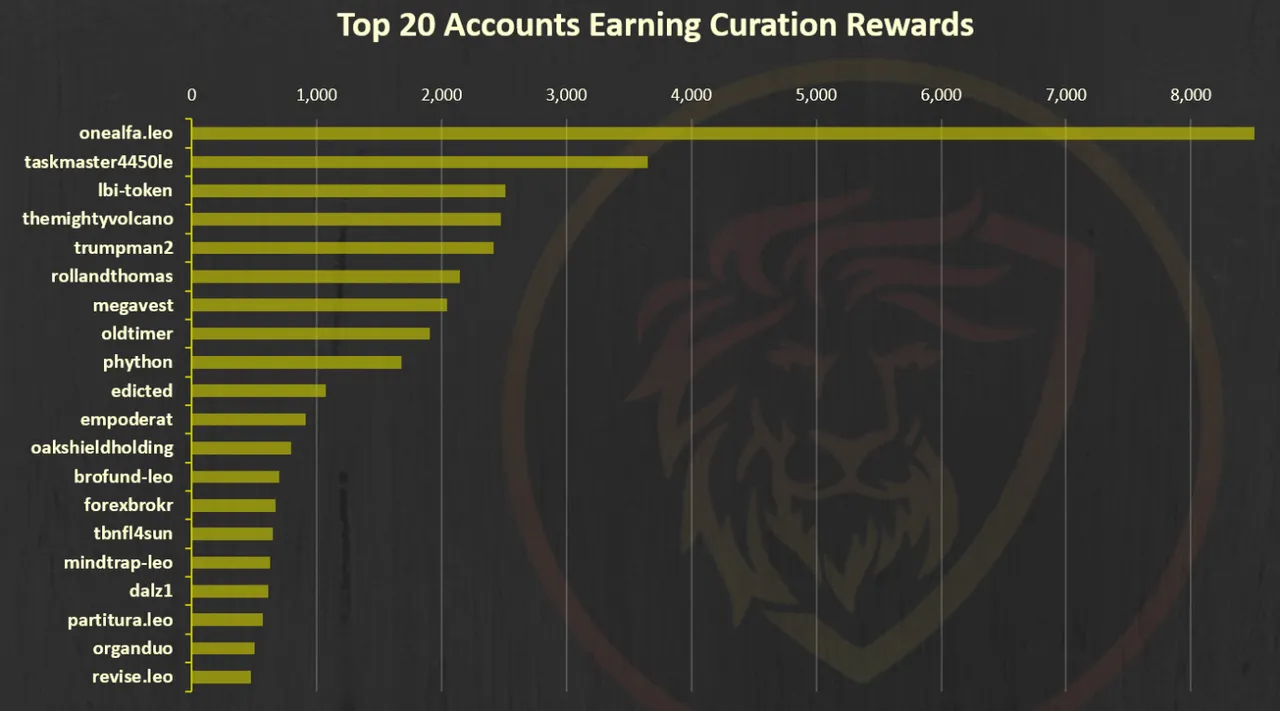

Top 20 LEO Curators by Earnings

In the last curation report, @onealfa.leo was the leader in curation rewards. He is obviously still in the lead as the top LEO stakeholder, but you can see that much of the rewards have started to spread to smaller stakeholders. The widening of distribution and number of LEO stakeholders has played a massive role in this.

Since the last report, the growth in the number of accounts holding LEO and the amount of LEO POWER staked has grown immensely.

Another interesting thing to note about curation rewards is the value of rewards (in USD terms). While the top curators are actually earning less LEO tokens each month (due to increased staking rates on the network), they are actually earning more value each month. These ideas go hand-in-hand as demand for LEO has increased as users stake along with a general rise in the crypto market.

The top 20 LEO POWER curators earned a total of 35,815 LEO throughout the month of January. At today's LEO price ($0.66), that is $23,637 USD in rewards for curation in a single month.

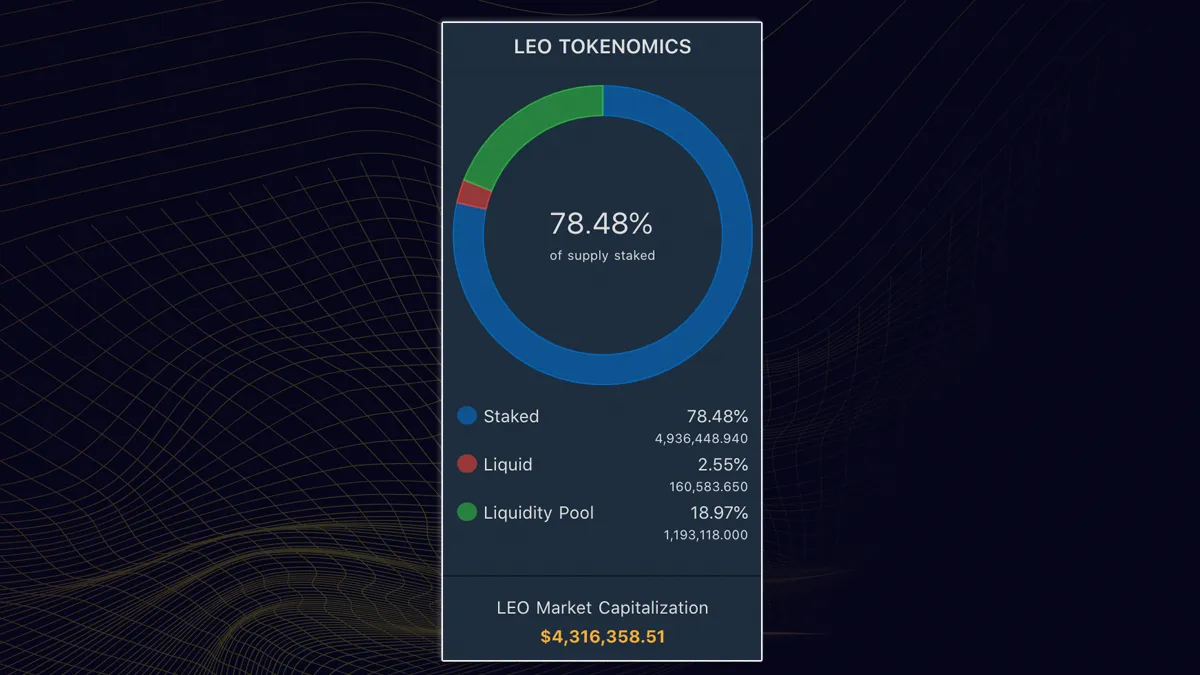

I guess it makes sense that only 160,000 LEO (2.5% of the total supply) is liquid:

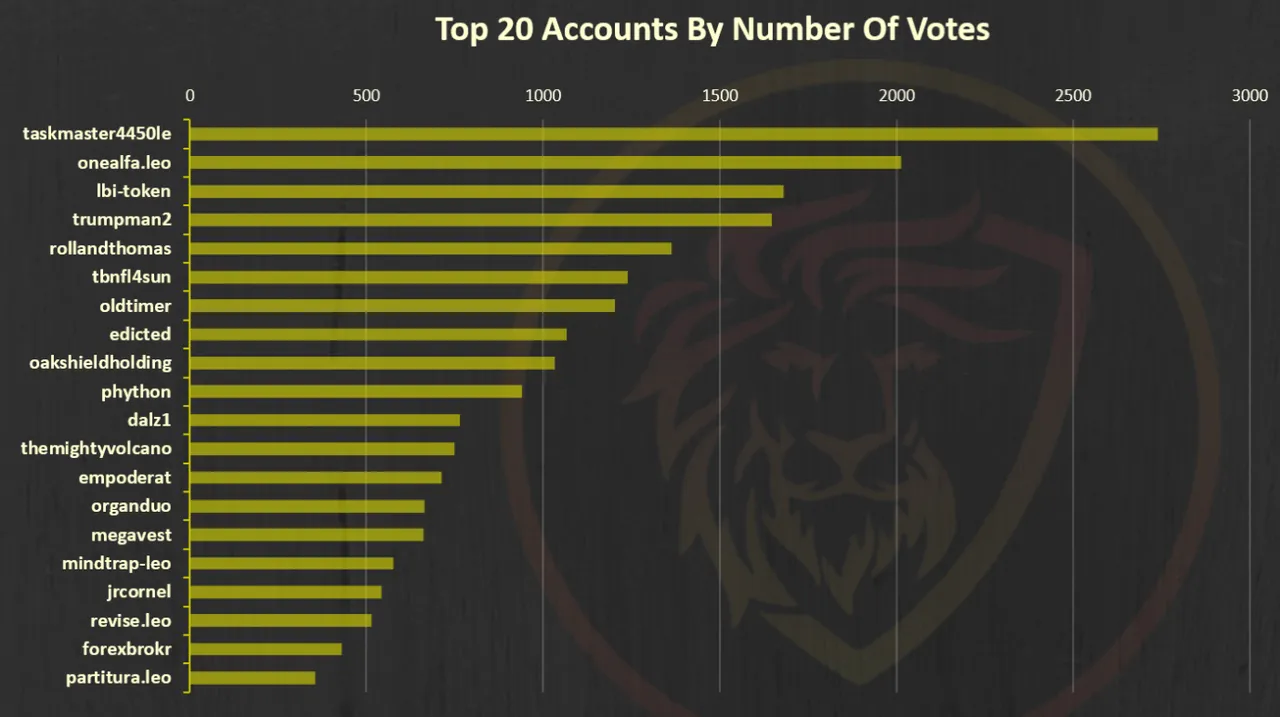

Number of Votes from the Top 20 Curators

In the last report, @onealfa.leo was #1 for the number of accounts he voted. In January, @taskmaster4450le took the lead as his engagement numbers are through the roof.. typically getting more than 100 comments per post.

LeoFinance is one of the (if not the) most engaging crypto social platforms on the internet. Task has proven that upvoting and responding to the community members who engage with your content is an extremely valuable and productive activity. We hope to see more of that from our creators as the platform continues to grow and we see new users onboarded.

@onealfa.leo is still #2 on the list which is incredible. We have a very unique set of whales on LeoFinance. Investors who bought massive quantities of LEO but don't seek to just circle jerk their friends' content. Instead, they spread that stake to new and existing users who bring massive value to the platform. Seeing them distribute so many votes to such a wide group of users is really incredible and we hope to see that trend continue as well.

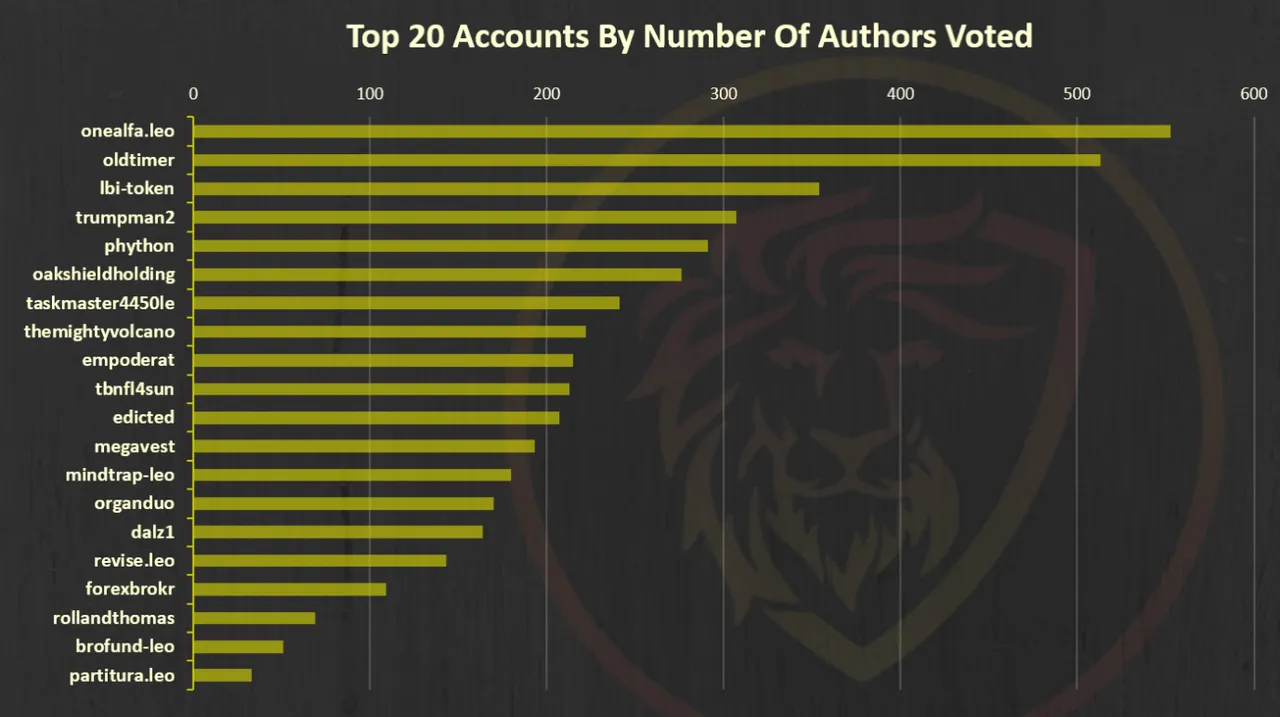

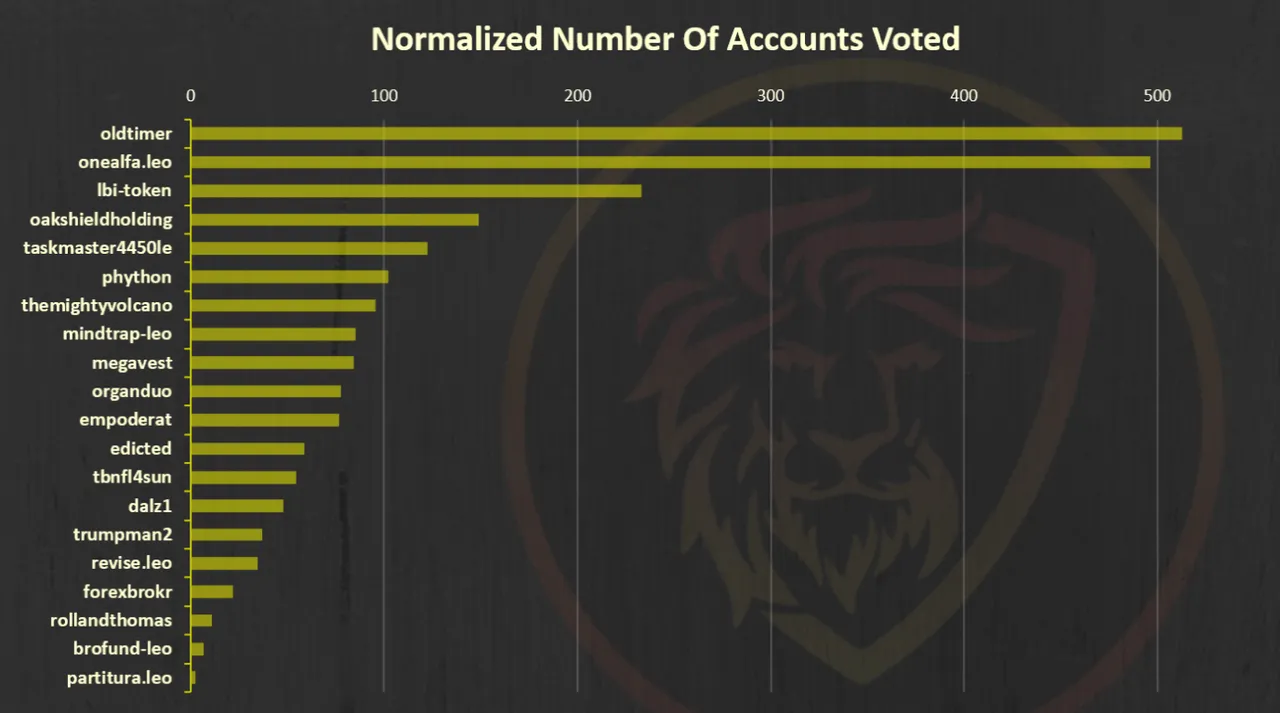

Number of unique accounts voted from the top curators

Here's where @onealfa.leo comes back into the lead as he upvotes the widest number of unique authors and commenters across a wide variety of posts. His nickname is "Toruk" because he flies in the sky, always waiting to drop in on someone's post or comment and leave them with a massive upvote.

@oldtimer and the LBI fund also do a great job of spreading out votes. As does everyone on this list. Again, seeing the LEO upvote economy working by distributing tokens to a wider and wider set of new and existing users is the key to the long-term growth of LeoFinance. Our community has been cultivated from the ground up and we're just getting started.

Vote Diversification

The following is a chart of the standard deviation % of the top 20 curators. Don't be discouraged by the math "nerdiness" of this data. It looks a lot more intimidating than it actually is.

A higher standard deviation % = the majority of upvote power is clustered around the same creators.

A lower standard deviation % = upvotes are more spread out to unique accounts.

The difference between these standard deviation figures and the previous section (number of unique authors) is in the vote weight of the upvotes distributed. The chart below ranks curators essentially by the total weighting of their upvotes and how widespread they curate.

In the following chart, @oldtimer is ranked #1 as he has the lowest standard deviation of upvotes which means that he is spreading his total upvote power amongst the widest set of authors relative to every other curator on the platform.

| Rank | Curator | Standard Deviation |

|---|---|---|

| 1 | oldtimer | 0.35% |

| 2 | onealfa.leo | 0.39% |

| 3 | lbi-token | 0.53% |

| 4 | oakshieldholding | 0.64% |

| 5 | taskmaster4450le | 0.68% |

| 6 | mindtrap-leo | 0.74% |

| 7 | organduo | 0.76% |

| 8 | megavest | 0.80% |

| 9 | themightyvolcano | 0.81% |

| 10 | empoderat | 0.98% |

| 11 | phython | 0.99% |

| 12 | dalz1 | 1.19% |

| 13 | edicted | 1.23% |

| 14 | tbnfl4sun | 1.36% |

| 15 | revise.leo | 1.43% |

| 16 | forexbrokr | 1.72% |

| 17 | rollandthomas | 2.24% |

| 18 | brofund-leo | 2.73% |

| 19 | trumpman2 | 2.91% |

| 20 | partitura.leo | 4.75% |

In Other News

We just took the 30th snapshot for Month 3 of the WLEO-ETH Geyser. That report and distribution will go out tomorrow (Friday, February 12th) along with a small change to the initial Geyser curve. We had some new LPs join the pool throughout Month 2 and 3 which highlighted an issue with our Geyser curve: it is far to harsh on new entrants into the pool.. often giving them a 2-5% yield for the first 3-5 months.

We found a solution that will decrease the depth of this initial curve without having any real impact on the long-term LPs who have been in the Geyser for a long period of time. The entire goal of the Geyser model is to encourage LPs who add liquidity to the WLEO pool(s) for the long-run but we want to ensure that we're not discouraging new LPs from joining the pool(s) at any time.

LeoFi is also right around the corner. We're excited to unveil LeoFi's dashboard and first application for LEO POWER hodlers along with our designs for adding a Geyser UI to the current and future WLEO Geysers.

A LeoFinance UI update is ready to be rolled out. We're still testing some final bugs to make sure it all works properly before pushing it to the live production UI.

#ProjectBlank feels closer than ever. LeoInfra V3 is coming along..

We've written more lines of code in the past 3 months than the past 2 years of LeoFinance combined. It's pretty incredible to see everything coming together on the backend as we get ready to launch all of these different projects simultaneously.

I (Khal) have also personally written more words in the past 3 months than I think I have in my entire lifetime (maybe not). The infamous 100k word LeoFinance eBook Whitepaper and dev roadmap is almost ready for publicity circuits. I think the roadmap alone will tickle the hair on your lion mane 🦁

p.s. we have more devs working on the project than ever before, but we could always use more for some of the other aspects of our roadmap that we haven't yet started. If you're a dev and looking for some occasional freelance work, please drop me a line on Discord. I may not get back right away (also infamous for being slow to respond to all the messages), but I'll be on the lookout. Thanks :)

LeoFinance is a blockchain-based social media platform for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | wLEO On Uniswap | Vote |

|  |  |