Hello, LBIer's. If LBI were a company, how much would it be worth? Of course, this is a pointless question but it's something worth exploring just for the fun of it. I dont think that LBI could ever be sold off as its model doe not support it but still...what if?

There are alot of different ways to value a company using different values such as shares price, incomes, equities, current and future cashflows, etc. We only have the option of using a few ways because alot of these methods are not applicable to us plus we've only been up and running for just over 1 year. Let's took a quick look and see what we are worth based on figures from the end of year 1.

Using number's from LBI's first year

1/ Book Value

That's start with book value because this is what LBI uses to determine it's token price. Working out the book value is fairly simple. You add up all your assets excluding intangible assets and then remove any debts.

HIVE wallets - 315,727 LEO

Hive-engine wallets - 10,958 LEO

Non-HIVE wallets - 52,800 LEO

Debts - 0 LEO

LBI's Value - 378,980 LEO

Each LBI token - 1.63 LEO

2/ Market Capitalization

This is another simple method and one that is used by most companies that feature on a public stock exchange. You take the number of shares that are issued and multiply it by the current price of a single share. The answer you get is the market cap.

If we look at LBI and use Hive-engine trading prices, we can work it out. Right now, there are 233,097.88 LBI tokens in circulation. The last sold LBI token sold for $0.328. Ok, we need the LEO price and the last LEO sold for $0.216 so that would mean the last LBI sold on hive-engine was sold or bought whatever way you look at it for 1.518 LEO.

LBI's market cap is currently 353,963 LEO

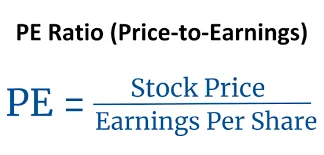

3/ Price to earning ratio (P/E)

Companies can value themselves based on their stock price to earnings ratio using pre-tax profits and a multiple of years. Eg, If a company had a PE ratio of 5 this would mean if they produced pre-tax profits of $100,000 per year, they would be valued at $500,000. In most cases, this ratio is used to decide if a company is under or overvalued but in other cases, it can be used by reversing the formula to get a valuation. So instead of stock price divided by earnings per share to get the PE ratio, we guess the P/E based on incomes and potential future growth and then multiply the number by our yearly earnings to get our value. Companies that have a consistent track record of profitable yearly results, an excellent plan for growth or being a start will often have high PE ratios. Companies that would have smaller PE ratios would likely be mature with growth excused or local high street businesses like hairdressers are cafes. I have no idea what the average bank P/E ratio is but

LBI is somewhere in the middle I feel. We have plenty of room for growth but it requires man/women/other hours so im going to work out and show the values of 5 which is low, 15 which is normal and 40 which is high. To give you an idea, currently, Tesla has a PE ratio of 322. This means if you bought all of Telsa, it would take you 322 years to get your money back. I dont think those green Tax credits will last forever Elon!! and of course, we should expect Tesla to turn a real profit soon as they do better each year.

LBI's Earnings last year were 82,476 LEO giving us an average of 1,586 LEO per week. We dont need the average, I just thought you'd like to know 😉. So we take our yearly earnings and multiply it by whatever we decide.

P/E of 5 - 412,380 LEO = 1.77 per LBI

P/E of 15 - 1,237,140 LEO = 5.31 per LBI

P/E of 40 - 3,299,040 LEO = 14.15 per LBI

Based on LBI's recent weekly earnings of around 2100, we can guess we'll pull in at least 109,000 LEO this year which is a growth of 32.8% on year 1. I guess you could say we have a projected 33% growth in earnings this year. That's a decent number and would give us a good PE ratio in investors eyes. In my mind, LBI would have a PE ratio of 4-5, i know this is a low number.

There you have it, there are 3 simple ways to work out LBI's value and you can see that each way will end on a different valuation. In order from the lowest, we have the market cap, book value and then P/E ratio. Using the book value obviously works best for LBI because... well just because.

How would you value LBI?