It is rational for one to say no to Defi projects because of the vulnerability of the system. In 2021, a total sum of $361 Million has been stolen from defi projects and this has made investors lukewarm towards using them.

When Defi projects entered the cryptocurrency world, it was welcomed with an open hand because it offered investors a decentralized financial system and also an opportunity to earn passive income. Sadly, this novel project has drawn the attention of hackers to itself because the system used in its creation ( Smart Contract ) can be vulnerable.

A clear understanding of why Defi projects are susceptible to hacking will help us to make the right decisions on whether to avoid Defi projects or to use them with caution.

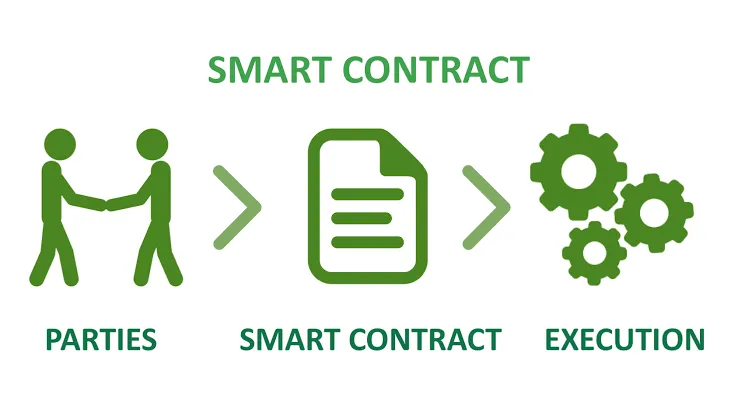

Decentralized exchanges and wallets remove the role of the third party during transactions, and to achieve this they have to create a system that can be able to run on its own. This is where smart contracts came to play.

Photo shop

Smart Contracts are self-sustaining contracts that run when predetermined conditions are met. To achieve this, a set of conditions are being arranged in form of codes and this makes it possible that transactions are carried out automatically once the pre-arranged conditions have been met.

Because the coding is done by humans, there are always chances of creating a loophole. This loophole once discovered by a black hat hacker is capitalized on to steal from the exchange. This is why most defi projects hire White hat hackers to test the smart contracts against errors.

These vulnerabilities associated with the defi projects can be reduced to a minimal level with time, thus early adopters may be the ones to feel the tension of these vulnerabilities.

However, there are defi projects that have been able to offer strong security to their users. It all depends on our ability to interact with a good Defi project and being able to withdraw our funds once we have been able to make our desired profit from the exchange. Another way to be safe is by disconnecting with the smart contracts we interacted with ( for each time we make a transaction with a smart contract, we permit it to our wallet, this permission can be limited or unlimited ) This help to keep our wallets safe from smart contracts that can spend our funds( you can use beefy finance to check such contracts).

If there has been any cryptocurrency project that has helped me to earn passive rewards, it is surely Defi projects and I wouldn't want to miss out on such an opportunity to earn rewards even when I am asleep. Secondly, the decentralized nature is something that makes it more enticing as one may not have to struggle with controlling his funds as it is with the centralized exchange.

In conclusion, Defi projects are susceptible to attacks but presently there are measures put in place to reduce the rate at which hacks occur in defi projects. Investors only need to invest in defi projects that have been vested. **Their security may be a concern now that it is still new but will eventually see improved security with time. ** It is normal for a new system like defi to face such a challenge.

Feel free to affirm or criticize my points as I will like to see other views on defi projects.