When spotting a trend in Finance, it's best to own the Fastest Horse

When retail started moving to the internet, did it pay you to own the mom and pop stores or large retail stores that eventually started selling some of their products online, or did it pay to buy the company that sold EVERYTHING online?

The answer to that one is simple, buying AMZN was the way to go as it was clearly the fastest horse in the race.

With the dollar being weak and looking like it's going to continue being weak for the foreseeable future, store of value investments are likely to be en vogue.

While just about everything priced in dollars will "go up" as the dollar loses value, two of the more popular store of value hedges are bitcoin and gold.

Gold has held this title for centuries, long before the US dollar was even a thing.

However, bitcoin has recently emerged on the scene and emulated just about everything that gold does, only better.

For this reason there is a very real chance that bitcoin eventually replaces gold over the coming years as the favorite store of value allocation in portfolios.

We can see the early evidence of that playing out in just about any way you slice the last 8 years...

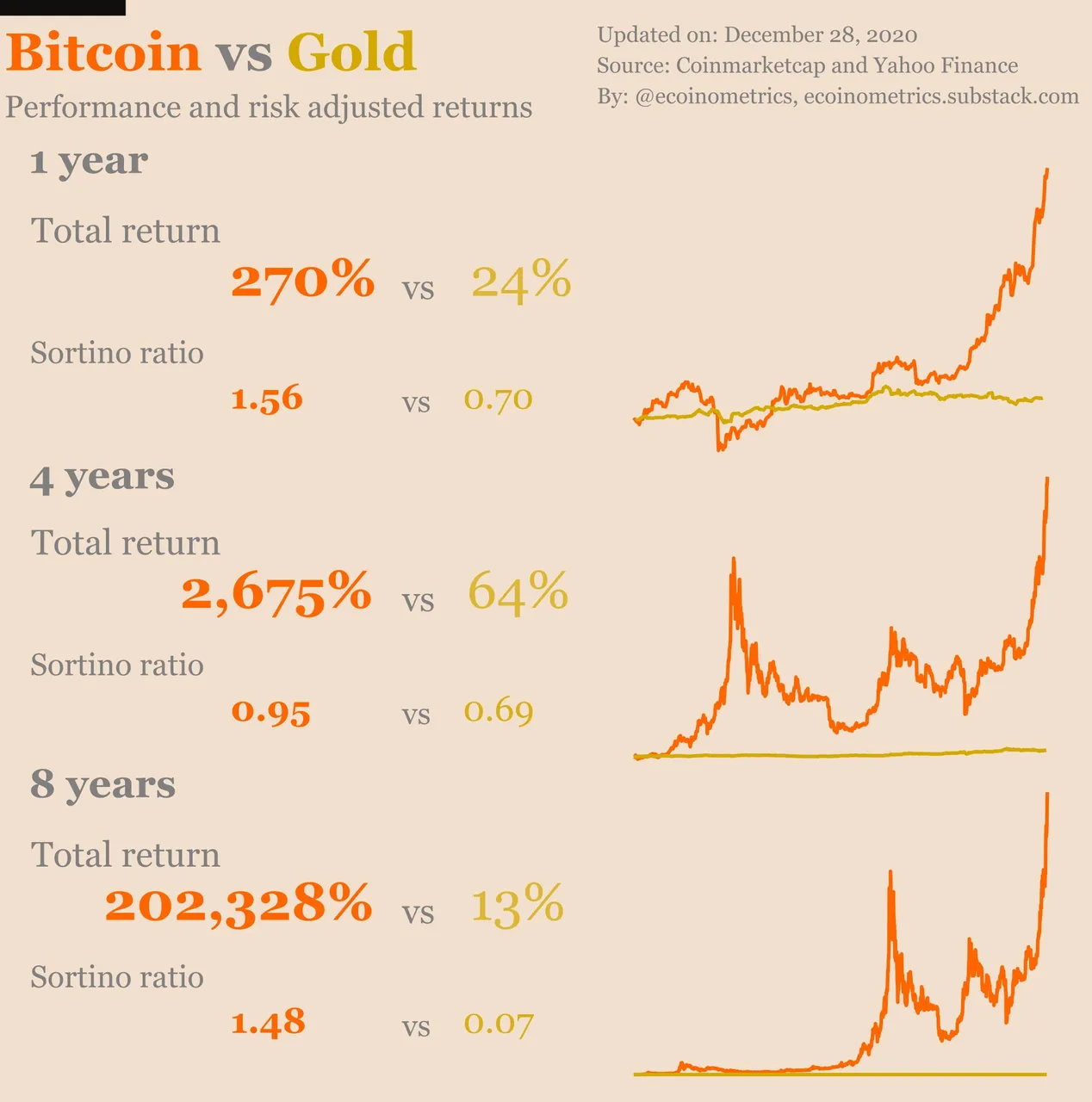

Bitcoin returns vs. Gold returns:

(Source:

)https://twitter.com/ecoinometrics/status/1354225867690450944/photo/1

- ecoinometrics

If you had held gold for the last 8 years, you made roughly 13% on your money. Not ideal, but it ALMOST kept up with inflation.

To make sure we aren't just cherry-picking the data, we can also can look at the 4 year and 1 year returns...

Which show gold investors making 64% and 24% respectively, now that's more like it during a time period when the dollar has been significantly weak.

However, during that same time period, bitcoin returned 2,675% and 270% respectively, while also returning 202,328% over the last 8 years.

As you can see, it's really not even comparable. I will admit though, bitcoin is not likely to see these types of returns over the long run as bitcoin is very new compared with bitcoin.

However, given the fact that not only is bitcoin likely to do well against the dollar on its own merits, it's also likely to pull some of the money sitting in gold or that would be going to gold.

For that reason bitcoin is likely to continue to be the fastest horse over the next several years, and possibly decades.

@jrcornel/gold-is-the-horse-with-a-broken-leg-and-bitcoin-s-loading-the-shotgun

It's one of the few assets I have ever seen that has store of value properties but has returns like a high flying tech stock.

In fact, it's the only investment I have ever seen like this.

The fuse has been lit...

What do you think happens when we break this line?

I have a guess...

Now we just have to make sure we don't do anything silly like sell too early and miss out on the really large moves during these bull market cycles.

Gold is old, cash is trash, and bitcoin is king.

Stay informed my friends.

-Doc