Regular followers of mine would know that I have taken an interest in the Balancer platform. The BAL token is rewarded on a weekly basis to Liquidity Providers based on some rather complicated math, with weightings favoring pools with the BAL token and pairings that are not co-related (ETH/sETH pairs for example).

For the last week, I have been watching my liquidity provided in a 60% BAL/ 40% WETH pool, without adding or removing anything, to get a solid weeks worth of returns recorded. A short time ago, the weekly BAL payout come in, so here is what it looks like.

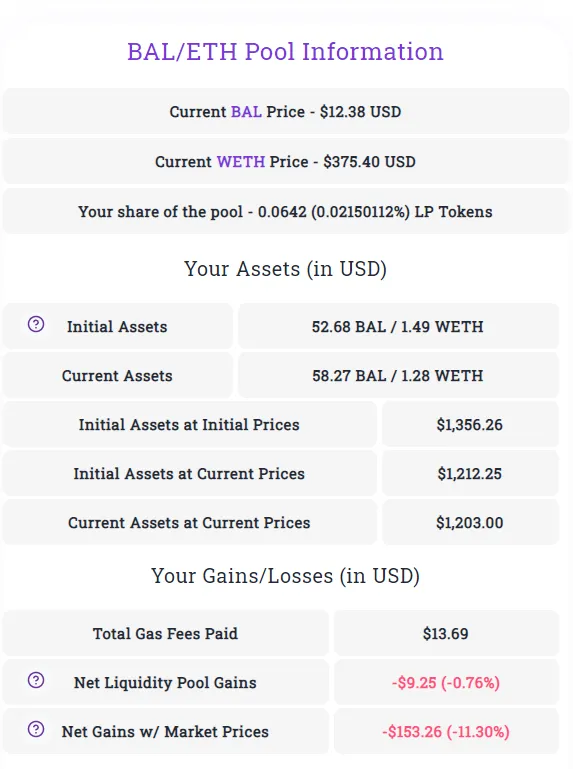

Over a couple of weeks prior to the one just ended, I was gradually building up my Liquidity in this pool. Here is how it has performed since from the start, with the figures sourced from Liquidity Vision website

That's the all time stats for me, over the last week I've lost around $140 in total value on the pool, primarily as the result of a drop in the BAL price over the week of over 18%. This drop is broadly in line with many defi tokens, with RUNE down 15%, UNI down 10%, SNX off 16%, comp down 15% and AAVE down 35%.

Still, the loss of value over the week is small concern, but I think BAL will recover over the mid to long term so I'll not panic.

Income.

One of the main reasons for choosing this pool is for income purposes, which are not really reflected in the above stats. Today I received a BAL payout for my Liquidity provided of 2.101 BAL, worth $26.30 at the current price. That works out to be a return for the week of 2.16%, or an annualized figure of 112.65%. At that rate it would take me just under 11 months to receive my initial investment back as income. Of course that income could change, and likely will change on a weekly basis, depending on the inflows/outflows of capital to Balancer pools, along with any governance changes to the rewards schedule of time.

The thing I like about Balancer is that the BAL tokens are payed as liquid funds, separately each week. They don't just get added to the pool and the clarity of return is nice. I'm now looking around at other pools with a similar ROI to add liquidity to.

My approach to impermanent loss.

The approach I have elected to take when it comes to IL is to basically ignore it. When selecting a pool to invest into, I choose on the basis of whether I like both assets long term, and the other income that stake will generate. Then, once I put the funds in, I don't really watch the changes in the number of each tokens, fluctuations of the prices, and so on. Once added to the pool, I consider the investment as one investment, and just monitor the total value and income generated. I.L. is only a thing if you are short term, or only like one side of the pair. If you are happy to be long on both, the day to day variations don't matter.

So there you have it, The BAL/WETH pool gave me a return of 2.16% in income for the week. The value of the asset dropped by around 10% over the week - broadly in line with its market peers.

Thanks for reading, in a future post I'll take a look at how my other main LP investment, the RUNE/BNB pool is going.

Cheers,

JK.